How to properly file a tax return in Poland and avoid fines

-

Zinaida Rumyantseva

Copywriter Elbuz

In Poland there is one important rule for individual entrepreneurs: filing a tax return correctly. And guess what? In this article I will tell you exactly how to do this. From step-by-step instructions to all the information you need to file your taxes, you won't have to worry about a thing. So, let's begin this exciting journey to tax security in Poland!

Glossary

- Types of annual PIT returns for individual entrepreneurs: options for personal income tax (PIT) returns that a sole proprietor can file in Poland. Includes PIT O, PIT D, PIT-2K, PIT B, PIT Z, PIT ZG and PIT M.

- Filing deadlines: specific dates, by which a sole proprietor is required to file his or her tax returns. These deadlines vary depending on the type of declaration and the category of entrepreneurs.

- Return versions: updates and changes to the formats of PIT returns that the Polish Tax Office may issue each year. Designed to accommodate the latest legal and tax changes.

- Filing returns for income from different sources: the process of submitting tax returns when an individual entrepreneur has income not only from business activities, but also from other sources , such as rental payments or investments.

- Tax Return Attachments: Additional forms and documents that a sole proprietor can attach to his or her returns. These may include information about tax benefits, construction, or the income of a minor child.

- PIT O: The most common attachment to the PIT declaration. Designed for reporting income from business activities and other sources.

- PIT D and PIT-2K: special attachments to the PIT declaration designed to take into account tax benefits for construction completed in previous years.

- PIT B and PIT Z: applications for entrepreneurs that reflect income and expenses from business activities.

- PIT ZG: PIT application, which is required to be submitted if the individual entrepreneur receives income from publishing activities.

- PIT M: PIT application required for reporting the income of a minor child.

- How to file a return with the tax office: step-by-step instructions on how to correctly file a tax return through physical submission to the tax office.

- How to file an electronic return: step-by-step instructions on how to correctly file a tax return online using the electronic services of the Polish Tax Service.

- Conclusion: The final section of an article that summarizes the findings and gives a brief summary of what the article contains.

Tax returns for sole traders in Poland

When it comes to doing business in Poland , paying taxes becomes one of the most important responsibilities of individual entrepreneurs. To avoid errors and penalties, it is necessary to submit tax returns to the appropriate tax office on time. In this article, we will look at what declarations an individual entrepreneur in Poland must file and provide step-by-step instructions on how to correctly file these declarations.

PIT income tax in Poland

The main tax that an entrepreneur is required to pay is the PIT income tax (Dochodowy od osób fizycznych). The amount of this tax depends on the profit or income in the case of a lump sum tax. During the tax year, individual entrepreneurs are required to regularly calculate and pay advance income tax payments. The period for which advances are calculated depends on the type of payment declared in the CEIDG-1 application and can be monthly or quarterly.

Other tax returns

In addition to the PIT, sole proprietors may be required to file other tax returns. tax returns depending on the nature of your activities. Here are some examples of tax returns you may encounter:

-

VAT return (Deklaracja VAT) - submitted by entrepreneurs registered in the VAT system (podatek od towarów i usług). This is a declaration of value added tax, which is usually paid during the quarter.

-

Declaration in ZUS (Deklaracja ZUS) - submitted by entrepreneurs who are registered in the social insurance system (Zakład Ubezpieczeń Społecznych). This declaration indicates the amount of social and health insurance contributions.

-

Excise tax declaration (Deklaracja akcyzowa) - submitted by entrepreneurs who sell goods subject to excise taxes.

-

Real estate tax declaration (Deklaracja podatku od nieruchomości) - submitted by entrepreneurs who own real estate or are engaged in construction .

This is not a complete list of tax returns and your responsibilities may vary depending on your specific situation. It is recommended that you consult with a tax advisor or attorney to ensure that you are meeting all tax responsibilities correctly.

How to File Tax Returns

Filing taxes is an important process that requires care and accuracy. To make this process easier for you, follow these step-by-step instructions:

-

Gathering the necessary documents - before filing your returns, make sure ensure that you have all the necessary documents, such as bank statements, tax receipts, invoices and contracts.

-

Accurately filling out the declaration - when filling out tax returns, pay attention to each line and make sure you enter the correct data .

-

Check before sending - before sending returns to the tax office, it is recommended to carefully check all data and make sure that they are accurate. This will help avoid possible mistakes and problems in the future.

-

Timely Submission - Tax return filing periods vary and it is important to submit them on time according to established deadlines.

Please note that this instruction provides a general understanding of the tax filing process and it is recommended that you consult a professional tax advisor or attorney for detailed information and personalized advice. , based on your situation.

Helpful Tips and Tricks

To avoid problems and make your life easier when filing your taxes, follow these best practices:

-

Meet deadlines - Make sure you file your taxes on time to avoid penalties and additional costs.

-

Maintain documentation - keep all necessary documents and records so that you can verify your information in the event of an audit .

-

Consult a Professional - Don't hesitate to seek the help of a tax advisor or lawyer to make sure you fulfill your tax obligations correctly.

-

Stay updated - stay tuned for changes in tax laws and always stay up to date with the latest news and requirements.

Summary

Correct filing of tax returns is an integral part of doing business in Poland for individual entrepreneurs. We hope this article will help you gain all the knowledge you need and follow the correct process to avoid mistakes and penalties. Remember to consult with professionals and stay up to date with the latest changes in tax laws. We wish you successful business in Poland!

"The only way to avoid mistakes is to do nothing: neither scary things nor important things" - Aristotle

Types of annual PIT declarations for individual entrepreneurs

A tax return is an important document that every individual entrepreneur in Poland must submit to the tax office after the end of the tax year. In this document, the entrepreneur takes into account all income received during the year. But what types of declarations exist and how to properly file each of them? Let's find out!

1. Declaration PIT-36: Income under the general tax scale

Declaration PIT-36 is intended for individual entrepreneurs who are taxed under the general tax scale. In this declaration, the entrepreneur takes into account all his income and expenses, and the tax is calculated according to progressive tax rates on general principles.

2. Declaration PIT-36L: Income at a flat tax rate

Declaration PIT-36L is intended for entrepreneurs who are taxed at a single tax rate. In this declaration, the entrepreneur indicates his income and expenses, but the tax is calculated at one single tax rate, which is 19%.

.gif)

3. Declaration PIT-28: One-time lump-sum taxation

Declaration PIT-28 is intended for entrepreneurs who want to take advantage of the lump sum tax system. In this declaration, the entrepreneur takes into account his income only for one unscheduled tax period and pays tax at a fixed rate.

4. Declaration PIT-16A: Taxation under a tax card

Declaration PIT-16A is intended for entrepreneurs who are taxed under a special “card” or “tariff” . In this declaration, the entrepreneur indicates his income and expenses, and the tax is calculated at special rates for a specific type of activity.

Now that you know about the different types of annual PIT returns for sole traders in Poland, it is important to follow the correct deadlines and methods for filing these returns. Please remember that timing may vary depending on the circumstances and the annual period.

Filing Deadlines

Different types of PIT returns for self-employed individuals have their own filing deadlines. Check them out to ensure you don't miss important dates and avoid penalties for missing filing deadlines.

1. Declaration PIT-16A

Declaration PIT-16A must be submitted before the end of January of the year following the reporting year. This declaration is used for tax purposes using the tax card.

2. Declarations PIT-36, PIT-36L, PIT-28

For declarations PIT-36, PIT-36L and PIT-28, the filing deadline begins from February 15 and ends at the end of April of the year following the reporting year. This way, you have enough time to properly prepare the declaration and enter all the necessary data.

Exceptional circumstances, such as a pandemic or other force majeure situations, may result in changes to the filing deadlines. In such cases, monitor the official information from the tax office and find out about possible changes.

Don't forget to carefully monitor the deadlines for filing returns to avoid fines and problems with the tax office. Timely filing of the declaration is the key to peace of mind and good relations with the tax authorities.

📌 Tip: Please note that filing deadlines may vary depending on the year and circumstances. It is important to pay attention to official sources of information and follow updates.

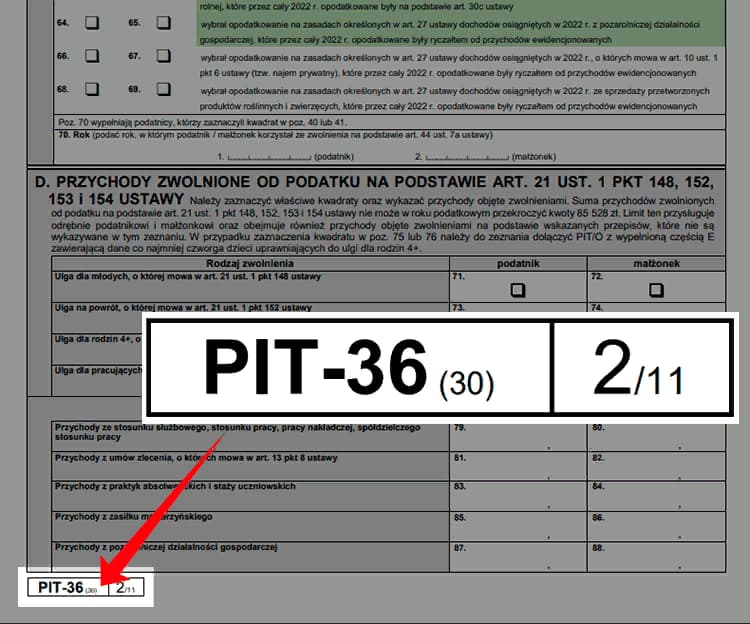

Return Versions

Each PIT return has its own version, which corresponds to a specific tax period. It is important to make sure that you are using the correct version of the return to avoid errors and problems with interaction with the tax office.

As a rule, each version of the PIT declaration has a serial number, which indicates the sequence of changes to the form of the document. It is recommended to always check the version of the declaration on the official website of the tax office to be sure that you are using the current version.

📌 Tip: The document version number is not associated with the current year or document type. It only indicates the serial number of changes.

On the official website of the Polish Tax Inspectorate podatki.gov.pl you can find out the latest versions of PIT declarations and check that you are using the correct form for submitting documents.

🏆 Best Practice: Always make sure you are using the latest version of the PIT declaration to avoid possible errors and problems with the tax office.

Filing returns for income from different sources

If your income comes from different sources and requires different forms of declaration, you need to know how file returns correctly to take into account all income and avoid problems.

For example, if you work under an employment contract and at the same time conduct business, you will need several different declarations. The tax office will automatically generate the PIT-37 declaration based on the data provided by your employer about your income from employment. However, you must also independently file a declaration PIT-36, PIT-36L, PIT-28 or PIT-16A, depending on the conditions of your business.

📌 Important: When earning income from different sources, pay special attention to the correct filing of all relevant declarations to avoid misunderstandings and possible problems.

We looked at the different types of PIT declarations for sole traders in Poland and explained in detail how to properly file each of them. Now you know which returns you must use and the important deadlines for filing them. Don’t forget to closely monitor changes in legislation and updates on official resources to stay up to date with the latest information.

🔍 Overview: Below is a table to help you better understand each type of annual PIT return for self-employed individuals and choose the right option based on your situation.

| Declaration type | Purpose | Filing deadlines |

|---|---|---|

| PIT-36 | General tax scale | February 15 - end of April |

| PIT-36L | Unified tax rate | February 15 - end of April |

| PIT-28 | One-time lump-sum taxation | February 15 - end of April |

| PIT-16A | Taxation by tax card | Until the end of January |

⚠️ Important Please note that the deadline for filing returns may vary depending on circumstances and changes in tax legislation. Check the current deadlines on the official website of the tax office.

Now that you have all the information you need about the types of annual PIT returns for sole traders in Poland, deadlines for their submission and features, you can be confident in your ability to correctly file a return and avoid possible problems with the tax office.

🌟 Expert advice: “It is recommended to carefully study the rules and requirements for each type of declaration in order to emphasize your professionalism, authority and reliability in the eyes of the tax inspectorate. Be careful, provide accurate data and submit your returns on time - this will help you avoid problems and establish good relations with the tax authorities." - Dorota Madej, tax expert.

Tax Return Attachments: Useful Tools for Accounting for Income and benefits

PIT O: the most common annex to the PIT declaration

For individual entrepreneurs filing tax returns in Poland, the PIT O application is one of the most common and important tools. This application must be completed in cases where tax credits and deductions are used, as well as when taking into account construction benefits.

When is the PIT O application required?

Here are some of the most common cases when you need to fill out the PIT O application:

- Ulga for the Internet. A taxpayer can receive deductions for using the Internet for business purposes.

- Ulga for the children. Parents may receive tax benefits related to raising children.

- Ulga for rehabilitation. People in need of medical rehabilitation can receive tax breaks to pay for the related services.

- Ulga for teaching students. Parents of students can receive tax benefits for their children's education.

- Ulga for introducing new technologies. Businessmen can receive tax benefits if they actively implement new technologies in their activities.

- Ulga for various types of donations. People who give charity and make donations may be eligible for tax breaks.

How do I complete the PIT O application?

When filling out the PIT O application, you will need to provide the details and amounts of the tax deductions and benefits you are claiming. You must also provide additional information about your activities, including information about income and expenses that may be associated with the use of tax benefits and deductions.

Please read the instructions and tips provided in the PIT O application carefully to ensure that you complete your return correctly. If you have any questions or concerns, it's always a good idea to seek help from professionals such as tax advisors or accountants to prevent mistakes and pay your taxes on time.

PIT D and PIT-2K: Accounting for Prior Years' Construction Tax Credits

Another important supplement to PIT tax returns for self-employed individuals is Forms PIT D and PIT-2K. They are used to account for construction-related tax benefits received in previous tax years.

When do I need to complete the PIT D and PIT-2K applications?

- PIT D is completed by persons paying construction benefits received in previous years and removed from the tax benefit catalogue.

- PIT-2K is completed in the first year of using the construction interest benefit. If you took advantage of the construction incentive, you will need to fill out Form PIT-2K.

How to fill out the PIT D and PIT-2K applications?

To complete Forms PIT D and PIT-2K, you will need to provide details and information about tax benefits received in previous years, as well as the amounts and dates associated with receiving those benefits.

Before filling out the forms, make sure you have all the necessary documents to prove you have received the construction tax credits. If you have any questions or difficulties, do not hesitate to contact tax advisors or accountants for professional assistance.

Schedules PIT B and PIT Z for Entrepreneurs

Schedules PIT B and PIT Z are most important for sole proprietors who file PIT-36 or PIT- tax returns 36L. These forms are necessary to record income and losses from business activities in the reporting tax year.

Appendix PIT B: Accounting for Business Income

PIT B is information about the amount of business income or loss and must be completed based on the Ledger data income and expenses. Form PIT B also includes information about business activities in a civil partnership in which the taxpayer is a partner.

- If spouses file a joint return, they can report deductions on the same Schedule PIT O, but in different columns. Each spouse completes their own business information on Form PIT B.

- If both spouses are entrepreneurs, they must submit separate PIT B applications.

- If only one spouse is a business owner, only the spouse running the business must file the application.

PIT Z Application: Tax Credit Accounting

PIT Z is completed entrepreneurs using tax credits. A tax credit is provided to entrepreneurs to take into account certain expenses associated with their business activities. Details of the tax credit are provided in Annex PIT Z.

Annex PIT ZG and when it is required

Annex PIT ZG is required for Polish tax residents who received income outside Poland in the previous tax year and reported it on tax returns PIT-36, PIT-36L, PIT-38 and PIT-39. The application also shows the amount of foreign income and income tax advances, if any.

- If the income is received in several countries outside Poland, it is necessary to fill out the PIT ZG application for each case.

- To convert foreign income into Polish zlotys, the average exchange rate of the National Bank of Poland for the day preceding the receipt of income is used.

- Spouses who earn income abroad must complete the PIT-ZG applications separately, even when filing joint tax returns.

- Foreigners working in Poland do not need to submit the PIT ZG application.

- Also, the application is not completed by persons receiving income abroad as a result of an employment relationship concluded in Poland (for example, in the case of delegation).

PIT M application for income of a minor child

In some cases The income of minor children is subject to taxation together with the income of their parents or guardians. Parents are required to report such income when calculating taxes annually and use the PIT M application to do this, which indicates the child’s income.

- If spouses file one annual tax return, they include the child's total income and attach one Schedule PIT M.

- If parents or guardians file individual tax returns, they complete separate PIT M applications, where they each report half of the child's income.

Important to note:

- Parental income is not included in the income of minor children from work and some types of scholarships.

- If the child receives income from other sources, he must file his own tax return, which the parents sign in his name.

Now, with all these attachments to your PIT tax returns, you will be able to prepare and file your Polish tax return without errors and taking into account all the necessary tax benefits and deductions.

"Remember to always seek professional help and advice on tax matters to ensure that you complete all paperwork correctly and take into account all tax reduction opportunities" - Janita Matushevskaya, freepudents expert.

Overview

The table below shows the most useful tax applications PIT declarations in Poland for individual entrepreneurs:

| Appendix | Description |

|---|---|

| PIT O | Filling in when using tax benefits and deductions |

| PIT D | Accounting for construction benefits for previous years |

| PIT-2K | Filling out in the first year of using construction benefits |

| PIT B | Accounting for income from business activities |

| PIT Z | Accounting for tax credit |

| PIT ZG | Accounting for earnings outside Poland |

| PIT M | Accounting for the income of a minor child |

The skill of filling out these forms will help you manage competently taxes and avoid penalties for tax violations.

How to properly file a tax return in Poland

When filing a tax return in Poland, sole traders must follow certain rules and procedures. In this section, we will look at what tax returns an individual entrepreneur must file, as well as step-by-step instructions for filing these returns correctly.

How to sign your return

Before you begin the tax return filing process, you need to decide on your signing method. If documents are submitted in paper form, the declaration must be signed by the entrepreneur himself. However, when it comes to electronic filing, there are several options.

You can sign your return electronically using a qualified electronic signature. A qualified signature is the signing of a document using an electronic signature certified by a customs certificate certyfikatu celnego. This method is also applicable when returns are submitted through the Tax Portal, CEIDG or the Tax and Customs Electronic Platform.

How to file your return electronically

There are various ways to file your return electronically. One of them is the use of the Electronic Declaration System using an interactive form. Another way is to use the online forms available on the Tax Portal if you have an account on that portal. You can also use PUESC (Platform for Electronic Tax and Customs Services). It is important to note that a new Electronic Tax Inspectorate system is being developed, in which it is planned to introduce new forms of declarations and programs for submitting them through Twoj e-PIT.

You should be attentive to current changes and updates, so regularly check links and articles containing up-to-date information on the latest changes.

Conclusions

As can be seen from the information presented, filing a tax return in Poland can be done both in paper and electronic form. The declaration can be signed manually in the case of paper filing or using a qualified electronic signature in the case of electronic filing.

If you choose to file electronically, you must decide on the method for signing the declaration and select the appropriate online platform or portal. Please remember that systems and portals may be updated, so keep up-to-date information and check links to official sources.

The table below summarizes what is useful to use and what to avoid when filing a tax return in Poland.

| Helpful | Not recommended | |

|---|---|---|

| Paper submission | Handwritten signature | N/A |

| Electronic Filing | Qualified Electronic Signature | Non-use of official platforms and portals |

It is important to comply with all requirements and instructions to avoid errors and penalties when filing a tax return in Poland. You must be careful and follow the given procedures exactly.

It is recommended to consult official sources and contact tax law specialists for more detailed information and advice.

"Knowledge is power. In the case of tax returns, this also means avoiding problems and penalties. Be professional and thorough!" - Edita Kovalevskaya, expert in economics.

If you want to know more about tax returns in Poland, check out the other sections of our article where we We provide detailed information about each type of declaration and the procedures for submitting them.

Conclusion: The importance of filing tax returns for sole traders in Poland 📝

Filing a tax return is a mandatory requirement for everyone individual entrepreneurs operating in Poland. In this section, we summarize the main points on this topic and provide useful information about what documents need to be submitted and how to do it correctly to avoid errors and penalties.

👉 Filing tax returns: obligations and conditions

One of the important aspects that you need Please note that filing tax returns is mandatory for all individual entrepreneurs in Poland. Depending on the conditions and specific situation, additional attachments to the declarations may be required.

👉 Methods of submitting documents

Individual entrepreneurs can choose between submitting documents in paper or electronic form. Both options have their advantages and limitations. Some types of returns may require only one filing method.

👉 Recommendations and tips

To make the process of filing tax returns in Poland as efficient as possible and avoid possible problems, follow some recommendations:

-

Gather all necessary documents and information in advance. This will help you avoid last-minute hassles and provide accurate and complete information on your return.

-

Use online platforms to file electronic returns. This will save you time and make the process convenient and fast.

-

Contact a professional if you have any difficulties. Accountants and tax advisors can provide you with knowledgeable advice and ensure that your return is completed correctly.

-

Don't forget about submission deadlines. Keep track of calendar dates and submit documents on time to avoid penalties and problems with the tax service.

👉 Basic requirements for successful filing

To successfully file tax returns in Poland, it is recommended to consider the following factors:

-

Accuracy and completeness of information. Please ensure that all information provided on your return is accurate and complete. Errors or omissions may result in incorrect tax assessments and problems.

-

Compliance for each declaration form. Use the correct forms appropriate to your activity or responsibilities. Choosing the wrong form can cause problems and complicate the verification process.

-

Keeping track of documents and important deadlines. Keep a record of all tax return-related documents and stay on top of important filing deadlines. This will help avoid misunderstandings and late fees.

👉 What to do and what to avoid

To make the process of filing tax returns in Poland easier, it is recommended to follow the following table of best practices:

| What to do | What to avoid |

|---|---|

| 👍 Collect all necessary documents in advance | 👎 Postpone document preparation until the last minute |

| 👍 Use online platforms for filing electronic declarations | 👎 Submit documents without checking and assessing the correctness |

| 👍 Seek help from professionals | 👎 Avoid consultations and assistance from accountants and tax consultants |

| 👍 Submit documents on time | 👎 Ignore calendar dates and filing deadlines |

👥 Expert comments

Requested expert opinions on the importance of correct filing of tax returns for individual entrepreneurs in Poland. Experts agree that correct and timely completion of declarations is the key to a successful business and avoiding troubles with the tax authorities.

Experts also noted that self-employed individuals can use professional help to make it easier to ethically file taxes completely and accurately.

📋 Conclusions

In this section, we reviewed the importance of filing tax returns for sole proprietors in Poland. We've reviewed the basic application requirements and conditions, provided guidance for a successful application process, and provided expert opinions.

Don't forget that filing your taxes correctly and completely is important to the success of your business. Follow the recommendations and seek professional help if necessary.

You now have all the information you need to successfully file your taxes in Poland.

Frequently asked questions on the topic "How to properly file a tax return in Poland: instructions for individual entrepreneurs"

What tax returns must be filed by an individual entrepreneur in Poland?

Individual entrepreneurs in Poland are required to file PIT tax returns depending on their type of activity and income, such as PIT-36, PIT-37 and PIT- 38. You can find out more about each declaration in our article.

What are the deadlines for filing tax returns for individual entrepreneurs in Poland?

Typically, the deadline for filing tax returns in Poland for self-employed individuals is April 30 each year, but there are some exceptions and additional deadlines for certain types of returns. It is recommended to check the current tax office deadlines.

How to file a tax return with the tax office in Poland?

A tax return in Poland can be filed in person at the tax office, sent by mail or filed electronically through a special tax office system. In this article we provide detailed instructions about each of these methods of filing a declaration.

Which PIT tax return annexes are most important for sole traders in Poland?

For individual entrepreneurs in Poland, such annexes to PIT tax returns as PIT O, PIT D, PIT-2K, PIT B, PIT Z and PIT M are especially important. In our article you will find information about each of them and their application.

How to file an electronic tax return in Poland?

An electronic tax return in Poland can be submitted through a special electronic tax office system. In this article we provide step-by-step instructions on how to correctly submit a declaration in electronic format.

Which tax returns should I use if I have income from different sources in Poland?

If you have income from different sources in Poland, then you will most likely need to fill out several types of PIT tax returns, such as PIT-37, PIT-36 , and PIT B. In the article you will find information on how to correctly submit such declarations.

Which tax returns should I use to claim construction tax credits for previous years in Poland?

To settle construction tax credits for previous years in Poland, it is necessary to use tax returns PIT D and PIT-2K. In the article you will find information about each declaration and its role in obtaining tax benefits.

What is the PIT ZG app and when should it be used in Poland?

The PIT ZG application is used in Poland to record certain types of income, such as income from the sale of real estate or shares. In this article, we provide information about the PIT ZG application and situations when it should be used.

Which PIT M application should I use for the income of a minor child in Poland?

To record the income of a minor child in Poland, you should use the PIT M application. In this article, we provide instructions on how to correctly fill out this application and include the child’s income in the tax return.

Where can I find more information about tax returns and filing rules in Poland?

For more information about tax returns and the rules for filing them in Poland, please visit the official website of the Polish Tax Office or contact a tax advisor.

Thank you for your attention and for becoming a highly qualified specialist!

🎉 Congratulations! Now you have all the knowledge you need to file your tax return flawlessly in Poland. You can move forward with confidence and succeed in business!

💼 📝 You can rest assured that your tax return will be completed correctly and filed on time with our detailed guide. So, no longer worry about the complexities of taxation, focus on growing and reaching new heights with your business!

🙌 Your tax return expertise will now enable you to achieve financial success in Poland. Don't forget that knowledge is power, and you have that power! 💪

Keep our detailed guide handy to ensure your tax obligations are met and you can rest easy knowing your business is in good hands.

📚 Thank you for choosing our blog as a source of information. We hope that our article was useful and interesting for you! If you have any questions, don't hesitate to contact us. Good luck on your entrepreneurial journey! 🌟

.gif)

- Glossary

- Tax returns for sole traders in Poland

- Types of annual PIT declarations for individual entrepreneurs

- Filing Deadlines

- Tax Return Attachments: Useful Tools for Accounting for Income and benefits

- How to properly file a tax return in Poland

- Conclusion: The importance of filing tax returns for sole traders in Poland

- Conclusions

- Frequently asked questions on the topic "How to properly file a tax return in Poland: instructions for individual entrepreneurs"

- Thank you for your attention and for becoming a highly qualified specialist!

Article Target

Provide the individual entrepreneur with all the necessary information about tax returns in Poland and explain how to submit them correctly to avoid errors and fines.

Target audience

Individual entrepreneurs working in Poland or planning to open their own business in this country.

Hashtags

Save a link to this article

Zinaida Rumyantseva

Copywriter ElbuzIn the world of automation, I am the weaver of the story of your prosperity. Here, every sentence is a drop of a catalyst for success, and I am ready to guide you along the path of an effective Internet business!

Discussion of the topic – How to properly file a tax return in Poland and avoid fines

In this article you will find all the necessary information about what tax returns a sole proprietor must file in Poland, as well as step-by-step instructions on how to properly file these returns.

Latest comments

8 comments

Write a comment

Your email address will not be published. Required fields are checked *

.png)

.png)

John

Wow, interesting article! I recently started my business in Poland and don't know anything about tax returns. It will be useful!

Emma

Really useful information! I have been working as an entrepreneur in Poland for several years now, but I am still always interested in new information about taxes. Thanks for sharing!

Pierre

This article is a real find! I'm just about to move to Poland and start my own business, so knowing the tax returns will be very useful.

Carlos

I also want to try my hand at Poland. This article will help me organize my business correctly and avoid tax problems.

Isabella

Very interesting! I run a business in Italy, but would like to consider expanding to Poland. This article will be a good start for learning about the tax system.

Oliver

I work with German entrepreneurs who often work in Poland. Your tax return tips will help them become more knowledgeable.

Sophie

I'm from the UK, but it's always interesting to learn about the tax procedures of other countries. This information may be useful in the future. Thank you!

Grumpy

Another article about taxes... such materials only confuse people. It seems to me that it is better to hire a specialist than to understand all these declarations.