Open your company in Poland: Complete guide to company registration

-

Svetlana Sibiryak

Copywriter Elbuz

Do you want to open a company in Poland and register your own company? We are here to help you. Starting a business is an exciting process, full of potential and opportunity. And today we will reveal to you all the secrets of successful company registration in Poland. Do you have a dream to start your own business? We invite you to become the hero of your own success story.

Glossary

- Firm is a legal entity registered for the purpose of carrying out commercial activities.

- Company is a synonymous concept for a company.

- Poland is a European country located in Eastern Europe.

- Company registration is the process of officially registering a legal entity to carry out commercial activities.

- Foreigner is a citizen of another state.

- Starting a business - creating and launching a commercial enterprise.

- Organizations - public and private institutions that provide necessary services and assist in the process of company registration.

- Intermediaries - persons or companies who assist foreigners in the process of opening a company in Poland for a certain fee.

- Company activities - the type of commercial activity that the company will engage in.

- Authorized capital - the amount of money or property that must be contributed to create and register a company.

- Notary is a public servant who certifies legal documents and transactions.

- State Register - state register in which the company is registered.

- Tax accounting - a system for recording a company's income and expenses for paying taxes.

- ZUS is the government body responsible for social security and health insurance in Poland.

- Seal - a special printed symbol containing information about the company and its registration.

- Registration of a company online - the process of registering a company via the Internet, without visiting government organizations.

- Confirmation - verification and confirmation of the data provided during online registration of the company.

- Form is a structured document that must be filled out when registering a company online.

- Basic information - basic information about the company that must be provided during online registration.

- Founders are the main participants and owners of the company.

- Electronic signature - an electronic analogue of a regular signature, used to confirm the legitimacy of documents and transactions.

- Memorandum of association - an agreement that regulates the rights and obligations of the founders of the company.

- Application for contribution of capital - a document indicating the amount of monetary contribution of the founders to the authorized capital of the company.

- KRS - KRS (Regional Registration Service), the body responsible for registering legal entities in Poland.

- Payment - the process of making a payment for registering a company and obtaining the necessary documents.

- Residence permit - Residence permit, temporary residence and work permit in Poland for foreigners.

- Advantages - positive aspects and benefits of starting a business in Poland.

- Disadvantages - negative aspects and problems that a business in Poland may face.

- Taxes are mandatory payments that a company must pay in accordance with Polish legislation.

- Reporting - the process of submitting reports on financial activities and payment of taxes by an entrepreneur.

- Conclusion is the final section of the article, which summarizes the results and formulates the main conclusions.

What business structures are in Poland

In Poland there are a large number of types of organizations for running business. Each of them has its own characteristics, advantages and limitations. In this section we will look at the most popular types of legal structures that Polish law offers for entrepreneurs.

Sole proprietor (Jednoosobowa działalność gospodarcza)

Sole proprietor is the simplest and most common type of business organization in Poland. When opening it, the entrepreneur works for himself and does not create a separate legal entity. This means that he has no obligations towards other participants and can directly manage his enterprise.

Benefits:

- Simple and fast registration.

- There is no requirement for a minimum authorized capital.

- Lack of publication of reports.

- Full ownership and control of the entrepreneur over the enterprise.

Restrictions:

- Personal liability of the entrepreneur for the debts and obligations of the business.

- Restricted access to certain industries and activities.

- Limited opportunities to attract financing.

Limited liability company (Spółka z ograniczoną odpowiedzialnością, sp. z o.o.)

Limited liability company - one of the most popular forms organizing business in Poland. In this case, the entrepreneur creates a legal entity that has its own rights and obligations. Members of the company are divided into shares and bear responsibility only within the limits of these shares.

Benefits:

- Limited liability of participants.

- Possibility of attracting investments.

- Flexibility in managing and regulating relations between participants.

- Prestige and trust in the business environment.

Restrictions:

- Requirement of a minimum authorized capital of PLN 5,000.

- More complex registration and accounting procedures.

- Restrictions on the transfer of shares to other participants.

Joint stock company (Spółka akcyjna, S.A.)

Joint stock company in Poland is the most complex and financially intensive type of business organization. Shareholders make contributions to the company and are part owners of it. The activities of a joint stock company are strictly regulated by joint stock legislation.

Advantages:

- Limited liability of shareholders for the debts and obligations of the company .

- Possibility of attracting large investments from third parties.

- High status and prestige in the business environment.

Restrictions:

- High minimum authorized capital of PLN 100,000.

- Complicated registration process and the need to go through a number of formalities.

- Strict corporate responsibility and shareholder control.

This is just a brief description of the most common types of business organizations in Poland. The decision to choose a structure depends on your goals, financial capabilities and preferences. Consulting with legal and business advisors can help you make the right choice based on your individual needs and situation.

Choosing the right business structure in Poland is an important step towards success. You should carefully review the available options and consult with experienced professionals to select the most appropriate structure for your business.

What to choose? Recommendations for choosing a business structure

| Type of structure | Benefits | Restrictions |

|---|---|---|

| Individual entrepreneur | - Simple registration | - Personal liability of the owner |

| Limited liability company | - Limited liability | - Minimum authorized capital |

| Joint-stock company | - Attracting investments | - High authorized capital |

Do not forget that the choice of business structure is an individual decision that depends on many factors. The best solution would be to seek help from lawyers and business consulting specialists who will help you through the entire process of opening a company in Poland and choosing the optimal structure for your business.

Who can open a company in Poland without intermediaries?

Opening a company in Poland can be a fairly simple process, especially for citizens of Poland or other European Union countries. However, not only Polish citizens have the right to do business in this country. In this section we will look at which foreigners also have the opportunity to open a company in Poland without the need to contact intermediaries.

Who has the right to open a company in Poland?

So, who can register a company in Poland without intermediaries? Let's look at the following categories of persons:

- Citizens of European Union countries - citizens of all EU countries have the right to open a company in Poland without having to apply to intermediaries. This includes citizens of Poland as well as citizens of other EU countries.

- Family members of EU citizens - spouses and children of EU citizens also have the right to open a company in Poland. This applies to spouses of Polish citizens and spouses of citizens of other EU countries.

- Citizens of European Free Trade Association (EFTA) countries - citizens of Iceland, Liechtenstein, Norway and Switzerland also have the right to open a company in Poland without having to apply to intermediaries.

- Holders of a long-term residence or long-term EU resident card - persons who have a long-term residence or long-term EU resident card can also open a company in Poland without intermediaries. This applies to both Polish citizens and citizens of other EU countries.

- Holders of a Pole's Card - persons who have a Pole's Card (Karta Polaka) can also legally open a company in Poland without the intervention of intermediaries.

- Holders of the Hourly Residence Card - if you are the spouse of a Polish citizen and are in Poland on the basis of a family reunification program, then you have the right to open a company.

- Refugees and persons with temporary or subsidiary protection status - refugees, persons granted leave for humanitarian reasons, or those with tolerated stay may also It is legal to open a company in Poland.

- Poland.Business Harbor program participants - participants of this program also have the right to open their own company in Poland.

Each of these categories of persons has the right to work and open a company in Poland with the same rights as Polish citizens.

Advantages of self-registration of a company

Registration of a company without intermediaries has its advantages. Firstly, it reduces the costs of intermediaries. You can go through all the procedures yourself and prepare the necessary documents, which will significantly save your budget.

Secondly, registering a company yourself gives you complete control over the process and confidence that everything is done correctly. You will know all the requirements and can make sure you comply with them.

Thirdly, starting a company on your own allows you to better understand the process and learn how to manage your business from the very beginning. You will gain valuable experience and knowledge that will help you develop as an entrepreneur in Poland.

What is needed for self-registration

Before you start registering a company in Poland, you need to prepare certain documents and go through certain procedures. Here are some of them:

- Determining the form and type of activity - decide on the form and type of activity of your future company. This will help you choose the right type of business activity and fill out all the necessary documents correctly.

- Preparation of necessary documents - to register your company you will need several documents such as a passport, birth certificate, proof of residential address and others. Make sure you have all the necessary documents.

- Opening a Bank Account - You will need to open a bank account for your company. Contact your bank and find out what documents you will need to open an account.

- Creating a company charter - the charter is the main document of your company. It specifies the basic rules and conditions of activity. Based on the charter, a decision will be made to register your company.

- Tax Registration - After creating the articles of association, you need to register with your local tax office. This is an important step for the legal functioning of your company.

- Registering with the Business Registration Authority - Finally, you will need to register your company with the Business Registration Authority. Provide all required documents and complete registration forms.

Useful materials and best practices

Determining who can open a company in Poland without intermediaries can be a complex process. To help you with this, we have prepared useful materials and best practices to help you get more information and make the right decision.

Determining the form and type of activity - before starting to register a company, study the various forms and types of business activity to choose the one that best suits your needs and goals.

Preparing the necessary documents - make sure you have all the necessary documents to register your company. If any documents are missing, contact the relevant authorities to obtain them.

Tax Registration - Contact your local tax office for information about the registration process and your company's tax obligations.

Timely compliance with requirements - follow all requirements and deadlines specified by business registration authorities. This will help you avoid delays and problems during the registration process.

Getting Professional Help - Don't hesitate to seek professional help when needed. Lawyers and accountants can help you with the preparation of documents and advice on registering a company.

Now you have all the necessary information about who can open a company in Poland without intermediaries. Select the category that suits you and follow the necessary steps to register your company. Good luck!

"Success is a combination of skill and opportunity. If you can't find it, create it."

- Raymond Albert Kroc, American entrepreneur, restaurateur, one of the first owners of the McDonald's restaurant chain

Overview

Below is a table summarizing useful information about self-registration of a company in Poland:

| Step | Useful information |

|---|---|

| Determining the form and type of activity | Explore the different forms and types of activity to choose the appropriate option. |

| Preparing the necessary documents | Make sure you have all the necessary documents to register your company. |

| Opening a bank account | Contact the bank to open an account with your future company. |

| Creating a company charter | Create a company charter with the help of a lawyer or specialist. |

| Tax Registration | Register your company with your local tax office. |

| Registration with the Entrepreneurs Authority | Submit an application for company registration to the Entrepreneurs Registration Authority. |

Now you are ready to start registering your company in Poland without intermediaries. We wish you success in your business!

Instructions for opening a company in Poland and registering a company

Opening a company in Poland and registering a company are important steps for entrepreneurs who want to run their business in this country. In this manual, we will look at the step-by-step procedure for opening a company in Poland and registering a company, and also tell you about the necessary documents, procedures and organizations that you should contact.

Step 1. Determining the company's activities

The first step when opening a company in Poland is to determine the main activities of the company. This is an important process that affects many aspects of a business, including profitability and taxation. To choose an activity, you need to study the Polish market and familiarize yourself with the relevant advice. According to Polish law, a company must select one main activity and can specify up to nine additional ones. Changes in selected activities can be made at any time, but this will require additional costs for re-registration.

Step 2. Formation of the authorized capital

The next stage is the formation of the authorized capital of the company. Polish legislation sets the minimum authorized capital for an LLC at 5,000 zł. The founder must make a contribution of at least 50 zł. There is no maximum share capital limit, but the level may affect certain fees and costs.

Step 3. Contact a notary

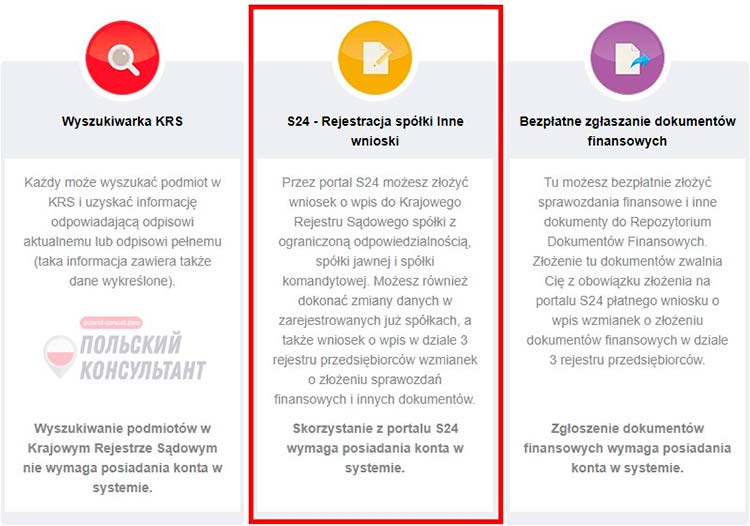

In the third step, all founders must get together and notarize the fact of creating the company. During the meeting with the notary, the founders' agreement is completed, the contribution of funds to the authorized capital is confirmed and the signatures of the founders are certified. A meeting with a notary is mandatory when registering offline, however, holders of an ePUAP digital profile can register online through the S24 system without contacting a notary.

Step 4. Registration in the State Register

The next step is to submit all necessary documents to the State Register of Judgments (Krajowy Rejestr Sądowy, KRS). The documents must be accompanied by the articles of incorporation, certified signatures and other required documents. The result of registration is the publication of the fact of registration in the Judicial and Economic Gazette (Monitor Sądowy i Gospodarczy) and the assignment of a statistical unique identifier of a legal entity (REGON).

Step 5. Tax accounting

After registration in the State Register, you must contact the local tax authority (Urząd Skarbowy) for registration. Along with the application, you must provide a receipt for payment of the state fee. As a result, the company receives its tax number (NIP), which is equivalent to the Russian TIN.

Step 6. Registration in the social insurance system

To register in the social insurance system (Zaklad Ubiezpieczen Spolecznych, ZUS), you must submit an application to register a new contribution payer. The application must provide information about employees and entrepreneurs themselves. However, if the entrepreneur already has other sources of income for which he already pays social contributions, registration with ZUS may not be required.

Step 7. Making a seal (optional)

The last step when opening a company in Poland is making a seal. The law does not stipulate the obligation to have a seal, but in some cases it may be useful for the implementation of the actual activities of the company.

The table below provides a description of each step and the required costs:

| Step | Description | Costs |

|---|---|---|

| 1 | Definition of the company's activities | Minimum |

| 2 | Formation of authorized capital | Minimum |

| 3 | Contacting a notary | 450 zł |

| 4 | Registration in the State Register | 1500 zł |

| 5 | Tax accounting | 170 zł |

| 6 | Registration in the social insurance system | No cost |

| 7 | Seal production | 30 zł |

It is important to remember that each stage has its own characteristics and may require additional documents or costs depending on type of activity and region of registration. If you complete all these steps, you will be able to successfully open a company in Poland and register the company.

Company registration in Poland: from online filling to receiving documents

Opening your own company in Poland is an important step for those who want to start their own business in this country. In this article we will look at the process of registering and opening a company in Poland to help you figure out how to go through all the stages and obtain the necessary documents to successfully start a business.

Step 1. Create an account

The online method of opening a business is convenient and effective. To start registration, you need to create an account on the website of the Ministry of Justice of Poland. Go to the website ems.ms.gov.pl and select the first option "Rejestracja spółki z o.o.".

Next, log in to the site and fill out the information, indicating your first name, last name, email address and creating a password. After filling out the form, your account will be created and you can proceed to the next step.

Step 2: Registration Confirmation

After creating your account, you will receive an email asking you to confirm your registration. Follow the link in the email to confirm your account and continue the registration process.

Step 3: Create Form

Once your registration is confirmed, you need to create a form to register your company. On the website of the Polish Ministry of Justice, go to the “Moje przedsiębiorstwa” tab and click “Dodaj Przedszebjorstwo”. Here you will need to enter the name of your company and select one of the proposed registration forms.

You can also add a brief description of your company's activities. After entering all the necessary data, click the "Zapisz" button to save the changes.

Step 4. Basic Information

At this stage, you need to enter basic information about the company. Go to the "Wnioski" tab and click "Nowy Wniosek". Select the first item for LLC and go to the list of documents.

Select the required documents for registration. If the list of documents is not available, click "Nowy document" and wait for the documents to download. Then select the application date and click "Zapisz" to save the changes.

Step 5. List of founders

At this stage, you need to enter information about the founders of the company. Select "Lista wspólników" and create a new document. Fill out all the required fields, indicating the first name, last name, identification documents, and other information about the founders.

Step 6. Electronic signatures

Each company founder must have an electronic signature. If you already have a verified account, you can click the "Podpisy" button and go through all the system requirements to create an electronic signature.

If the founder is not yet registered, he needs to create an account on the website of the Ministry of Justice of Poland and activate the electronic signature. After this, the founder must confirm the account, select the company to be registered and click the "PODPISZ" button to sign the documents.

Step 7. Memorandum of Association

At this stage, you must return to the documents page and select "Umowa spółki z ograniczoną odpowiedzialnością". Fill in the required fields, including the date of establishment and information about the shares of the founders.

You can also specify the rules for selling shares and establishing rules for changing reserves. After filling in all fields, click "Zapisz" to save the document.

Step 8. Application for contribution of capital

At this stage you need to create a document "Oświadczenie o wniesieniu kapitału". Select the appropriate document from the list and fill in all the required fields. After that, click "Zapisz" to save the changes.

Step 9. Electronic signatures

All founders, except the one who has already confirmed his signature, must create an account on the website of the Ministry of Justice of Poland and activate the electronic signature. They can then sign the documents by going to the "Podpisy" tab and clicking the "PODPISZ" button.

Step 10. Application to KRS

After signing all the documents, you can apply to register your company. Go to the "Wnioski" tab and select "Wniosek o rejestrację podmiotu w rejestrze przedsiębiorców spółka z o.o. przy wykorzystaniu wzorca umowy".

Fill in all required fields, including the name of the court, registered address and type of activity of your company. After filling out all the fields, click "Wybierz" and select your main and additional areas of activity. Then click "Zatwierdz" to save your changes.

Step 11: Payment

To complete the registration process, you must pay the appropriate fee. Click "Opłać i wyślij" and select a convenient payment method using one of the Polish banks or Visa or MasterCard payment systems. Follow the instructions of the payment system and enter the required data.

Step 12. Receiving documents

After completing the payment, all you have to do is wait for the documents to be received. This process usually takes about 7 days. Once the status of your request changes, you will be able to print the documents, sign them, and submit them to your chosen court in person or by mail.

It is important to save all documents received, as you will need them for the future activities of your company.

Registering a company in Poland is a process that requires attention to detail and many steps. However, by following this guide, you will be able to register your company online and receive all the necessary documents to successfully start your business. Please note that each case may be slightly different and the registration steps may vary.

Table: Basic steps for registering a company in Poland

| Step | Description |

|---|---|

| Step 1 | Account creation on the website of the Ministry of Justice of Poland |

| Step 2 | Confirmation of account registration |

| Step 3 | Create a registration form |

| Step 4 | Filling out basic information about the company |

| Step 5 | Entering a list of founders |

| Step 6 | Creating electronic signatures |

| Step 7 | Execution of the articles of incorporation |

| Step 8 | Application on capital contribution |

| Step 9 | Signing documents |

| Step 10 | Submitting an application to the registration court |

| Step 11 | Pay the appropriate fee and submit the documents |

| Step 12 | Receive the necessary documents and save them for future reference |

Note: When registering a company in Poland is advised to obtain specialist or legal advice to ensure that all steps are completed correctly and in full compliance with the requirements of Polish law.

Remember that every business case is unique, and for specific advice, it is recommended to consult professionals in the field.

It is important to ensure correct registration and obtain all necessary documents for the successful launch and development of your business in Poland.

"Registration of a company in Poland is an important step for starting your own business. Gradually take all the necessary steps for successful registration and opening of the company. This will help you avoid many troubles and ensure proper functioning your enterprise." - Irena Sokolovskaya, expert in company registration.

By registering a company in Poland, you will have the opportunity to officially work and develop your business. Please note that the entire registration process may take some time and require some effort, but with a good approach and professional support it will be possible.

If you want to learn more about the process of registering and opening a company in Poland, check out [detailed article](link to article about registering a company in Poland) on our blog.

As you can see from the description of each step of registering a company in Poland, this process can be complex and confusing. To save time and avoid mistakes, it is recommended to contact professionals specializing in company registration in Poland. They will help you go through all stages of registration without unnecessary problems and prepare all the necessary documents.

Don't be afraid to register your company in Poland - this is an important step towards your success!

How to get a national business visa for founders of a Polish company

When you decide to set up a company in Poland, you may A visa is required to enter and work in this country. The founder of a Polish law firm is entitled to a national business visa D, which allows him to officially open a company and be its owner. In this section we will look at how to obtain this visa, under what conditions it is issued and what documents you will need.

Conditions for obtaining a D visa for founders of a company in Poland

In order to obtain a national business visa D as the founder of a Polish legal entity, you need to meet certain requirements . Here are the main ones:

-

To be a founder of a Polish company: You must be one of the founders or owners of a company registered in Poland. In other words, you need to first open a company and then start applying for a visa.

-

Availability of sufficient funds: Your company must have sufficient funds to pay wages and support your stay in Poland. The embassy may request evidence of the financial stability of your company.

-

Compliance with the rules of entry and stay: You must be prepared to comply with the rules of stay in Poland and intend to carry out business activities within your company.

Procedure for obtaining a business visa D

-

Register your company in Poland: First of all, you need to register your company in Poland and obtain an extract from the Unified State Register of Legal Entities (KRS).

-

Prepare the necessary documents: To obtain a D business visa, you will need to prepare a set of documents including:

- A copy of an extract from the Unified State Register of Legal Entities (KRS), confirming the registration of your company in Poland.

- A business plan for your company, detailing your business goals and plans.

- Contracts or agreements with clients or partners, if any.

- Documents confirming the availability of sufficient funds to support your stay in Poland.

- Other documents requested by the consular department in your country.

-

Contact the Embassy or Consulate: After preparing all the necessary documents, contact your nearest Polish Embassy or Consulate to submit your application to obtain a business visa D. Please note that the procedure and requirements may vary slightly depending on your country of residence.

-

Obtain a D business visa: After submitting your application and having your documents verified by the consulate, you will be issued a D national business visa. The process usually takes several weeks, but may take longer depending on specific circumstances.

Summary

Obtaining a national business visa D for the founders of a Polish company is an important step in the process of opening a business in Poland. Before you start applying for a visa, make sure that your company is registered and ready to provide the necessary financial documents. Contact your Polish embassy or consulate to clarify all requirements and begin the visa process.

Useful and useful (best practices):

| 🟢 What to do | 🔴 What not to do |

|---|---|

| 🟢 Try to prepare a business plan for the company with a detailed description of its goals and development plans. | 🔴 Do not provide false financial documents that may influence the consulate’s decision. |

| 🟢 Seek help from a consultant or lawyer who specializes in business migration issues. | 🔴 Do not leave submitting documents until the last minute, as the process may take some time. |

| 🟢 Carefully review the requirements of the Polish embassy or consulate and make sure that you meet all the conditions. | 🔴 Don't forget to keep an eye on your visa expiration dates so you can renew it in a timely manner or get a new one if necessary. |

Move forward!

Now that you have an idea of how to obtain a National Business Visa D for founders of a Polish company, you can begin the process of opening your business in Poland with confidence. Please remember that each case may be different, so it is recommended that you contact a specialist or consultant for individual support and advice.

"Obtaining a national business visa for founders of a Polish company is an important step towards opening your business in Poland. Make sure you fully meet the requirements and prepare for the process in advance, so that everything goes smoothly. Be sure to contact specialists to get adequate support and expert advice on applying for a visa,” comments Wladzimierz Krawczyk, a specialist in migration law.

How to obtain the right to a residence permit in Poland if you have a company ?

Poland is an attractive country for entrepreneurs from all over the world, and opening a company here can lead to many benefits. One of these advantages is the possibility of obtaining a Temporary Residence Permit (RP) for company owners. In this section we will look at what conditions must be met in order to be able to obtain a residence permit if there is a company in Poland.

Conditions for obtaining a residence permit

-

Stable income of the company: One of The main indicators that people pay attention to when considering an application for a residence permit is the income of your company. For the previous reporting year, your company must show a stable income of at least 13,000 euros. It is important to note that this figure may vary by region.

-

Employment of citizens of the Republic of Poland or foreigners with a work permit: Your company must employ at least 2 citizens Republic of Poland or foreigners with a work permit. These employees must work full time for the company and have worked for at least a year. In addition, the duration of their employment should not be limited.

-

Detailed business plan for the development of the company: Although the main conditions for obtaining a residence permit are the income of the company and the employment of local citizens , there is also the possibility of providing a detailed business plan for the company’s development. If your business plan shows growth prospects and compliance with the above conditions, this may be an additional argument for successfully obtaining a residence permit.

Process of obtaining a residence permit

-

Preparation of necessary documents: Before starting the process of obtaining a residence permit, you need to prepare the following documents: an application for obtaining a residence permit, documents confirming the company’s stable income and copies of documents of your company’s employees.

-

Submitting an application: The application for a residence permit along with the necessary documents is submitted to the relevant Polish migration office or consulate. There your documents will be checked and reviewed. It is important to ensure that all documents provided look professional and fully comply with the requirements of the authorities.

-

Application Review: Once your application and documents are submitted, your case review process begins. Over time, you may need additional information or documentation to verify your income and employment status.

-

Making a decision: After reviewing your application and conducting all necessary checks, a decision will be made whether to approve or deny the issuance Residence permit is accepted. If approved, you will receive a document confirming your right to a Temporary Residence Permit in Poland.

What is useful and what should not be done?

| Helpful | Don't |

|---|---|

| Partnerships with local entrepreneurs | Ignoring requirements and rules |

| Business development and strengthening | Negative image of your company |

| Providing complete and accurate information | Hiding information or providing false data |

Results

If you are the owner of a company in Poland and want to obtain a residence permit, then for this you must fulfill certain conditions. Opening a company, maintaining a stable income and employing local citizens or foreigners with a work permit are the main factors that are paid attention to when considering applications for a residence permit. In addition, providing a detailed business plan can further help in successfully obtaining a residence permit. Do not forget that the process of obtaining a residence permit may take some time and will require effort in collecting and submitting the necessary documents. However, by obtaining a residence permit, you will be able to legally live and work in Poland, as well as receive a number of benefits for your business.

"Obtaining a residence permit is an important step for entrepreneurs who want to develop their business in Poland. I strongly recommend that you familiarize yourself with the requirements and provide complete information to increase your chances of successfully obtaining a residence permit " - Nina Vitkovskaya, expert on international migration.

Pros and cons of starting a business in Poland

In this section we will look at the main advantages and disadvantages of starting a business in Poland. This will allow you to get a complete picture of what awaits you when opening a company and registering a company in this country.

Pros

1. Opportunity to work for yourself

The most important advantage of starting your own business in Poland is the opportunity to work for yourself, make independent decisions and manage your business. You will be the main leader of your company and will be able to control all work processes.

2. Transparent legal conditions

Poland offers transparent legal conditions for business. The official registration of a company and accounting takes place in strict accordance with the law, which makes doing business easier and prevents the occurrence of legal problems.

3. Possibility of obtaining a business visa

Opening a company in Poland gives you the opportunity to obtain a business visa, which will allow you to legally stay in the country and run your business . This is an excellent opportunity for foreign entrepreneurs who want to live and work in Poland.

4. Obtaining a residence card based on business

When opening a business in Poland, you will have the opportunity to receive a residence card based on doing business. This will make your stay in the country easier and protect your interests as an entrepreneur.

Cons

1. The need to know Polish

One of the main disadvantages of starting a business in Poland is the need to know Polish language. Some activities may not be possible without knowledge of the language, so you should study it or find a reliable translator.

2. Bureaucracy and complex reporting

Extensive bureaucracy and complex reporting requirements are another disadvantage of starting a business in Poland. You should be prepared to spend additional time and effort completing formalities and submitting reports.

3. High taxes

Another disadvantage of starting a business in Poland is the hefty tax payments. Poland has one of the highest tax rates in Europe, which can have a significant impact on your profitability.

Summary

Opening a business in Poland has its pros and cons. You should carefully consider all aspects and decide whether this country is suitable for you to register a company. The need to speak Polish, complex bureaucracy and high taxes are factors you should keep in mind. However, the prospect of working for yourself, transparent legal conditions and the possibility of obtaining a business visa and residence card make Poland an attractive place for business.

"It is important to remember that each business has its own characteristics and what may be a disadvantage for one, can be a plus for someone else. Always evaluate your capabilities and advantages before making a decision." - Patrick Klimek, expert on business in Poland.

Useful tips when starting a business in Poland

| What to do | What not to do |

|---|---|

| Study Polish thoroughly | Forget about the need to know Polish |

| Contact turn to professionals for help | Ignore the complexities of bureaucracy and reporting |

| Study the Polish tax system | Fail to properly analyze taxes and their structure |

| Consult a lawyer for advice | Ignore transparent legal terms in Poland |

| Develop a business plan for your future company | Put off developing a business plan until later |

| Consult Industry Experts | Ignore Experience and Advice of Industry Experts |

We hope that this review will help you make a decision about opening a business in Poland and registering a company. Be prepared for challenges, but remember that with the right preparation and knowledge, you can succeed in this country.

Tax system and reporting for business in Poland

The Polish tax system is a tricky tightrope in which it is sometimes easy to get lost . And frequent changes in legislation only increase this complexity. In this section we will look at the main aspects of taxes and reporting for entrepreneurs planning to open a company in Poland and register a company.

Types of taxes in Poland

In Poland, there are several types of taxes that an entrepreneur will have to pay depending on the form of ownership and type of activity of the company. Major taxes that may be applicable include:

- Personal Income Tax (PIT) - is a tax on personal income and applies to both for individuals and individual entrepreneurs.

- Value Added Tax (VAT) is a goods and services tax paid by customers when purchasing goods or services.

- Income tax is a mandatory tax for legal entities that levies companies on their net profits.

- Excise tax is an additional tax that is levied on goods such as alcohol, tobacco and cars.

- Social Security is a tax levied on employers and employees to provide social security.

Each of these taxes has its own characteristics, and therefore it is important to understand which tax applies to your type of activity.

Reporting Responsibilities

In addition to paying taxes, entrepreneurs are also required to comply with certain reporting rules to tax authorities. Reporting in Poland includes the following aspects:

- Quarterly reporting for value added tax - companies must report their sales, services and transactions with VAT every quarter. These reports include information about the amount of VAT that the company must pay or receive back in accordance with the transactions.

- Monthly Income Tax Return – Individuals and self-employed individuals must submit monthly PIT tax returns detailing income, tax deductions, and the amount of income tax due. tax payable.

- Annual income statement – legal entities must submit an annual income statement (balance sheet), which provides information about the company's income, expenses, profits and losses.

Tax Accounting Tips

To make your life easier when managing the tax system in Poland, here are some tips from the experts:

- Maintain accurate and accurate bookkeeping - bookkeeping should be the basis for tax reporting. Make sure your financial records are accurate and compliant with the law.

- Follow reporting deadlines - Do not miss filing deadlines with tax authorities, as this may result in fines and legal problems.

- Contact a tax accounting specialist - if you are not confident in your abilities or want to avoid possible mistakes, you can contact professionals who will help you with accounting taxes.

Once you are familiar with the basic aspects of the tax system and reporting in Poland, you will be ready to start opening a company and registering companies in this country. However, each case is individual, so it is recommended to seek advice from professionals and study in more detail the requirements and procedures in accordance with your plans and type of business.

"A proper understanding of the tax and accounting system is the key to successfully doing business in Poland." - Zuzanna Drozd, tax expert.

| Useful to do | Better not to |

|---|---|

| Keep accurate accounting records | Skip deadlines for submitting reports |

| Get advice from specialists | Rely only on yourself |

| Comply with the requirements of the tax system | Ignore ambiguities in the legislation |

| Understand the peculiarities of your industry | Make mistakes in tax calculations |

| Learn new things and follow changes in legislation | Avoid cooperation with professionals |

Opening a business in Poland: useful tips for everyone

Have you always dreamed of opening your own business in Poland? The good news is that this opportunity is available to almost everyone, including foreigners. Regardless of whether you are Ukrainian, Russian or Belarusian, this article will help you understand the steps required to open a company in Poland and register a company.

Important aspects of starting a business in Poland

Before starting your business in Poland, it is important to understand the main aspects of this process. Here are a few key steps that will help you successfully register a company in Poland:

1. Decide on the form of organization

The first important step is to decide on the form of organization of your future companies in Poland. Options can be different: from individual activity to the creation of a joint stock company. The choice of form of organization depends on your goals and the benefits you plan to get from the business.

2. Prepare the necessary documents

Before registering a company, you need to prepare a number of documents. This may include passport details, birth certificate, copies of previous work experience and other documents necessary to confirm your identity and qualifications.

3. Prepare start-up capital

You must have sufficient start-up capital to open a company in Poland. The amount may vary depending on the type of organization and other factors. Make sure you evaluate all the costs associated with starting a business to avoid financial problems in the future.

4. Register your company

Once you have prepared all the necessary documents and raised the starting capital, you will need to register your company. This can be done at the registration office or online. You will need to fill out a special form and provide all the necessary documents.

5. Contact business experts

Opening a business in Poland can be a complex process, so it is recommended that you contact experts to help you with this matter. Business consultants, lawyers and accountants with experience in Poland will be able to provide you with valuable advice and help you with all the necessary paperwork.

Important links and contacts

When starting a business in Poland, many questions will likely arise. Here are some useful links to help you get more information and go through all the stages of starting a company:

- Citizens' portal with information on doing business in Poland

- Official website of the Polish Tax Service

- Official register of Polish companies

- Consultation centers for entrepreneurs

By turning to these sources, you will receive all the necessary information and you can open your own business in Poland without unnecessary problems.

"Opening a business is about making your dreams come true. Don't be afraid to take the first step!" - Wojciek Muszynski, expert on entrepreneurship in Poland.

Helpful overview of the basic steps

Now that you're familiar with the main steps of starting a business in Poland, let's review what you need to do and what actions are best avoided:

| What you need to do | Things to avoid |

|---|---|

| Explore different forms of organization and choose the one that suits you | Take your time with your choice, carefully consider all options |

| Prepare all necessary documents in advance | Do not put off collecting documents until the last minute |

| Contact specialists for qualified assistance | Do not try to cope with the process yourself if you are not confident in your knowledge |

| Use useful online resources for information | Do not limit yourself to only one source of information, conduct a comparative analysis |

By following these recommendations, you will be ready to successfully open and register your company in Poland.

We hope this guide helps you start your business in Poland. Good luck on your entrepreneurial journey!

"Success comes to those who are not afraid to go forward and achieve their dreams!" - Caleb Davis Bradham, American pharmacist, businessman, best known as the inventor of the soft drink Pepsi.

Frequently asked questions on the topic "How to open a company yourself in Poland and register a company?

1. What documents need to be prepared to open a company in Poland?

To open a company in Poland, you will need documents such as a passport, memorandum of association, registration certificate, as well as documents confirming the authorized capital and information about company activities.

2. Can a foreigner register a company in Poland without intermediaries?

Yes, foreigners have the right to independently register a company in Poland without intermediaries. They must follow established procedures and provide the necessary documents.

3. On what grounds can a foreigner open a business in Poland?

A foreigner can open a business in Poland on the basis of a residence permit, work permit or business visa.

4. What are the steps to open a company in Poland for a foreigner?

For a foreigner, opening a company in Poland includes the following steps: determining the company's activities, forming an authorized capital, visiting a notary, registration in the State Register, tax accounting, registration in ZUS and print production.

5. How to register a company in Poland online via the Internet?

To register a company in Poland online, you will need to create an account on a special platform, fill out the necessary forms and provide basic information about the company and its founders. Then you need to send an application to KRS and pay for registration. After checking and approving the application, you will receive company registration documents.

6. How can company owners get a Polish visa?

Company owners who wish to obtain a Polish visa must contact the Polish consulate in their country with a visa application and documents confirming the purpose of their arrival in Poland.

7. How to obtain the right to a residence permit if you have a company in Poland?

If you have a company in Poland, you can obtain the right to a residence permit by submitting an application to the relevant authorities. To do this, you will need documents confirming your business activity and justifying the need to be in Poland.

8. What are the advantages and disadvantages of starting a business in Poland?

The advantages of starting a business in Poland are access to the EU market, a variety of investment opportunities and government support for entrepreneurs. However, the disadvantages may be difficulties in obtaining permits, high competition and local market conditions.

9. What taxes and reporting must an entrepreneur in Poland submit?

An entrepreneur in Poland must pay taxes such as value added tax, income tax and social contributions. He also needs to submit financial statements and reporting to the tax service.

10. What documents do you need to obtain after registering a company in Poland?

After registering a company in Poland, you will be issued documents confirming its registration, such as a certificate of incorporation, statute of the company and an extract from the business register.

Thanks for reading and becoming a savvy entrepreneur!

Congratulations! You have just read an article that will help you become a real professional in opening your own company in Poland. You now have valuable knowledge about all the necessary steps, documents, procedures and organizations that you will encounter.

You are an enterprising and determined entrepreneur, ready to take on a challenge and implement your business in Poland. Opening a company is not only a new business chance, but also a journey through the wonderful world of entrepreneurship.

And remember that all the information you learned in this article will be very useful for you in the future. You now have the tools and knowledge to turn your dreams into reality.

So don't be afraid to take risks, take on challenges and strive for new horizons. We are confident that your new company in Poland will be successful and bring you great satisfaction.

Good luck! 🍀

- Glossary

- What business structures are in Poland

- Who can open a company in Poland without intermediaries?

- Instructions for opening a company in Poland and registering a company

- Company registration in Poland: from online filling to receiving documents

- How to get a national business visa for founders of a Polish company

- How to obtain the right to a residence permit in Poland if you have a company ?

- Pros and cons of starting a business in Poland

- Tax system and reporting for business in Poland

- Opening a business in Poland: useful tips for everyone

- Frequently asked questions on the topic "How to open a company yourself in Poland and register a company?

- Thanks for reading and becoming a savvy entrepreneur!

Article Target

Provide a detailed guide about the process of opening a company in Poland and registering a company

Target audience

Entrepreneurs, businessmen, freelancers who want to open a company in Poland or receive information about the process

Hashtags

Save a link to this article

Svetlana Sibiryak

Copywriter ElbuzThe magic of words in the symphony of online store automation. Join my guiding text course into the world of effective online business!

Discussion of the topic – Open your company in Poland: Complete guide to company registration

In this article we will look at the steps required to open a company in Poland and register the company. You will learn what documents need to be prepared, what procedures to go through and what organizations to contact. This information will be useful to those who are planning to start a business in Poland and need guidance on opening it.

Latest comments

10 comments

Write a comment

Your email address will not be published. Required fields are checked *

.png)

.png)

John

It is very interesting! I had heard a lot about business opportunities in Poland, but didn't know where to start. I will listen carefully!

Mia

Yes, Poland does offer many opportunities for entrepreneurs. If there are specific steps to take and organizations to contact, it will make things easier.

Klaus

I have already launched several companies in Germany and Sweden. I can share my experience regarding registration and procedures in these countries. Perhaps we can find similar steps?

Ivan

It's great that you are considering opening a company in Poland! I am ready to help you with advice based on personal experience. Registration procedures may seem complicated, but it is generally achievable.

Alicia

I just opened a company in France, so I can share my experience and advice. Each country may have some peculiarities, but general principles must exist.

Lukas

I'm interested in learning more about the rules and requirements in Poland. Perhaps there are any specific documents or procedures that we should be aware of?

Olga

I think the article will be useful. Many entrepreneurs are looking for information about company registration in other countries. I'll be waiting for details.

Grumpy

Trends and starting companies... It doesn't seem to be for me. What could be more beneficial than staying in your comfort zone? But anyway, thanks for the information.

Vincent

My team and I are considering the possibility of expanding to Poland. I heard that there are favorable tax rates and a good business climate. It will be interesting to read your article.

Emma

Opening my own company is my dream! I hope this article will help me understand the process and provide valuable advice.