Steps to register as a VAT payer in Poland

-

Galina Ostrachinyna

Copywriter Elbuz

Registering as a VAT payer in Poland is a mysterious and complex process. Which path should you take? What documents should I collect? In this article, we will tell you everything you need to know to successfully register as a VAT payer in Poland. Are you ready to learn all the secrets? Keep reading and success will be on your side.

Glossary

-

VAT (Value Added Tax) is the general name for value added tax, which is applied in various countries around the world, including Poland. It is levied on goods and services at every stage of their production and sale.

-

VAT UE is a special tax regime that is provided to businesses engaged in domestic and international trade with European countries -members of the EU. Under this regime, companies are required to obtain a VAT UE number for their operations in the European Union.

-

VAT payer is a legal entity or individual entrepreneur who is obliged to collect and pay value added tax for goods sold and services provided.

-

What is VAT EU is a similar value added tax that applies in other countries of the European Union. It has similar rules and procedures to Polish VAT, but requires separate registration and tax number.

-

Obtaining VAT payer status is the procedure that must be completed in order to become an officially registered payer of added value tax. cost in Poland. To do this, you need to prepare certain documents and submit an application to the relevant tax authority.

-

Registering a VAT number in Poland is a procedure for obtaining a unique VAT identification number for your business from the Polish Tax Service . This number is used for accounting and payment of value added tax.

-

VAT-EU registration is the process of registering as a value added tax payer in other European countries union. This also requires submitting an application and providing the necessary documents to the relevant tax authorities.

-

How to check VAT payer status VAT UE is a procedure by which you can check your VAT payer status on added value in Poland and other European Union countries. This allows you to ensure that the company is an official payer and can carry out its activities in accordance with tax requirements.

The glossary presents the main terms and concepts that will be used in the article. This will help readers better understand the text and avoid confusion when reading information about registering a VAT payer in Poland.

What is VAT in Poland?

Understanding VAT

VAT, or flat value added tax, is a tax on goods and services in Poland. This tax is paid by entrepreneurs on each financial transaction related to the sale of goods or services. The calculation and payment of taxes rests on the shoulders of the businessman himself.

Operation of VAT in Poland

Entrepreneurs, in accordance with Polish legislation, add the amount of tax to the price of goods or services that they continue to sell. At first glance, the tax is paid by the entrepreneur to the state treasury. However, in practice, in most cases, these costs are usually passed on to the buyer.

We can roughly say that the entrepreneur acts as an intermediary who receives tax from the client and puts it into the budget. Thus, entrepreneurs play an important role in the tax system, contributing to the collection of funds for the Polish budget.

Procedure for registering as a VAT payer in Poland

In order to register as a VAT payer in Poland, entrepreneurs must go through a certain procedure. In this section, we will look at the required documents and steps you need to follow for successful registration.

Required documents

To register as a VAT payer in Poland, the following documents are required:

- Application for registration VAT.

- Entrepreneur details, including company information, address, contact information, etc.

- Documents confirming the activities of the enterprise, such as an extract from the register of enterprises or a constituent agreement.

- Documents confirming that the turnover amount threshold has been exceeded, if applicable.

Registration steps

Basic steps to be followed to register as a VAT payer in Poland:

- Prepare all necessary documents and complete the VAT registration application.

- Submit your application to the Internal Revenue Service or mail it to the appropriate department.

- Wait until you receive your VAT number or registration notice from the tax office.

- Contact the appropriate organizations to update your information, including banks, suppliers and customers.

Why do you need to get a VAT number?

Registration as a VAT payer is mandatory for all entrepreneurs who pay this tax. In most cases, this means that all businesses must register for VAT, except those who are exempt from this obligation by law.

Exceptions

There are certain exceptions where VAT registration is not required. For example, if your turnover in the previous reporting year was less than PLN 200,000 and you are not engaged in certain types of activities specified in the relevant articles of the VAT law.

Useful tips for VAT registration

To successfully register as a VAT payer in Poland, it is recommended:

- Please read the registration requirements and procedures carefully.

- Prepare all necessary documents in advance.

- Contact professionals such as lawyers or accountants for further advice and assistance with registration.

- Keep your information up to date as required by the IRS.

- Use banking services and software systems to simplify accounting and tax payments.

Obtaining VAT payer status

In this section, you will learn about the process of registering as a payer of the Unified Value Added Tax (VAT) in Poland. We will tell you what documents are needed to submit an application, as well as step-by-step instructions for online registration on the portal biznes.gov.pl.

Registering a VAT number in Poland

You can register as a VAT payer either in person by contacting your tax office and submitting a paper application, or online through the biznes portal .gov.pl. In this section we will look at the online registration process.

-

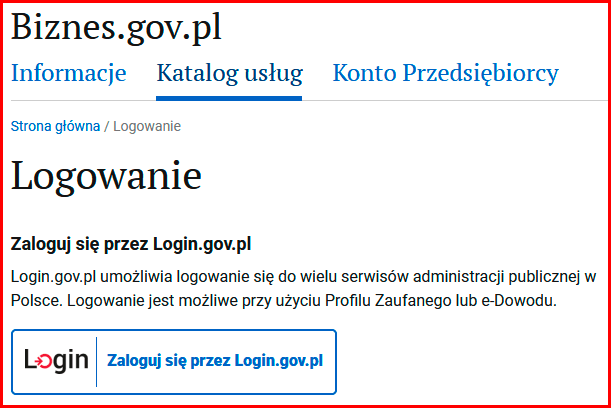

Go to biznes.gov.pl and log in using your trusted ePUAP profile. To do this, click on the link "Logowanie Zaloguj się przez Login.gov.pl".

-

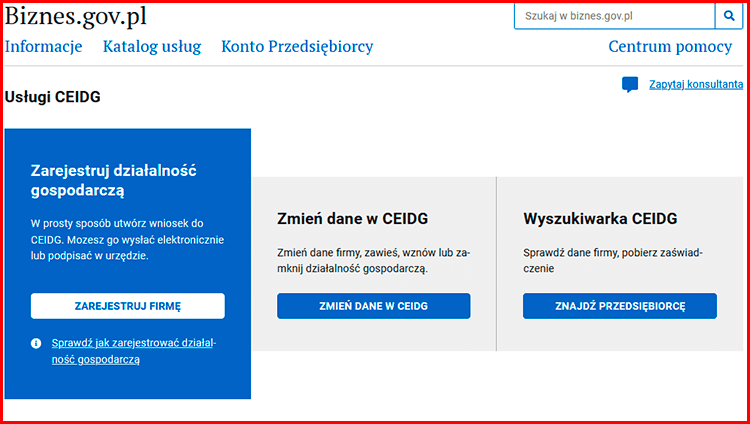

Log in to your account and select the "Zmień dane w CEIDG" option.

-

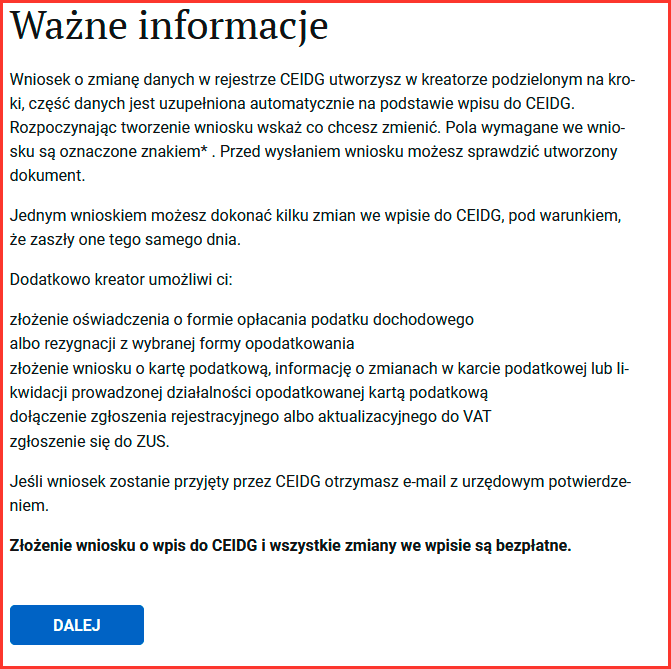

Review the information provided and click the "Dalej" button.

-

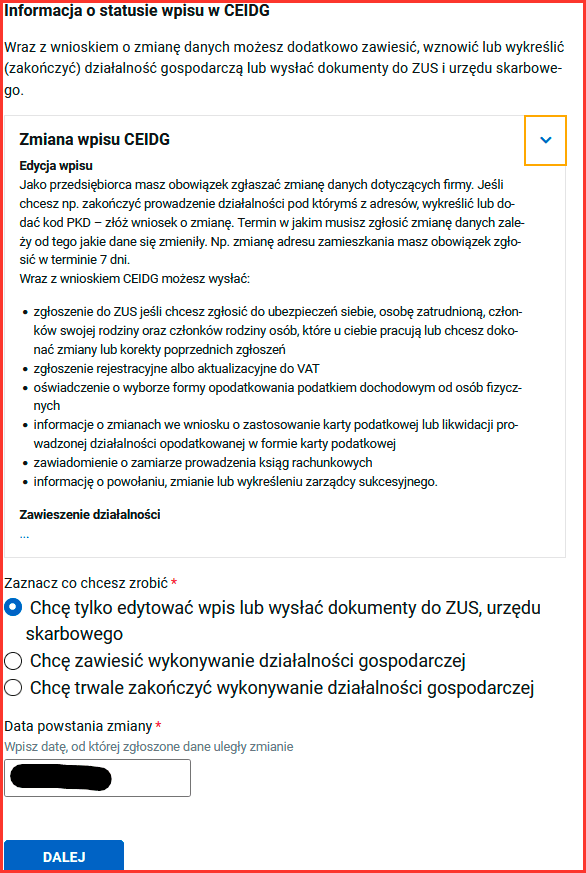

On the page that opens, select the first item “Data correction”.

-

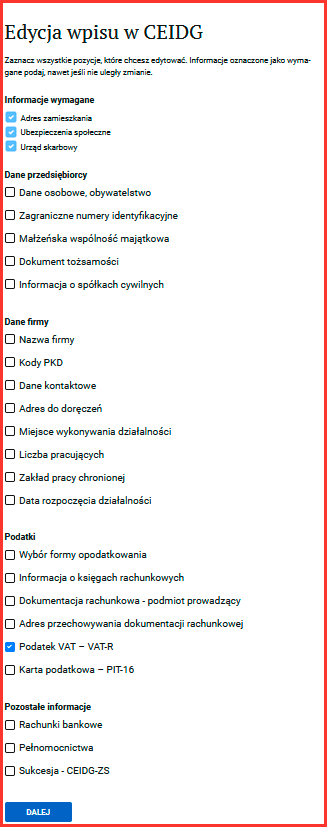

Enter a date, which can be either current or past. Then select the data you want to edit. The main interest for us is the item "Podatek VAT VAT-R". However, you can also change other settings.

-

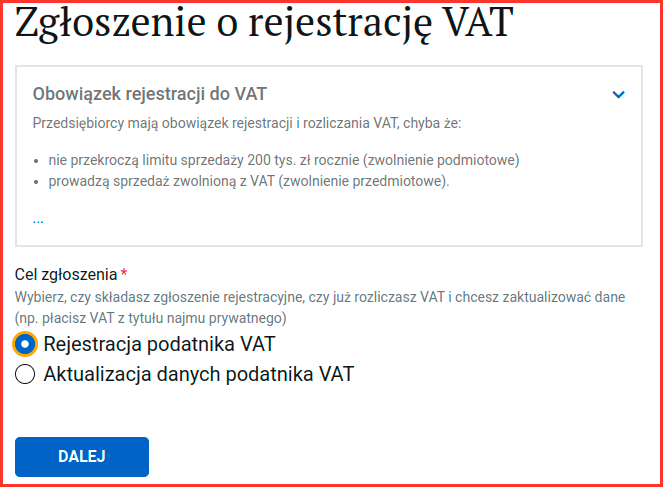

Go to the next screen and select the first item about registering as a VAT payer.

-

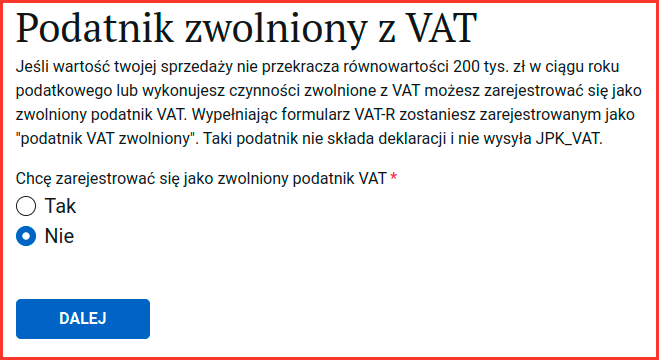

On the page that opens, you will be asked to indicate whether there are grounds for VAT exemption. In case you want to register for VAT, please indicate "Nie".

-

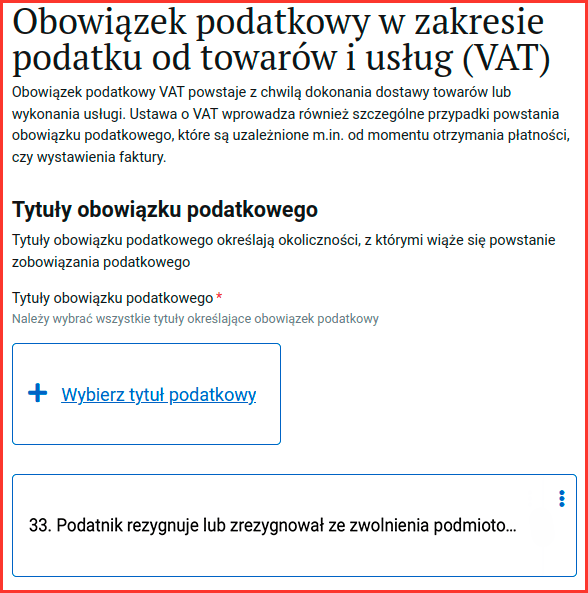

Then select the tax liability type "Podatnik nie ma prawa do zwolnienia 36" for activities that do not imply VAT exemption, and “Tytuł obowiązku podatkowego 33” for other cases.

-

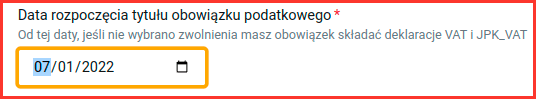

Enter the start date of the obligation. If you are applying in the current month, enter "nie" to select the current month.

Thus, you will successfully register as a VAT payer in Poland!

VAT-EU Registration

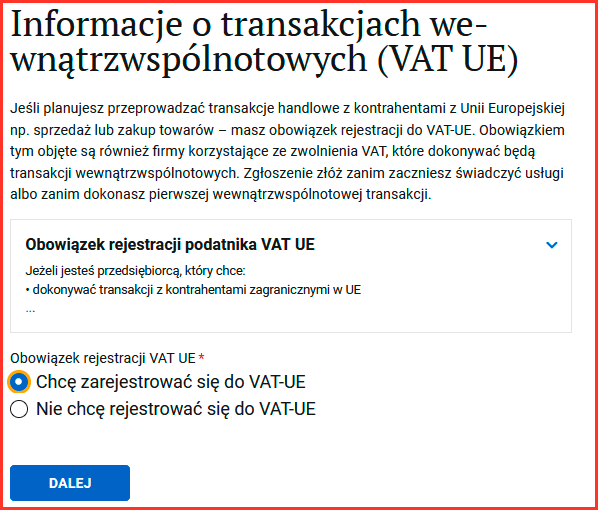

If you need to register for EU VAT, follow the same steps above until you select this option.

-

At the stage of selecting the main registration as a VAT payer, select the "Tak" option next to the offer to receive VAT-EU.

-

If you are already registered for regular VAT, select not to register VAT at the previous step , and updating the data.

-

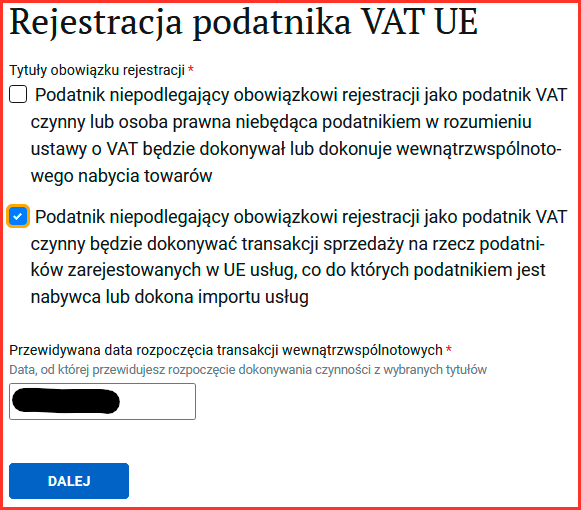

If a VAT number has not yet been issued, you can combine registration procedures. Indicate the products you plan to sell. It is acceptable to indicate both goods and services.

-

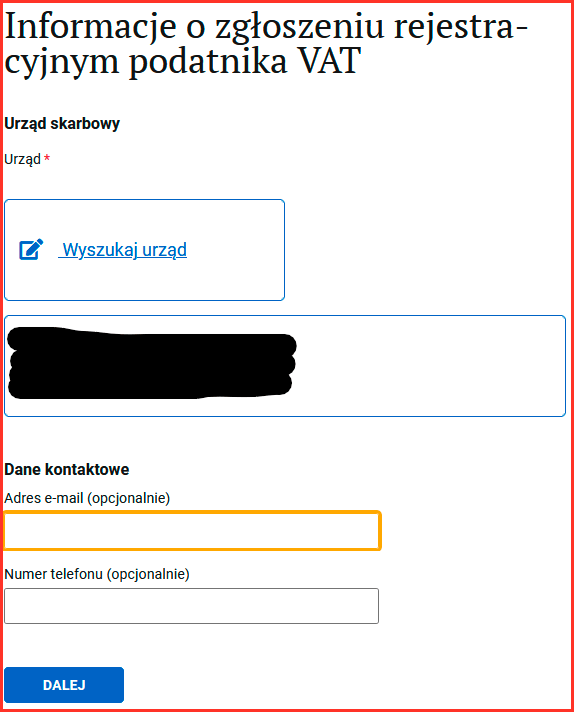

Enter a date no earlier than tomorrow from the current date and fill out your taxes and contact details.

-

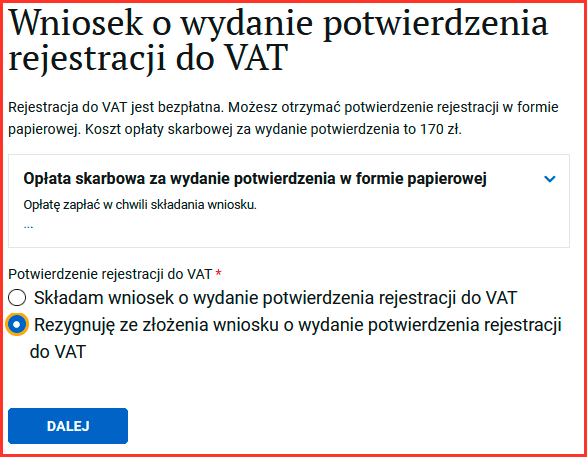

Select whether you require a paid paper proof of registration.

-

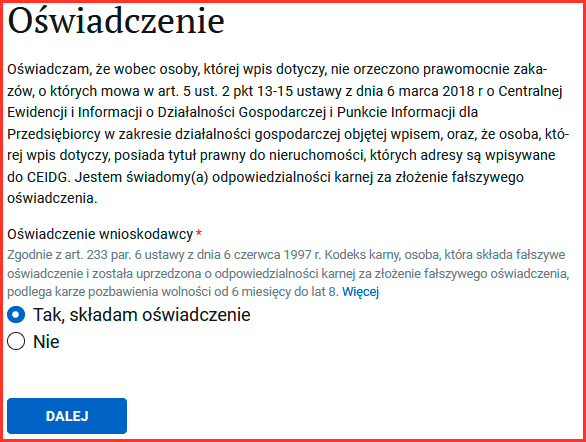

Read the disclaimer and click the "Dale" button.

-

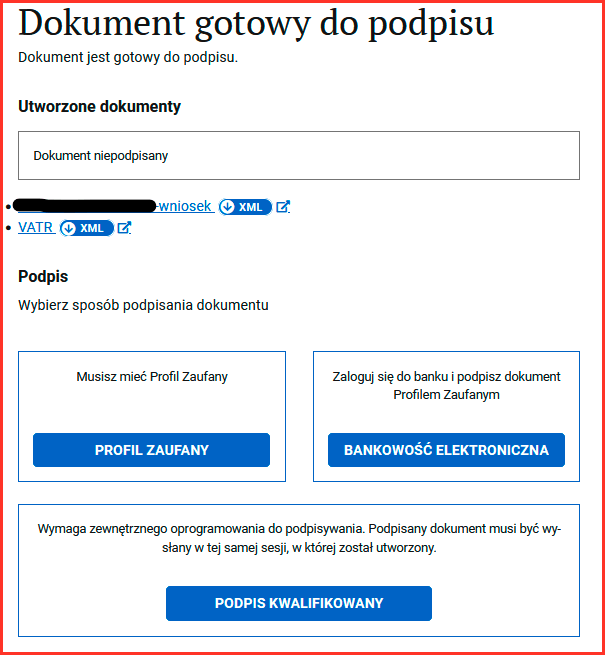

Review the summary information and electronically sign the application.

-

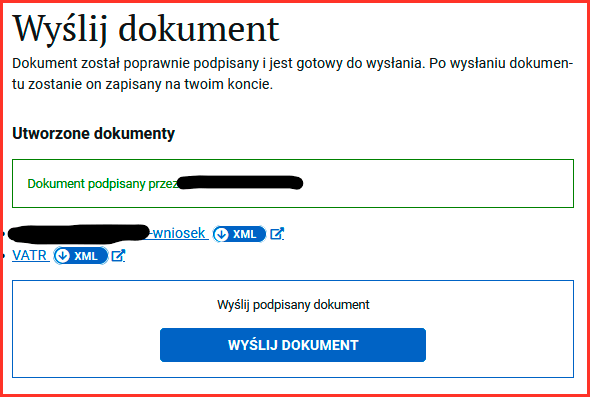

Submit the generated document.

Based on the results of registration, you will receive a notification to the specified contact information. Typically, a notification on paper is received within a month, on electronic media - about 2 weeks.

How to find out your payer status VAT in Poland?

In this section we will tell you how to check your VAT (Value Added Tax) status in Poland. Finding out whether you are registered as a VAT payer is very important for entrepreneurs and businessmen who want to conduct their activities in Poland. We will provide you with all the necessary information about the status check procedure and the available tools.

How to check VAT payer status?

VAT EU

If you want to check your VAT status in the European Union (EU), you will need to know your EC-EC number (European and Commonwealth Identification Number). ) of your enterprise. The only VAT payer identifier in Poland is the ND-EU number, consisting of the Poland Code Identifier (PL) and your Payer Identification Number (NIP).

You can check your VAT EU payer status by going to the website of the specified organization and entering your details. If your ND-EU number is active in the system, you will be recognized as a VAT payer in Poland.

Internal Polish VAT

You can check your status as an internal Polish VAT payer using the so-called white list of VAT payers. To check your status in Poland you will also need your ND-EU number. Again, the ND-EU number consists of the Poland Identifier Code (PL) and your Payer Identification Number (NIP).

Go to the specified website and enter your details to check your status. If your VAT-EU number is found in the white list of VAT payers, then you will be recognized as a VAT payer in Poland.

Where to ask questions?

If you have additional questions regarding checking your VAT payer status, you can ask for help through the telegram bot. Answers to your questions will help you better understand the registration procedure and determine your status.

Tax registration

If after submitting your application you have not been registered as a VAT payer, you must contact the tax office at your place of registration. They will be able to answer your questions and help you understand the reasons for the refusal.

Best practices

When checking your VAT payer status in Poland, it is recommended to follow the following guidelines :

- Please enter your information carefully to avoid errors during the verification process.

- If you have any questions, feel free to contact the telegram bot for further assistance.

- If registration is refused, contact the tax office for advice.

You now have all the information you need to check your VAT status in Poland. Good luck in your business!

Note

Please be aware that the process for checking VAT status may change over time . Make sure the information on the official websites of the tax authorities is up to date.

Table: Summary

| Action | Result |

|---|---|

| Check your payer status VAT EU | Determine if you are registered in Poland as a VAT EU payer |

| Check your status as a domestic Polish VAT payer | Find out if you are registered in Poland as a payer of internal Polish VAT |

| Contact the telegram bot to ask questions | Get answers to your questions regarding the registration procedure |

| Contact the tax office at your place of registration | Find out the reasons for refusal of registration and get additional advice |

Often asked questions about the topic "How to register as a VAT payer in Poland?"

What documents are needed to register as a VAT payer in Poland?

To register as a VAT payer in Poland, you will need the following documents: passport or identity card, a copy of the company registration certificate and documents confirming your residential address or the location of the company.

What is the process of registering as a VAT payer in Poland?

The process of registering as a VAT payer in Poland involves filling out the appropriate forms and submitting an application to the relevant tax office. The tax office then conducts an audit and issues you a VAT number once all the necessary conditions have been met.

What is VAT and VAT UE in Poland?

VAT (Value Added Tax) in Poland is a goods and services tax that is paid at every stage of the production and distribution process. VAT UE is a VAT payer status that allows trade within the European Union without paying tax at the borders between member countries.

Who needs to get a VAT number in Poland?

A VAT number is required for all companies that carry out trading operations in Poland, including the export and import of goods, the provision of services, domestic sales and purchases of goods and services.

What is the difference between VAT EU and VAT?

VAT EU (EU VAT) allows companies to trade within the European Union without paying tax at the borders between member countries. Regular VAT (SINGLE Value Added Tax) is applied domestically at every stage of the process of production and distribution of goods and services.

How to obtain VAT payer status?

To obtain VAT payer status in Poland, you must register with the tax service and provide all the necessary documents and information. After checking your application and fulfilling all conditions, you will receive VAT payer status.

How to register a VAT number in Poland?

To register a VAT number in Poland, you must fill out an application form and provide the relevant documents to the tax office. Once the verification has been completed and all requirements have been met, you will be issued a VAT number.

How to register as a VAT-EU payer?

To register as a VAT-EU payer, you must register with the Polish Tax Service and provide documents confirming your right to become a VAT-EU payer. After passing the verification and meeting all conditions, you will be assigned the status of a VAT-EU payer.

How to check the VAT, VAT UE payer status?

VAT, VAT UE payer status can be checked through the online service of the Polish Tax Service. You will be required to enter the corresponding VAT number and receive information about the current status of your company.

Thank you for reading the article and becoming a true professional!

Now that you have mastered the knowledge of the VAT registration procedure in Poland, you are ready to take your business to new heights! You are provided with all the necessary tools for a successful registration, and you will no longer encounter any unpleasant surprises.

Don't forget to save all the necessary documents and follow the recommendations presented in the article. And remember: VAT is not just a tax, it is an opportunity to grow and develop in your business endeavors!

Good luck in all your entrepreneurial endeavors in Poland! 💼✨

Article Target

To inform and help readers understand the procedure for registering as a VAT payer in Poland.

Target audience

Entrepreneurs and businessmen who want to register as a VAT payer in Poland and need information about the process.

Hashtags

Save a link to this article

Galina Ostrachinyna

Copywriter ElbuzThe secrets of online store automation are revealed here, like the pages of a magic book of a successful business. Welcome to my world, where every idea is the key to online effectiveness!

Discussion of the topic – Steps to register as a VAT payer in Poland

In this article you will learn about the procedure for registering as a VAT (SINGLE Value Added Tax) payer in Poland. We'll walk you through what documents are needed, what registration process you should go through, and what steps you need to follow to successfully register.

Latest comments

13 comments

Write a comment

Your email address will not be published. Required fields are checked *

.png)

.png)

Tom

How to register as a VAT payer in Poland?

Emma

The procedure for registering as a VAT payer in Poland is a small puzzle 😅 To register, you will need confirmation of company registration, an extract from the Trade Register, your documents, including a passport and Taxpayer Identification Number, as well as confirmation that your company is required to pay VAT.

Hans

Yes, in almost all countries there is such a puzzle! 😉 But I consulted with a lawyer, and he recommended contacting the local tax office in Poland, they will definitely be able to help in understanding the registration process and will provide the necessary forms and instructions.

Sophie

It will also be useful to study local tax laws. In Poland it is updated from time to time and it is always useful to keep up to date with the latest changes.

Luca

Thanks for the advice, Sophie! By the way, I know that not all companies are required to register as VAT payers in Poland. Each has its own criteria for determining whether to register. For example, if your company has a turnover of more than PLN 200,000 per year, then registration is required.

Natalia

Yes, Luca, it's true! It is also important to remember that once you register, you will have to provide regular reports of sales and purchases, as well as calculate VAT on your goods or services.

Pablo

I recently registered for VAT in Spain and it was not easy 🥵 To be honest, I was pleasantly surprised by the efficiency and friendliness of the local tax office. They helped me understand the process and answered all my questions.

Olga

Pablo, that's good to hear! Other people's experiences are always helpful. Welcome to the VAT payers club! 🔥

Max

That's what I think. VAT is such bullshit! Set of papers and complexity. Why can't they simplify the process? Who's with me?

Emma

I understand, Max. Sometimes it seems like the tax system is deliberately making life difficult. But once you register, you will be able to enjoy certain benefits and benefits.

Tom

I also encountered some difficulties during registration. But, frankly speaking, it is important to understand that this taxation is part of the business process. Ultimately, the decision to register as a VAT payer should be an informed one based on your specific situation and the benefit to your business.

Anna

I agree, Tom. Although the process can be complex, registering as a VAT payer can open up new opportunities and help your business grow. This is even despite all these papers! 😉

GrumpyOldMan

I'm already tired of this chatter... Papers, taxes, registrations... I would rather be in Arctic solitude than among these noisy and useless brethren!