How to calculate and submit a PIT-11 declaration in Poland: Detailed guide

-

Galina Ostrachinyna

Copywriter Elbuz

Have you ever wondered how to calculate and submit your PIT-11 tax return in Poland? This may seem like a daunting task, but don't worry, we are here to help you understand the process in great detail. From filling to submitting, we'll show you a step-by-step guide that will make everything easy and simple! Get ready to learn everything you need to know about declaring your income in Poland. Don't delay reading this article - interesting secrets await you!

Glossary

- PIT-11 - declaration of income of individuals in Poland.

- Conditions of employment - conditions that determine who must submit the PIT-11 declaration.

- Declaration of income - the process of showing your income in the PIT-11 declaration.

- Ukrainians are foreigners from Ukraine working in Poland.

- Entrepreneurs - individuals engaged in entrepreneurial activities.

- PIT-11 online - the ability to submit a PIT-11 declaration via the Internet.

- PIT-11 calculator - tools for calculating the tax amount in the PIT-11 declaration.

- Benefits - special conditions and discounts when calculating tax in the PIT-11 declaration.

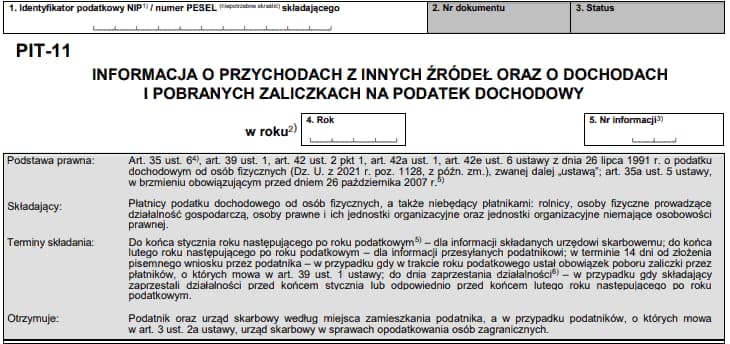

- Declaration header - information about the applicant and the purpose of submitting the declaration.

- Sections of the declaration - sections containing information about the applicant, income, expenses and other information.

- Declaration PIT-11 in 2024 - updated declaration form, valid in 2024.

🌟 Now you can easily understand the basic terms and concepts associated with calculating, filling out and submitting the PIT-11 declaration in Poland.

How to calculate, fill out and submit the PIT-11 declaration in Poland?

What is PIT-11? What are the responsibilities of an employer

PIT-11 in Poland is a tax return that employers file for their employees. It reflects income and income tax payments, including advance payments, made during the tax year. According to the law, the employer is required not only to calculate and pay taxes, but also to submit this declaration.

Filing PIT-11 is mandatory for employers in Poland, regardless of the type of contract with the employee. This means that it is submitted for each hired employee with whom an agreement was concluded between the parties, or the agreement between them.

The amounts indicated in the declaration may vary depending on the type of contract. For example, PIT-11 according to umovy zlezenie does not indicate the costs of compulsory disability insurance, while according to umovy o dzelo the costs of ZUS are not indicated. However, the declaration itself is submitted in any of the listed cases.

For which employees is PIT-11 applied for umovy zlezenie, umovy o dzelo and umovy o pratse?

Filing a PIT-11 declaration does not depend on the nationality of the employee or his status in Poland. The employer is required to submit PIT-11 for each hired employee, regardless of whether he is a Polish citizen or a foreigner.

It is important to note that the type of contract may affect the amounts reported on the return. For example, in the case of umov o pratsa, different tax rates or preferences may apply than in the case of umov zletseniya or umov o dzelo.

How to submit PIT-11 for Ukrainians and other foreigners?

You will be glad to know that the process for filing PIT-11 for foreigners who are not tax residents of Poland is very similar to the process for Polish citizens. The only exceptions are those foreigners who withdraw their earnings outside of Poland. In this case, a separate IFT form must be submitted.

For all other cases, including Ukrainians with temporary protection, the process for filing PIT-11 is no different from declarations submitted by Polish citizens. The only difference is the indication of nationality in the corresponding column of the declaration.

Does an entrepreneur need to submit PIT-11 for himself?

PIT-11 returns are submitted only for employees. If you are an individual entrepreneur and do not have hired employees, then you do not need to submit PIT-11. However, if you are self-employed, you will still need to comply with your individual tax obligations.

Summary

Filing a PIT-11 declaration in Poland is a mandatory process for employers, including calculation and payment of taxes, as well as filing a tax return for all employees. Differences in the amounts indicated may depend on the type of agreement, but the declaration itself is submitted in any case.

For foreigners, including Ukrainians, the process for filing PIT-11 is usually no different from the procedure for Polish citizens. However, there are some exceptions for foreigners who withdraw their earnings outside of Poland.

Individual entrepreneurs who do not have employees are not required to submit PIT-11. However, they are still required to comply with other tax obligations appropriate to their status.

Note: It is important to remember that the information in this article is general information only and is not intended to replace professional advice. If you have any difficulties or questions regarding the process of calculating, filling out and submitting the PIT-11 declaration in Poland, we recommend that you contact professionals in tax consulting or the tax office.

Good to know:

| Action | Important to do |

|---|---|

| Get the correct forms | Consult tax authorities or online resources |

| Check details | Ensure information is completed correctly |

| Meet deadlines | Ensure return is filed on time |

Links:

How and when is the PIT-11 declaration submitted?

If you live or work in Poland and earn income, you are required to complete and submit the PIT-11 declaration (Podatkova Information Declaration) to the tax office every year. In this section, we'll look at how to calculate your tax amount, complete your return, and submit it according to the rules. Let's look into the details.

Calculation and submission of the PIT-11 declaration

The basic rule for filing the PIT-11 declaration is that it must be submitted to the tax office at the place of registration employer, and also provided to the employee himself. The timing of filing a return is also important. The declaration must be submitted to the tax office by the end of January of the year following the reporting year, for example, by 01/31/2024 for 2023. The employee must submit the declaration by the end of February of the year following the reporting year. These dates are extremely important and should be strictly adhered to.

Methods for transmitting the declaration

It is very important to choose the correct method for transmitting the PIT-11 declaration. Currently, the declaration must be submitted exclusively electronically to the tax office. Documents are sent online through a special electronic platform or using special software provided by the tax service. This simplifies the filing process and minimizes possible errors in the declaration.

However, the employee can also ask the employer to provide him with the declaration in paper format. This can be useful if the employee does not have access to a computer or prefers a paper version for their records.

Declaration components

Declaration PIT-11 contains information on income, tax deductions and other factors affecting the taxable amount. It is important to fill out all fields of the declaration accurately and completely. To do this, you will need the following documents and information:

- Proof of Identification Number (PESEL) or ID number

- First name, last name and address

- Information on income for the reporting period, including income from work, dividends, rentals, etc.

- Information about tax deductions such as expenses for education, treatment or donations

- Banking information for the possibility of a tax refund

It is important to accurately calculate the tax amount and fill out the declaration correctly. Failure to complete this form may result in a delay or denial of your tax refund.

Results

Filling out and submitting the PIT-11 declaration in Poland is a mandatory procedure for people living or working in the country. Remember that filing deadlines and the correct method of transmitting your return are extremely important.

If you choose electronic filing, make sure you are familiar with the process and use the official platforms and software provided by the IRS. If you prefer a paper format, make sure you obtain the return from your employer.

Do not forget to save all the necessary documents and follow the rules to avoid possible unforeseen situations. If you have questions or concerns, always contact a tax advisor or professional for detailed assistance.

Expert opinion

"Filling out and submitting the PIT-11 declaration is an important step in the process taxation in Poland. It is recommended to carefully study the rules, choose the appropriate transfer method and accurately fill out the documents to avoid problems and omissions. Do not hesitate to contact tax specialists if you have any questions or difficulties." - Tax consultant Urszula Kuczyńska.

Useful and necessary

| What to do | What not to do |

|---|---|

| Follow the filing deadlines | Do not wait until the last minute |

| Use the correct transmission method | Do not send the declaration by fax or regular mail |

| Please check all fields are filled out correctly | Do not leave blank fields in the declaration |

| Keep copies of all documents | Do not ignore possible tax deductions |

| Contact a tax consultant if necessary | Do not fill out the declaration without due care and knowledge |

Completing and filing your PIT-11 return can be a complicated process, but with the right information and support, you can perform these duties without problems. Don’t forget to contact specialists and use official resources to obtain up-to-date information on taxation in Poland.

And remember that the correct completion and timely submission of the PIT-11 declaration is important for your financial situation and complies with Polish legislation.

PIT-11 calculator: How does it work and is it worth using?

If you work in Poland and need to submit a PIT-11 return, you are probably wondering if there is an online calculator that can help you calculate your tax amount. Yes, such services exist, but some of them may not be reliable or accurate enough. In this article we will look at how these calculators work and also give recommendations for their use.

But before we begin, it is important to understand that the PIT-11 declaration is submitted exclusively in electronic format, and the filing method itself can be conditionally considered a calculator. However, the document contains figures that have already been calculated and paid earlier. This means that there is no need to make special calculations at the time of filling - they should have been made earlier.

If you mean calculating net salary and total expenses for social contributions, then, of course, there are various calculators that can help you with this. However, keep in mind that regular gross-net salary calculators do not take into account the employer's social security contributions. This way, they can only show you the amount of taxes and fees withheld from your paycheck.

To get all the necessary calculations, you should turn to specialized calculators that take into account both employee contributions and employer expenses. Please remember that there are many such services on the market and we cannot guarantee their functionality. However, we can give you some guidance on choosing the right calculator.

Things to consider when choosing a calculator

Calculation completeness: Make sure that the calculator takes into account all the necessary parameters, such as wages, tax rates and social contributions for both employees and employers.

Reliability: Check the ratings and user reviews of the calculator. Note how accurate and relevant the calculation results were for other users.

Data Update: Make sure the calculator regularly updates tax rates and other parameters to provide you with the latest information .

Ease of use: Try using a few different calculators and choose the one that offers the most intuitive interface and user-friendly functions.

Privacy: Check the calculator's privacy policy to ensure that your data will not be shared with third parties without your consent .

How to use the PIT-11 calculator

Enter your salary and other parameters specified by the calculator.

Indicate the amount of social contributions for employees and employers.

Get the result - your net salary after withholding taxes and contributions, as well as the employer's total costs for your employment.

Analyze the data received and use it to fill out the PIT-11 declaration.

"Keep in mind that the calculations obtained using the PIT-11 calculator , are intended as a guide only. Always verify your results with other reliable sources or consult a tax professional."

Review: In this article we examined the existence of the PIT-11 calculator and its use. We noticed that the PIT-11 declaration is submitted electronically and is itself a kind of calculator. However, if you need to calculate your net salary and social security contributions, you should turn to specialized calculators. We reviewed the criteria for choosing such a calculator and gave recommendations for use. Be sure to further check your results with other reliable sources or seek advice from tax experts.

Now that you know about the PIT-11 calculator, you can easily calculate your tax obligations and fill out your tax return in Poland.

📋 Note: It is important to remember that tax rules and rates are subject to change, so please update information regularly and check calculations with official sources or tax consultants.

Stay up to date with tax changes and get accurate estimates of your tax liability with reliable PIT-11 calculators. Just follow our recommendations and focus on current data to successfully cope with the process of calculating, filling out and submitting the PIT-11 declaration in Poland.

Benefits, filling out and submitting the PIT-11 declaration in Poland: a complete guide

Your tax liability doesn't have to be complicated and confusing. In this section, we will tell you about important tax benefits and how to correctly fill out and submit the PIT-11 declaration, simplifying the process of declaring your income.

Let's consider different types of tax benefits

1. Benefits for individuals under 26

If you are under 26, there are certain tax advantages available to you in Poland. For example, you may be eligible for the 4 Plus benefit, which offers special tax treatment for young people. This benefit can significantly reduce your tax burden. Make sure your eligibility for this benefit is reflected on your PIT-11 return.

2. Benefits for Working Retirees

Working retirees are also entitled to certain tax benefits that can significantly reduce their tax burden. They have the opportunity to take advantage of the special tax conditions offered in Poland. Complete your PIT-11 return correctly to reflect your benefit on your taxes.

3. Benefits for persons who received income from other sources

People whose income exceeds the limit for persons Those who receive income from only one employer, but still take advantage of the tax exemption allowed for this category, must also report this additional income on the PIT-11 return. Be sure to include this information to be compliant with Polish tax requirements.

4. Benefits for repatriates

People who returned to Poland after living abroad and have repatriated status can take advantage of special tax conditions. This may include tax exemptions or tax reductions. Be sure to reflect your repatriation benefit on your PIT-11 return.

Important steps for filling out the PIT-11 declaration

Various types of income require filling out the appropriate sections in the PIT-11 declaration. Therefore, it is important to provide your employer with information about your tax benefit rights in advance. Otherwise, you will have to amend your PIT-37 return to reflect your benefits.

Review table: best practices for filling out the PIT-11 declaration

| Action | Recommendation |

|---|---|

| Study tax benefits | Find out about the benefits available to you to reduce your tax burden. |

| Talk to an Expert | Consult a tax advisor for advice on benefits and their proper treatment. |

| Provide information to your employer | Notify your employer of your tax benefit rights in advance. Keep in mind that your employer must prepare your benefit information. |

| Fill out the PIT-11 declaration correctly | Carefully fill out all the necessary sections reflecting your tax benefits and additional income. |

| Review and submit your return | It is recommended that you review your return to ensure that all information is filled out correctly before filing. Submit your return in accordance with the requirements of the Polish Tax Administration. |

Examples and stories: help with successful declaration

Stories of people who correctly took advantage of tax benefits and filled out the PIT-11 declaration can inspire you to declare effectively. Meet Mr. Ivanov, who, thanks to the correct filling of the declaration, saved a significant amount on taxes.

Mr. Ivanov, a working retiree, provided his employer with information about his tax benefits in advance. He consulted a tax advisor to make sure he was taking the right approach. Thanks to this, he had no problems with declaration and successfully took advantage of his benefit, saving on taxes. So, don't be afraid to ask for help if you need it.

In depth: expert opinion

"To ensure correct understanding process of declaring and calculating taxes, it is important to consult with an expert. Tax advisers have extensive experience and professional knowledge of taxation in Poland. They will be able to assess your situation and advise you on the best ways to save on taxes and take advantage of available benefits." - Grzegorz Kowalik, tax expert.

Appendix: Insight into Practice

| Action | How is this useful? |

|---|---|

| Exploring Benefits | Helps you discover available tax benefits and increase your savings. |

| Consult an Expert | Enables you to receive professional opinion and advice based on your individual circumstances. |

| Timely provision of information to your employer | Ensures that your benefit is reflected on your PIT-11 return and that you receive the corresponding tax benefit. |

| Carefully filling out the declaration | Guarantees the accuracy and reliability of the data presented in your PIT-11 declaration. |

| Pre-submission check | Helps avoid errors and increases the chances of successfully filing your return. |

Seeing such benefits and examples of successful tax declarations, we are confident that you can succeed in this process and achieve a significant reduction in your tax burden. Be sure to contact your tax advisor for more detailed information and personalized advice.

Summary

In this section, we have described in detail the important tax benefits that must be taken into account when filling out the PIT-11 return in Poland. We've looked at the steps you need to take to ensure you successfully declare your income and take advantage of the available tax benefits. Remember the importance of consulting with an expert and providing information to the employer in advance. Follow the recommendations outlined in this section and you will be able to effectively manage your tax obligations in Poland.

Please note! All information provided in this section is general information only and is not a substitute for advice from a professional tax advisor. When planning your taxes, be sure to consult with a professional based on your unique situation.

How to properly file a PIT-11 declaration in Poland?

If you live or work in Poland and are subject to the obligation to submit a PIT-11 declaration, you should know how to submit this declaration correctly. In this guide, we will look at the process of calculating, filling out and submitting the PIT-11 declaration in Poland to make the income declaration procedure easier for you.

How to submit PIT-11 online?

Step 1: Preparation

Before you begin filling out the PIT-11 declaration, make sure you have all the necessary documents and information. You will need the following information:

- Personal information, including your passport details

- Income information for the reporting period

- Documents confirming your income, such as employment certificates, agency agreements, lease agreements, etc.

- Information about withheld taxes

Step 2: Select a platform

To file a PIT-11 return in Poland there are several options. One of the most popular methods is to submit through the e-Deklaracje online service provided by the state. To use this service, you will need to register an account on the website e-deklaracje.

Step 3: Filling out the declaration

After registration, you need to select the PIT-11 declaration form in the e-Deklaracje system. Next, follow the instructions to fill out the form. Make sure that you provide accurate and complete information, as incorrect information can lead to undesirable consequences.

Step 4: Sign and Submit

Once you have completed your PIT-11 return, check it for errors or inaccuracies. Then sign the declaration using your electronic signature if you are a sole proprietor. If you represent a company, you must have a qualified digital signature.

After carefully checking and signing your declaration, you can submit it electronically through the e-Deklaracje service. The system will automatically accept your declaration and give you confirmation of its receipt.

Please note that files for completing the PIT-11 declaration are only available in January of each year. In addition, in addition to the e-Deklaracje service, you can also use special programs integrated with government services to fill out and submit declarations.

Important details and features

- If you have any difficulties or questions in the process of filling out the PIT-11 declaration, you can contact tax specialists services of Poland or to professional accountants who will provide you with the necessary assistance and advice.

- Do not forget that correct and timely completion of the PIT-11 declaration is an important obligation that will help you avoid unpleasant consequences associated with tax violations.

- If your financial or marital status changes, you must update your PIT-11 return and provide the new information to the Internal Revenue Service.

Be careful and carefully check all the information before filing your PIT-11 return. Mistakes can lead to fines and troubles. If you have any doubts or questions, always contact a professional to avoid problems.

This guide provides general information and advice regarding filing a PIT-11 return in Poland. If specific situations or special circumstances arise, we recommend that you seek advice from tax specialists or qualified accountants.

Use this information and follow the correct steps to successfully file your PIT-11 return and comply with your tax obligations in Poland.

How to calculate and fill out the PIT-11 declaration in Poland?

When it comes time to file the Polish PIT-11 tax return, many people ask the question: “How to correctly calculate your tax and fill out the return?” In this section, we will take a detailed look at the process of calculating, filling out and submitting the PIT-11 declaration in Poland to help you cope with these procedures easily and without stress.

Step 1: Fill out the declaration header

The first step in filling out the PIT-11 declaration is to fill out the document header. In this section, you provide the basic information needed to identify the employer and the year for which the return is being filed.

When filling out the fields, please note the following:

- field 1 indicates your employer's PESEL or NIP.

- Fields 2 and 3 are filled in by the tax service.

- Field 4 is intended to indicate the year for which the declaration is being submitted.

- Field 5 is intended to indicate the serial number of the declaration.

Also, read the additional explanations for field 5:

- If this is the first PIT-11 for this employee in this year, enter number "1".

- If you are filing multiple returns in one year without amending the previous one, use the following numbers (2, 3, etc.).

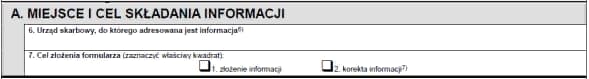

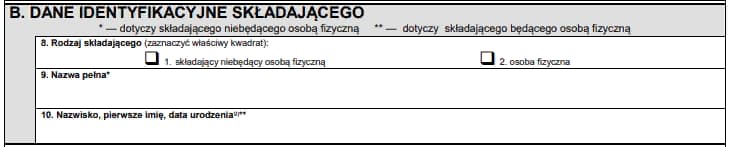

Step 2: Indicate the place and purpose of providing the information

In Section A of the PIT-11 form, you need to indicate the place and purpose of providing the information. This information will help the tax authority determine where to send your return and for what purpose it is intended.

- In field 6, indicate the tax authority to which you are submitting your return.

- In field 7, select the purpose for filling out the form. If this is a primary submission, check box 1 "złożenie informacji". If you are correcting a declaration that has already been submitted, check box 2 “korekta informacji”.

Step 3: Provide Applicant Identification Data

In Section B of the PIT-11 Declaration, you provide employer identification information.

- In field 8, indicate the legal status of the employer. If this is a legal entity, check the box "składający" or "niebędący osobą fizyczną". If your business is run as a company or you are a sole proprietor, please indicate this.

- In field 9, indicate the name of the employer's company if it is a legal entity.

- In field 10, indicate the first name, last name and date of birth of the individual entrepreneur.

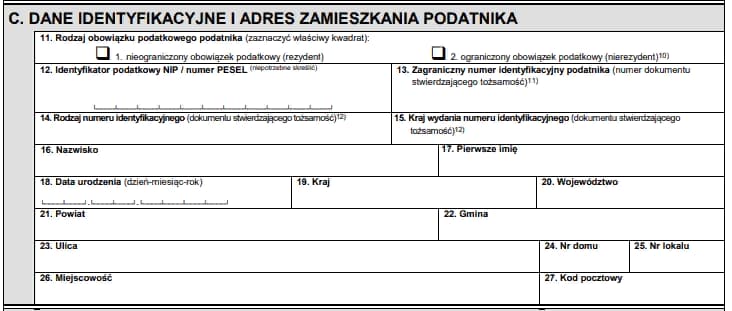

Step 4: Provide identification details and residential address of the employee

In section C of the PIT-11 declaration, you indicate the details of the taxpayer (employee) for whom the declaration is being prepared.

- In field 11, select the type of tax liability: square 1 for tax residents and square 2 for non-resident foreigners.

- In field 12, enter your employee's PESEL.

- If the employee is a foreigner without a PESEL, fill out fields 13, 14 and 15 with the appropriate foreign identifier. Please note that PESEL is mandatory for foreigners working in Poland.

- In fields 16 to 19, indicate the last name, first name, date of birth and citizenship of your employee.

- Fields 20 to 27 are intended to indicate the employee’s residential address.

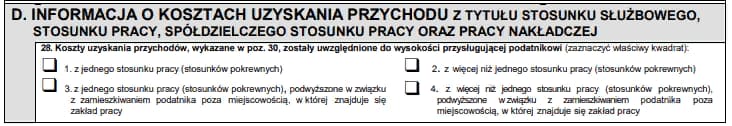

Step 5: Enter income expenses

In section D of the PIT-11 declaration, you indicate expenses for generating income within the framework of labor and service relationships.

- Field 28 is filled in only if you have expenses to generate income as part of official, labor, cooperative relationships or home work. Please indicate this fact by checking the appropriate box.

.jpg)

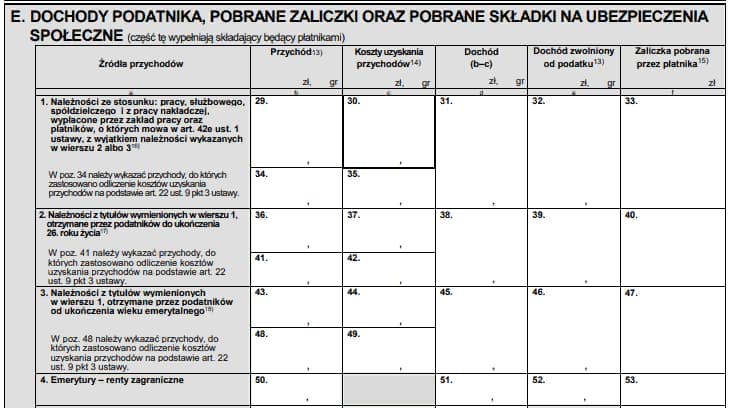

Step 6: Enter income and advance payments collected

Section E of the PIT-11 declaration you indicate the taxpayer’s income and collected advance payments.

- The first line (line No. 1) is used to calculate income from official, labor, home-based or cooperative relationships. In fields 29 and 34, enter the amounts of income received during the year. Fields 30 and 35 are intended to indicate the costs of obtaining the specified income.

- In field 31, enter the profit value, which is the difference between fields 29 and 34, minus fields 30 and 35.

- In field 32, indicate only the amounts of income exempt from taxation under double taxation agreements and other international treaties.

- In Box 33, enter the amount of PIT advances collected during the reporting year.

Step 7: Enter information about the amount of non-taxable income

Section G of the PIT-11 declaration you indicate information about non-taxable income.

- In field 106, enter the amount of the scholarship that does not exceed the non-taxable amount.

- In field 107, indicate disability pensions received from abroad in connection with military disability, benefits for war victims and their families, as well as accident pensions in connection with work in the Third Reich in the period 1939-1945.

- In box 108, record income from non-repayable foreign aid.

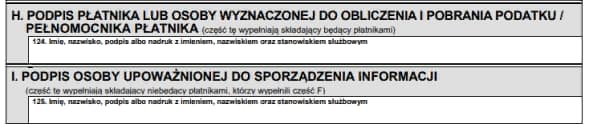

Step 8: Sign the declaration

In sections H and I Declaration PIT-11 you can sign the document.

- Part H is completed by taxpayers (applicants) who are tax payers. Here you can enter your signature.

- Part I is completed by non-taxpayer applicants who completed the previous Part F. These fields are not completed electronically, but your signature is required when receiving the paper form.

Overview

The table below provides an overview of the fields and actions which will help you correctly fill out the PIT-11 declaration in Poland:

| Field | What to indicate | What does this mean |

|---|---|---|

| 1 | PESEL or NIP | Your employer identification number. |

| 2-3 | Tax | Information filled out by the tax service. |

| 4 | Year | The year for which you are filing the return. |

| 5 | Sequence number | Sequence number of the declaration. |

| 6 | Tax Authority | Where to send your return. |

| 7 | Purpose of Filing | Initial filing or correction of a previous return. |

| 8 | Legal status | Individual or legal entity. |

| 9 | Company name | If your employer is a legal entity. |

| 10 | First name, last name, BD | For individual entrepreneurs. |

| 11 | Type of tax liability | Tax residents or non-resident aliens . |

| 12 | Employee PESEL | Employee identification number. |

| 16-19 | Full name, citizenship | Information about the employee. |

| 28 | Costs | Costs of generating income. |

| 29-35 | Income | Income, expenses and advance payments . |

| 106 | Scholarships | Non-taxable scholarship amount. |

| 107 | Pensions and benefits | Non-taxable pensions and benefits. |

This is just an overview of the process of filling out and submitting the PIT-11 declaration in Poland. All information is presented based on the most current requirements and instructions. When completing your own return, always consult official sources and follow current IRS instructions.

Filling out the PIT-11 return may seem like a complicated process, but with the right information and instructions, you can complete the task without any problems. If you have any questions or uncertainties, it is best to seek advice from a tax advisor or tax law professional.

Now that you know the basics of filing a PIT-11 return in Poland, you are armed with the knowledge to successfully file your tax return. Make sure that you carefully read the requirements of the tax service and fill out all fields correctly. This will help you avoid mistakes and make the filing process easier for you.

How to fill out the PIT-11 declaration in 2024?

In 2024 in Poland, when filing for income in 2023, a new version of the PIT-11 declaration form is used - version 29. In this material we will tell you how to correctly fill out this declaration and submit it without any hassle.

.png)

Why is it important to fill out the PIT-11 declaration correctly?

Declaration PIT-11 is an important document that allows the state to collect information about the income of citizens, as well as calculate the amount of tax that must be paid. Errors in filing your return can result in incorrect tax calculations, which can result in penalties and additional costs.

Steps to fill out the PIT-11 declaration in 2024

To correctly fill out the PIT-11 declaration in 2024 , you need to follow a certain sequence of steps:

Prepare the necessary documents - Before you start filling out the declaration, Be sure to prepare all the necessary documents. You'll need your income for the past year, including employment, royalties, rental income, and any other sources of income.

Register in the e-Deklaracje system - In order to submit the PIT-11 declaration electronically, you You must register in the e-Deklaracje system. This will allow you to conveniently complete your return online and submit it without having to visit the tax office in person.

Fill in your personal data - After registering in the e-Deklaracje system, you will need to enter your personal data in declaration, such as full name, address, TIN and other necessary information.

Enter your income information - The next step is to fill in your income information for the past year. Indicate all sources of income and attach the necessary documents to confirm these incomes.

Indicate possible losses or deductions - If you have any losses or deductions that can be taken into account When calculating tax, indicate them in the appropriate sections of the declaration. This can help reduce the amount of tax you need to pay.

Check and sign the declaration - After filling out all sections of the declaration, carefully check all the data for accuracy. Please ensure that you have provided all the required information and attached all required documents. After this, sign the declaration using an electronic signature.

Submit the PIT-11 declaration - After signing the declaration, you can submit it electronically through the e- system Deklaracje. After submission, you will receive confirmation of acceptance of the declaration.

.jpg)

What is useful and what should not be done when filling out the declaration PIT-11

| Helpful | Should not be done |

|---|---|

| Prepare all necessary documents in advance | Postpone filling out the declaration until the last minute |

| Carefully check all data before submitting | Leave empty fields in the declaration |

| Use an electronic signature when submitting | Submit a declaration without a signature |

| Save a copy of the filed return | Ignore notices from the tax office |

When filing your PIT-11 return in 2024, follow these guidelines to minimize potential errors and ensure accurate tax calculations.

Expert Note: “Filling out your PIT-11 return can be a complex and confusing process, especially if you have multiple sources of income. It is recommended that you contact a tax professional or advisor to receive professional assistance and confidence in completing your return." - Jadwiga Nawrocka, legal consultant.

Do not forget that correct completion and timely submission of the PIT-11 declaration is important for compliance with the law and avoiding troubles with the tax office. Follow our guide to successfully complete your declaration and contribute to the development of Poland.

📝Results and advice

Let's summarize results and provide useful recommendations on calculating, filling out and submitting the PIT-11 declaration in Poland.

Wrapping it up

Filing tax returns, including the PIT-11 return, is an important and not always easy part of business. There are two options for solving the problem: either gain experience and fill out documents yourself, or seek help from a qualified accountant or accounting service agency. The choice comes from the knowledge and preferences of each entrepreneur.

Regardless of the route chosen, below are the main recommendations aimed at simplifying the process of filing a PIT-11 declaration in Poland.

Recommendations for calculating, filling out and submitting the PIT-11 declaration

Get the necessary information: Before you begin the filing process, understand your responsibilities and obtain all the necessary information regarding tax rules and requirements in Poland.

Gather all necessary documents: Make sure you have all the necessary documents that will be required to complete correctly declaration PIT-11. This includes documents supporting income, expenses and other financial transactions.

Determine your tax status: Determine your tax status before filing your PIT-11 return. Some entrepreneurs may have special circumstances that may affect their tax base or tax rate.

Use modern software or online platforms: Using specialized software or an online platform can make it much easier the process of calculating, filling out and submitting the PIT-11 declaration. This will allow you to automate routine tasks and reduce potential errors.

Fill out the declaration correctly and accurately: Check that all fields of the PIT-11 declaration are filled out correctly and accurately before submitting it . Review your return several times to ensure accuracy and consistency of the information entered.

File your return on time: Make sure you file your PIT-11 return on time. Missing deadlines may result in negative consequences, such as fines or loss of tax benefits.

Seek help if necessary: If you have difficulties or are not sure about filling out the declaration correctly PIT-11, contact an experienced accountant or tax advisor. This will help you avoid potential problems and minimize the risk of errors.

Final tips from the experts

To make it easier for you the process of calculating, filling out and submitting the PIT-11 declaration in Poland, the experience of experts and specialists in this field has been accumulated. They share their tips and warn against common mistakes:

"It is important to understand that incorrectly filling out the PIT-11 return can lead to serious consequences, including fines and audits by the tax authorities Therefore, it is recommended to always carefully check the declaration for errors and submit it on time." - Yvonne Sobchak, tax consultant.

"The use of specialized software can greatly simplify the process of filling out and submitting the PIT-11 declaration. Online platforms also offer convenient functions for monitor the status of your return and make timely changes if necessary." - Dominik Janowski, accounting software developer.

Overview

The table below provides an overview of key points and useful practitioner in calculating, filling out and submitting the PIT-11 declaration in Poland.

| What to do | What to avoid |

|---|---|

| Carefully read the tax rules in Poland | Do not miss the deadline for filing your return |

| Choose the optimal filing method: yourself or with the help of specialists | Do not leave blank fields in the declaration |

| Use modern software or online platforms | Don't require or use irrelevant documents |

| Check the correctness and accuracy of filling out the declaration | Do not lose sight of documents confirming income and expenses |

| Submit declaration on time | Don't forget to ask for help if you are not sure about something |

Carefully following these recommendations will help you successfully cope with the process of calculating, filling out and submitting the PIT-11 declaration in Poland. Remember that high-quality work on your declaration is a guarantee of your financial security and compliance with tax legislation.

Frequently asked questions on the topic "How to calculate, fill out and submit a PIT declaration 11 in Poland?"

1. What is the PIT-11 declaration and who is it intended for?

Declaration PIT-11 is a declaration of income of employees whom the employer pays under an employment agreement, business agreement or work agreement. It must be submitted independently by the employees.

2. Which categories of employees must submit a PIT-11 declaration?

Declaration PIT-11 must be submitted by employees under the conditions of zlecenie, the conditions of dzelo and the conditions of prace in Poland.

3. How to submit a PIT-11 declaration for Ukrainians and other foreigners?

Ukrainians and other foreigners must file a PIT-11 return in the same way as local workers. The declaration is submitted to the Polish Tax Service.

4. Does an entrepreneur need to file a PIT-11 declaration for himself?

An entrepreneur must file a PIT-11 declaration only when he has the income of an employee under an employment contract, a business contract or a work contract.

5. When and how is the PIT-11 declaration submitted?

Declaration PIT-11 is submitted annually before April 30 for the previous calendar year. It can be filed either in person or online through the IRS system.

6. Is there a calculator for calculating the PIT-11 declaration?

Yes, there are online calculators that will help you calculate the tax amount for the PIT-11 declaration. You can find them on the website of the Polish Tax Service.

7. Should benefits for children, pensioners and youth under 26 years of age be reflected in the PIT-11 declaration?

Yes, benefits for children, pensioners and youth under 26 years of age must be reflected in the PIT-11 declaration in order to receive the corresponding deductions.

8. How to submit PIT-11 declaration online?

To file your PIT-11 return online, you must go to the Polish Tax Administration website and log into your Taxpayer Portal account. There you will find a section for filing a return and follow the instructions to complete it.

9. How to independently calculate and fill out the PIT-11 declaration?

To independently calculate and fill out the PIT-11 declaration, you will need all the relevant documents, such as an employment contract, information on income, information on withheld taxes, etc. Follow the instructions provided by the Polish Tax Administration on its website.

10. What does the PIT-11 declaration look like in 2024?

The appearance of the PIT-11 declaration may change in 2024. To find out the specific form and structure of the declaration, contact the Polish Tax Office.

Thanks for reading! Now you are a master of your craft! 👩💼🎉

You have just mastered the skills necessary to successfully calculate, complete and submit your PIT-11 return in Poland. You are now fully aware of the steps you need to take to declare your income securely.

Be sure to use our tips and tricks for maximum efficiency. Filling out your return can be challenging, but with your new knowledge, you can do it!

Now you can file your PIT-11 return with peace of mind and complete confidence in what you're doing!

We wish you good luck and reliable financial stability! 💰💼

- Glossary

- How to calculate, fill out and submit the PIT-11 declaration in Poland?

- How and when is the PIT-11 declaration submitted?

- PIT-11 calculator: How does it work and is it worth using?

- Benefits, filling out and submitting the PIT-11 declaration in Poland: a complete guide

- How to properly file a PIT-11 declaration in Poland?

- How to calculate and fill out the PIT-11 declaration in Poland?

- How to fill out the PIT-11 declaration in 2024?

- Results and advice

- Frequently asked questions on the topic "How to calculate, fill out and submit a PIT declaration 11 in Poland?"

- Thanks for reading! Now you are a master of your craft!

Article Target

To acquaint readers with the process of calculating, filling out and submitting the PIT-11 declaration in Poland.

Target audience

People living or working in Poland and subject to the obligation to submit a declaration PIT-11.

Hashtags

Save a link to this article

Galina Ostrachinyna

Copywriter ElbuzThe secrets of online store automation are revealed here, like the pages of a magic book of a successful business. Welcome to my world, where every idea is the key to online effectiveness!

Discussion of the topic – How to calculate and submit a PIT-11 declaration in Poland: Detailed guide

In this article you will learn how to calculate the tax amount, fill out and submit the PIT-11 declaration in Poland. We will go over the steps required to complete these procedures to make the process of declaring your income easier for you.

Latest comments

3 comments

Write a comment

Your email address will not be published. Required fields are checked *

.png)

.png)

John

This is really useful information! I live in Poland and every year I encounter problems filling out the PIT-11 declaration. I hope this post helps me figure it out!

Hans

To be honest, I don't know much about the Polish tax system, but it sounds interesting. Perhaps you can share your experience in filling out declarations?

Sophie

I also live in Poland, and this topic is very relevant to me. I would like to hear more about the features of filing a PIT-11 declaration. What mistakes are often made?