Opening an individual entrepreneur in Poland: Step by step guide

-

Roman Howler

Copywriter Elbuz

Open an individual entrepreneur in Poland? JDG step by step. One step, one document, one opportunity.

Glossary

- Individual Entrepreneur - Individual Entrepreneur, an individual carrying out business activities within the framework of one project.

- JDG - Jednoosobowa Działalność Gospodarcza (Polish slang) is a term used in Poland to describe Sole Proprietorship.

- Similar to JDG in other countries - similar forms vary in name in different countries, such as Sole Proprietorship (USA), Selbstständigkeit (Germany) and Autónomo ( Spain).

- Advantages and disadvantages - pros and cons of opening an individual entrepreneur, including fewer formalities during registration, the ability to independently manage the business, but also higher personal responsibility and tax obligations .

- Can foreigners open an individual entrepreneur in Poland - information on the availability of Individual Entrepreneurship in Poland for foreign citizens.

- Individual entrepreneurship on a Pole card - a special status of a foreign citizen in Poland, which allows you to open an individual entrepreneurship.

- Other restrictions for JDG in Poland - additional restrictions and requirements for opening and running an Individual Entrepreneurship in Poland.

- How to open an individual entrepreneur in Poland Instructions for Belarusians, Ukrainians and Moldova - step-by-step instructions on the process of opening an individual entrepreneur in Poland for citizens of Belarus, Ukraine and Moldova.

- Step 1. Preparation for filling out the application - preparation of the necessary documents and information for filing an application for registration of an Individual Entrepreneurship.

- Step 2: Completing the Application - Filling out the formal application with required information such as personal information, preferred business name and business description.

- Step 3. Submitting an application - the process of submitting a completed application to the registration authorities of an Individual Entrepreneurship.

- Step 4. Registration of an Individual Entrepreneur - registration of an Individual Entrepreneur in accordance with the legislation of Poland.

- Responsibilities in connection with starting a business - an indication of the main responsibilities and rules that must be observed in the process of doing business.

- What taxes does an entrepreneur pay - a list of taxes and mandatory payments that an Individual Entrepreneur must pay in Poland.

The concept of opening an individual entrepreneur in Poland

What is an individual entrepreneur in Poland?

Sole proprietorship in Poland, or "Jednoosobowa działalność gospodarcza" in Polish, is the registration of a person as an entrepreneur to conduct business, generate income and pay taxes. This is a form of entrepreneurship that allows individuals to carry out commercial activities in the country.

Opening a sole proprietorship in Poland can be a simple and efficient process if you know the necessary steps and documents, as well as the rules for registration and taxation. In this section we will take a detailed look at the process of opening an individual entrepreneur in Poland step by step.

Analogues of individual entrepreneurs in other countries

In different countries there are similar forms of entrepreneurship that allow conduct commercial activities in accordance with the law. Here are some of them:

- Belarus and Moldova: IP (Individual Entrepreneur).

- Ukraine: FOP (Physical Person).

- Czech Republic: Živnostenské oprávnění or colloquial form živnostenský list (license for individual entrepreneurship).

- Germany: Einzelunternehmer under the tax code (or less commonly Kaufmann under the commercial code).

- USA: Sole proprietorship.

Each of these forms has certain rules and requirements, but the essence remains approximately the same - registration of an individual as an entrepreneur to carry out commercial activities.

Advantages and disadvantages of opening an individual entrepreneur in Poland

Like any other form of entrepreneurship, opening an individual entrepreneur in Poland has its advantages and disadvantages. Let's take a closer look at them:

Benefits:

-

Simple registration: Opening a sole proprietorship in Poland is a relatively simple process, especially using online services.

-

Choosing a tax system: Entrepreneurs can choose between two main tax systems - simplified or general. This allows you to tailor taxation to the specifics of your business.

-

Freedom of action: As an entrepreneur, you have complete freedom to make decisions and act without depending on partners or superiors.

-

No minimum authorized capital requirement: When opening an individual entrepreneur in Poland, there is no need to have a minimum starting capital. You can start with the funds you have.

-

Simplified accounting: For incomes not exceeding 2 million euros, you can maintain simplified accounting, which significantly simplifies financial obligations.

Disadvantages:

-

Liability for the obligations of the individual entrepreneur: The entrepreneur is liable with all his property for the obligations of the individual entrepreneur. This means you take on the financial risk if the business fails.

-

Restrictions for foreigners: Not all activities in Poland are available to foreigners. There are certain restrictions regarding foreign entrepreneurs that you should find out about before opening an individual entrepreneur.

Of course, this is only general information about the advantages and disadvantages of opening an individual entrepreneur in Poland. For a more detailed understanding and to make an informed decision, consult with professionals or experts in the field.

"Opening an individual entrepreneur in Poland can be a profitable step for entrepreneurs who are looking for flexibility and freedom of doing business. But it is necessary to remember the financial responsibility and features of working for foreign market." - Bogna Mazurek, legal specialist.

Overview of the process of opening an individual entrepreneur in Poland

| Things to do | Things not to do |

|---|---|

| Study the requirements and rules for opening an individual entrepreneur in Poland | Do not ignore the process of registering an individual entrepreneur |

| Consult experts in the field | Don't neglect financial responsibility |

| Create a business plan and study the market | Do not open an individual entrepreneur without a conscious strategy |

| Use online services to simplify the process of registering an individual entrepreneur | Do not limit yourself to just one taxation system |

| Make sure that the activities of the individual entrepreneur comply with the requirements of the law | Do not neglect legal aspects when opening an individual entrepreneur |

Having completed the individual entrepreneur registration process, you will be ready to start doing business in Poland. Opening an individual entrepreneur is a big step that requires a thorough approach and compliance with the rules and requirements of the country. However, with the right preparation and support, you can achieve success in your new business.

How to open an individual entrepreneur in Poland for foreigners

In this section we will consider the possibility of opening an individual entrepreneurship (IP) in Poland for foreigners. The answer to this question is already obvious - yes, foreigners have the right to open an individual entrepreneur in Poland. However, there are certain requirements and criteria that must be taken into account.

Determination of the status of a foreigner

For legal entrepreneurship in the form of "Jednoosobowa działalność gospodarcza" (JDG), a foreigner must have a certain status on the territory of Poland. Status can be obtained on the following grounds:

- Having a stable residence (staly pobyt) or a long-term EU resident card (Karta pobytu na terytorium RP dla długoterminowego rezydenta UE).

- To have a temporary stay (czasowe pobyt) solely on the basis of family reunification with a person legally residing in Poland.

- Have a residence permit (czasowe pobyt) through marriage to a Pole.

- Be a full-time student at a Polish university, including graduate students.

- Have a residence permit (czasowe pobyt) on the basis of running a business registered and operating in Poland.

- Various humanitarian circumstances, including refugees, protected persons and others.

Note: Starting from December 16, 2020, citizens of Belarus, participants in the Poland.Business Harbor program, have the opportunity to register individual entrepreneurs in Poland. And from February 2022, all citizens of Ukraine legally residing in Poland and having PESEL received the right to open an individual entrepreneur.

Individual entrepreneurship with a Pole's card

Having a Pole's card, a foreigner receives the right to open an individual entrepreneur in Poland. The Pole's card itself does not allow stay in the country, but it does provide the opportunity to obtain a preferential visa, after entry with which you can apply for registration as an individual entrepreneur. It is important to note that the inability to open an individual entrepreneur for foreigners does not mean a complete ban on entrepreneurial activity in general. For example, a foreigner can register a company in the format "Spółka z o.o." or "Spółka cywilna".

Other restrictions for individual entrepreneurs in Poland

It is important to know that in addition to the status of a foreigner, there are and other restrictions for registering individual entrepreneurs in Poland. They do not depend on citizenship and apply to everyone. According to the law, certain areas of activity are limited for individual entrepreneurs. For example, registration of an individual entrepreneur will not be possible if you plan to engage in:

- Growing a certain type of plant.

- Animal husbandry.

- Insurance.

- Fire prevention measures.

- Trade union work.

- Organization of sports clubs.

- Banking activities.

There are other restrictions depending on the chosen field of activity. Before registering an individual entrepreneur, it is important to clarify whether the selected activity is available for this form of organization. This can be done in a special state register by selecting the item of interest. PKD classification codes play an important role in the entire procedure, but at times they may seem counterintuitive. For example, raising pigs for individual entrepreneurs may be limited, while uranium mining requires a special license.

It is important to study all the restrictions in advance in order to make an informed choice before registering an individual business in Poland.

"Raising pigs may not be available to PCs, while uranium mining may be permitted. Before registering an individual entrepreneur, it is important to carefully study the list of restrictions and choose your activity accordingly." - Bartosz Kujawa, business expert in Poland.

Useful to know before registering an individual entrepreneur in Poland

Before opening an individual entrepreneur in Poland, it is useful for every entrepreneur to know some key facts:

| Good to know | Don't forget |

|---|---|

| Individual entrepreneurship in Poland is available to foreigners with a certain status | Restrictions on types of activity |

| Possess a Pole's card gives the right to open an individual entrepreneur in Poland | Adding all the required information to the documents |

| Before opening an individual entrepreneur, check whether your activity falls under the permitted types | Reliably ensure the financial viability of the individual entrepreneur |

| Contact an expert to get precise information about requirements and restrictions | Follow tax and financial reporting rules |

| Carefully study and consider the advantages and disadvantages of individual entrepreneurs in Poland | Make timely changes to registration documents |

This section provides information about the process of opening an individual entrepreneur in Poland for foreigners. We looked at the requirements for foreigner status, the possibility of opening an individual entrepreneur using a Pole’s card, and restrictions that you should familiarize yourself with. We hope that this information will help you make an informed decision before opening a sole proprietorship in Poland.

Contact a lawyer or business consultant with experience in opening a sole proprietorship in Poland to get advice and accurate information tailored to your situation.

If you are still in doubt or have questions, do not hesitate to contact professionals who will help you understand the extensive structure and requirements of opening a sole proprietorship in Poland.

How to open an individual entrepreneur in Poland: Instructions step by step

Step 1. Preparing to fill out the application

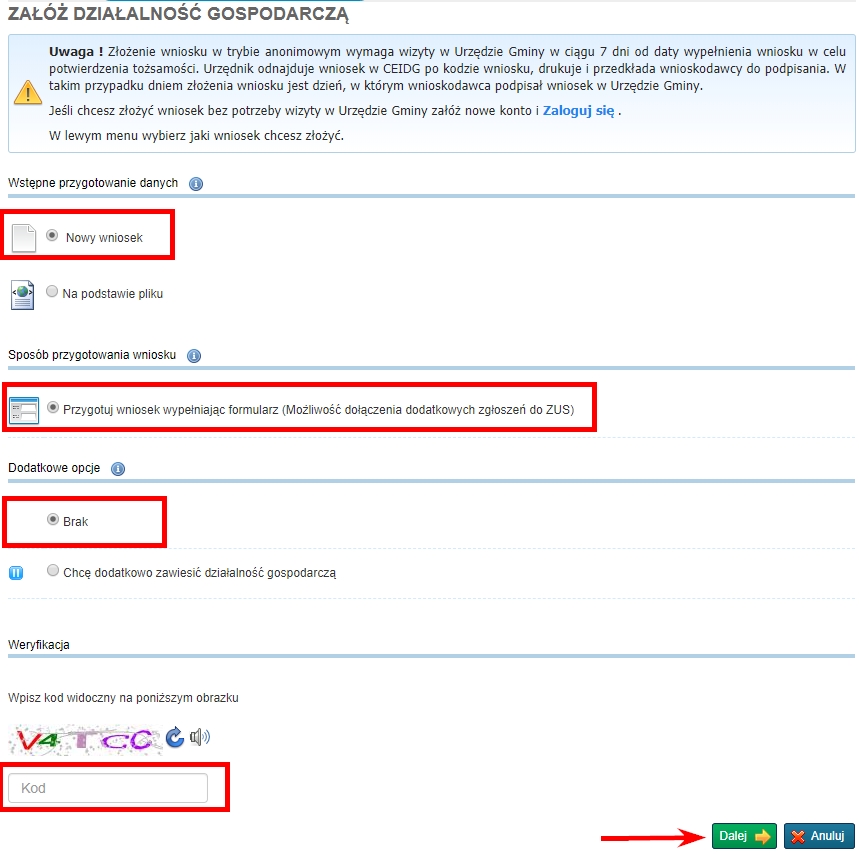

Registration of an individual entrepreneur in Poland is possible either by submitting a written application to the commune municipality, or online through the Central Register of Information on Economic Activities (CEIDG). In this section, we will go over the details of the online registration process and preparation for completing the application.

To start online registration of an individual entrepreneur in Poland, you must have a trusted ePUAP profile or a digital signature. If you don't already have any of these tools, you'll need to get them initially. Instructions for obtaining a trusted ePUAP profile and digital signature can be found in this article.

Once you have the necessary tools, you will need a few more steps to successfully complete your application and complete the registration process. Two frequently asked questions that we will now answer relate to the need for PESEL and milling.

PESEL or NIP: what is needed to register an individual entrepreneur?

To fill out an application for registration of an individual entrepreneur in Poland, you must indicate the PESEL number. After successful registration of an individual entrepreneur, he will be assigned a NIP number, which will be used for taxation. Therefore, in order to successfully complete the registration process, you must have both IDs.

If you do not have a PESEL, you can obtain one before submitting your application. Remember that having PESEL will save you time and facilitate faster registration of your individual entrepreneur.

Step 2. Filling out the application

Moving on to the next step, You must fill out the application for registration of individual entrepreneurs. Let's look at the main parameters of this form and discuss some important points related to filling it out.

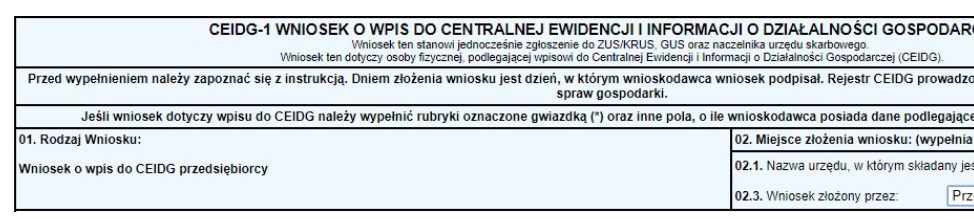

You will be presented with a page with an application form. A couple of sections (01 and 02) will already be filled in automatically. Note that some fields already contain information that can be selected from a list, and an icon next to certain data allows you to obtain additional help information.

For example, sections 02 and 02.1 relate to information about the place of application and will be completed by registration authorities. Section 02.3 refers to information about who is applying, and there you will need to select the "Entrepreneur" option.

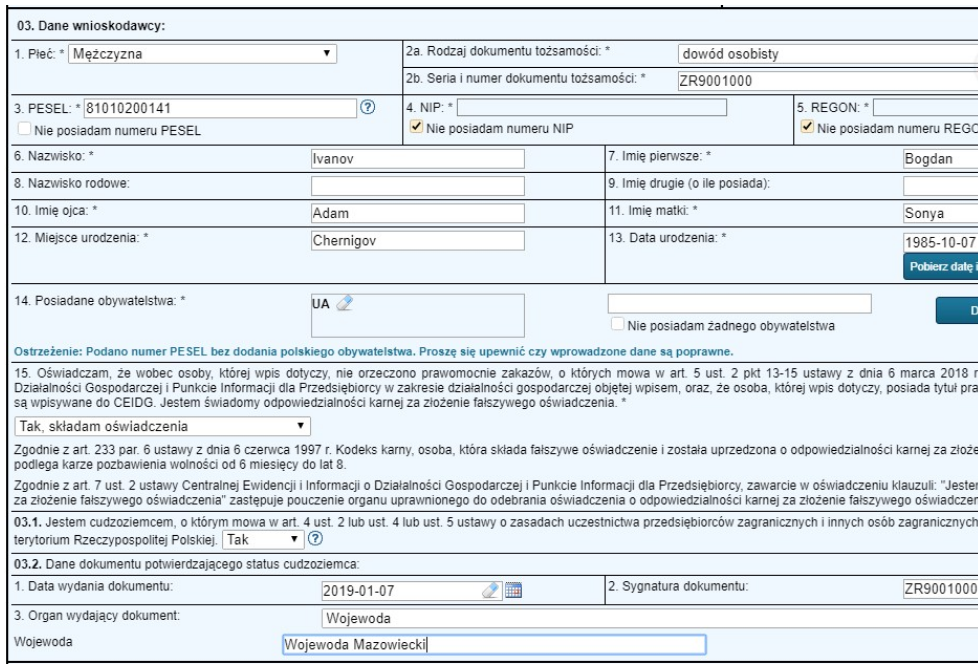

Another important section is “Applicant Data” (section 03). In this section, you must indicate the gender, document type, series and document number, as well as the PESEL number. If you do not have a PESEL, you can check the appropriate box and a PESEL number will be assigned to you after registration.

Step 3: Submitting an application

After successfully filling in all the required details, you will be required to attach the required documents (if any). Click the "Add necessary applications" button and upload scans of the necessary documents, such as residence cards or decree cards. After adding documents, click the "Next" button.

The system will check your application and if errors are found in it, you will be asked to correct them. If there are no errors, the application will be sent to CEIDG for processing. You will receive a notification of review to the specified email address and will be able to track the status of the application in your personal account on the registry website.

Step 4. Registration of an individual entrepreneur

Registration of an individual entrepreneur in the Polish Central Register of Information on business activities happen quickly and, as a rule, the very next day after submitting your application you will find your data in the corresponding database. NIP and REGON numbers will be assigned to your individual entrepreneur automatically.

If you are a VAT payer, you must also register with your local tax office. In addition, if you are not yet registered with the ZUS (the main Polish social insurance fund), you need to contact your local ZUS office within 7 days after registering your individual entrepreneur and submit a corresponding application.

It is important to note that you will not receive an individual entrepreneur registration certificate by mail - it can be downloaded from the CEIDG register. Also good news is that all the registration processes described above are free. You will only need to pay for copies, translations and other additional services if you need them.

Now let's take a look at a useful table that will give us an overview of the dos and don'ts of registering a sole proprietor in Poland.

| Do | Don't |

|---|---|

| • Register a trusted ePUAP profile or obtain a digital signature • Have PESEL for faster registration • Enter all required data in application • Attach the necessary documents • Monitor the status of the application in your personal account |

• Do not skip the step of receiving PESEL (it is better to have it in advance) • Do not forget to register with the ZUS (if necessary) • Do not expect to receive a certificate of registration of individual entrepreneurs by mail (it can be downloaded) |

Instructions for opening an individual entrepreneur in Poland, step by step, will help you successfully and consciously complete the registration procedure. Use this information, be confident in your actions and start your entrepreneurial journey in Poland with self-confidence and optimism!

🌟 Please remember that this section of the article is only an overview of the process and for more detailed information you are advised to consult official sources and consult with professional experts in the field.

Main responsibilities when opening an individual entrepreneur in Poland

What do you need to pay for and who do you report to?

When opening an individual enterprise (IP) in Poland, the main responsibilities to the state are reduced to timely payment of taxes, fees and provision of relevant documentation. It is necessary to take into account that each individual entrepreneur is obliged to fulfill the following tax obligations:

-

Income tax: Individual entrepreneurs are required to pay regularly income tax in accordance with current rates. At the same time, it is necessary to correctly evaluate and calculate your profit in order to avoid possible tax penalties in the future.

-

Contributions to ZUS: In addition to paying income tax, individual entrepreneurs must also regularly make contributions to the Polish Social Insurance system (ZUS). Contributions to ZUS are mandatory for all individual entrepreneurs and represent contributions to pensions, health insurance and social benefits.

-

Payment of VAT: If your business activity involves goods or services subject to VAT, you must register at the tax office and pay the appropriate tax.

The importance of timely paperwork and filing declarations

In addition to paying taxes and deductions, you must also understand that opening an individual entrepreneur in Poland requires timely execution and submission of various documents. This includes the following responsibilities:

-

Accounting: Your financial transactions must be recorded clearly and systematically in accounting. You must keep records in accordance with the requirements of the accounting regulations and retain this data for a specified period.

-

Declarations and Reporting: Various tax returns and reports must be filed with the Internal Revenue Service from time to time. Failure or delay in submitting these documents may be detrimental to you and may result in fines or criminal penalties.

Expert advice and use of accounting assistance

Given the complexity and responsibility associated with tax obligations and accounting, many entrepreneurs turn to accounting firms and specialists to assist in this process. This helps minimize the risk of errors and ensures compliance with government regulations.

📌 Results

When opening an individual entrepreneur in Poland, you need to take into account your responsibilities for paying taxes, deductions, VAT calculations and paperwork. Timely fulfillment of these duties will help avoid fines and problems with tax authorities. If it is difficult for you to understand all the details on your own, it is recommended to seek help from professional accountants or consultants.

💡 Expert advice: When opening an individual entrepreneur in Poland, remember that proper organization of accounting and timely compliance with tax obligations are the key points of successful entrepreneurial activity. Hiring the professional help of an accounting firm or consultant will make this process much easier and allow you to focus on growing your business. - Magdalena Wojcik, Allegro.

Taxation when opening an individual entrepreneur in Poland: main aspects

Opening an individual entrepreneurship (IP) in Poland requires not only registration and registration, but also preparation for paying taxes and fees. In this section, we will consider in detail the important aspects of taxation that must be taken into account when opening an individual entrepreneur in Poland.

Registration and choice of taxation form

Before starting the process of opening an individual entrepreneur in Poland, it is important to decide on the form of taxation. As a rule, the choice of taxation form is made at the stage of registration of an individual entrepreneur. It is necessary to carefully study all the options and determine which form is most suitable for your business.

Taxes and fees for individual entrepreneurs in Poland

After registering an individual entrepreneur in Poland, the entrepreneur is required to pay various taxes and fees. It is important to know what tax obligations fall on individual entrepreneurs and how to calculate them correctly.

Land tax

Land tax is one of the most common tax obligations for individual entrepreneurs in Poland. Its size depends on the area of the land on which the activity is carried out.

Value Added Tax (VAT)

Value Added Tax (VAT) is another important tax that may be mandatory for individual entrepreneurs in Poland, depending depending on the type of activity.

Income tax

Income tax is the main tax obligation for individual entrepreneurs in Poland. Its rate may depend on the level of income and the chosen form of taxation.

Calculating the cost of taxes and fees

The main difficulty when paying taxes and fees for individual entrepreneurs in Poland is the correct calculation of the cost of mandatory payments. To do this, it is necessary to take into account not only the tax rate, but also accounting periods, possible benefits and features of the type of activity.

What you need to know before opening an individual entrepreneur in Poland

Before opening an individual entrepreneur in Poland, it is recommended to prepare for the registration process, choose the most suitable form of taxation, and familiarize yourself with the rules for paying taxes and fees. Only in this way can you avoid unforeseen problems and start profitable activities as quickly as possible.

Don't forget to use our tips and recommendations to make the process of opening an individual entrepreneur in Poland as smooth and efficient as possible.

"Taxation of individual entrepreneurs in Poland requires careful planning and knowledge of all important aspects. By following our recommendations, you will easily cope with these tasks and successfully carry out your business in Poland."

| Benefits | Should be avoided |

|---|---|

| Choosing the optimal form of taxation | Incorrect calculation of the cost of taxes and fees |

| Accounting for tax obligations at various stages of the process | Lack of tax preparation |

| Tax planning | Violation of tax laws |

| Seeking advice from specialists | Misunderstanding of the tax system |

It is important to remember that each case is individual, and for an accurate understanding taxation of individual entrepreneurs in Poland, it is recommended to contact specialists. Our team is ready to help you in this matter.

Frequently asked questions on the topic: How to open an individual entrepreneur in Poland? JDG step by step

1. What is an individual entrepreneur and how to open one in Poland?

IP (individual entrepreneurship) in Poland is a form of entrepreneurial activity where one person owns and manages his own business. To open a sole proprietorship in Poland, you will need certain documents and follow certain registration steps, such as preparing an application and submitting it.

2. What documents are required to open an individual entrepreneur in Poland?

To open an individual entrepreneur in Poland you will need the following documents: - Identity card (passport or other identification document); - A document confirming the address of residence in Poland; - Application for registration of individual entrepreneurs; - A document confirming payment of the state duty.

3. What taxes will you have to pay when opening an individual entrepreneur in Poland?

When opening an individual entrepreneur in Poland, you will have to pay the following taxes: - Income tax on income of an individual entrepreneur; - Social security contributions; - Goods and Services Tax (BAT).

4. Who can open an individual entrepreneur in Poland? Can foreigners open an individual entrepreneur in Poland?

An individual entrepreneur in Poland can be opened by any individual, including foreigners. For foreigners, there are some special features and additional requirements, such as the need to obtain a residence permit and a work permit in Poland.

5. What is "Jednoosobowa działalność gospodarcza"?

"Jednoosobowa działalność gospodarcza" (JDG) is the Polish name for individual entrepreneur or individual entrepreneurial activity. It is used to refer to a business that is owned and operated by one individual.

6. What are the advantages and disadvantages of JDG in Poland?

The advantages of JDG in Poland include the ability to quickly start a business, low registration costs and ease of management. However, the disadvantages are the business owner's personal liability for debts and obligations, limited opportunities for attracting investment, and limited access to credit.

7. What other restrictions exist for JDG in Poland?

Some restrictions for JDG in Poland include: - Prohibition on certain activities requiring licensing or special permits; - Restrictions for foreigners without appropriate work permits; - Restriction of the right to administer state corporations or controlling positions in large companies.

8. How to open an individual entrepreneur in Poland: instructions for Belarusians, Ukrainians and Moldovans?

Instructions for opening an individual entrepreneur in Poland for citizens of Belarus, Ukraine and Moldova are similar to the general steps for registering an individual entrepreneur in Poland. However, foreign citizens may require additional documents and permits, such as residence permits and work permits in Poland.

9. What steps need to be taken to open an individual entrepreneur in Poland?

Steps for opening an individual entrepreneur in Poland include: 1. Preparation for filling out an application; 2. Filling out an application; 3. Submitting an application; 4. Registration of an individual entrepreneur. Each of these steps has its own specific requirements and procedures.

10. What responsibilities arise in connection with starting a business?

When starting a business, you need to fulfill the following responsibilities: - Maintaining accounting records; - Compliance with tax requirements and timely payment of taxes; - Providing the necessary reporting to relevant authorities; - Compliance with all rules and regulations affecting your business.

Thanks for reading and becoming a pro!

Thank you for reading this article to the very end! Now you have become a real expert in opening an individual entrepreneur in Poland. You have learned about all the necessary steps and documents that you will need to register. Also, you have mastered the tax rules for individual entrepreneurs and learned how to calculate the cost of the entire process.

Opening a sole proprietorship in Poland is an important and challenging step, but thanks to your dedication to reading this article, you are ready to take on this endeavor with confidence and knowledge.

Now you can become a successful entrepreneur and realize your wildest ideas in Poland. Don't forget to put what you've learned into practice and continue your professional growth.

We hope you found this article useful and interesting. We wish you good luck in opening a sole proprietorship in Poland and achieving all your entrepreneurial goals! 🚀

- Glossary

- The concept of opening an individual entrepreneur in Poland

- How to open an individual entrepreneur in Poland for foreigners

- How to open an individual entrepreneur in Poland: Instructions step by step

- Main responsibilities when opening an individual entrepreneur in Poland

- Taxation when opening an individual entrepreneur in Poland: main aspects

- Frequently asked questions on the topic: How to open an individual entrepreneur in Poland? JDG step by step

- Thanks for reading and becoming a pro!

Article Target

Provide readers with information about the process of opening an individual entrepreneur in Poland and help them make an informed decision

Target audience

Entrepreneurs and individual entrepreneurs interested in opening an individual entrepreneur in Poland

Hashtags

Save a link to this article

Roman Howler

Copywriter ElbuzMy path is the road to automating success in online trading. Here words are weavers of innovation, and texts are the magic of effective business. Welcome to my virtual world, where every idea is the key to online prosperity!

Discussion of the topic – Opening an individual entrepreneur in Poland: Step by step guide

Find out how to open an individual entrepreneur in Poland? JDG step by step. This article will tell you about the necessary steps and documents for opening an individual entrepreneur in Poland, registration rules, taxes for individual entrepreneurs and calculating the cost of this process.

Latest comments

9 comments

Write a comment

Your email address will not be published. Required fields are checked *

.png)

.png)

Tom

Interesting article! I, as a British citizen, am thinking about the possibility of opening an individual entrepreneur in Poland to expand my business. It would be great to hear the experiences of other people who have gone through this process.

Maria

Hi Tom! I'm Maria from Germany. I recently opened an individual entrepreneur in Poland and I can share my experience. It is important to follow the steps exactly and provide the correct documents. You may be interested in the tax benefits available to foreign entrepreneurs.

Pierre

Maria, thanks for the information! I am French, and I am considering options for opening an individual entrepreneur abroad. I am interested in what taxes in Poland apply to foreign individual entrepreneurs. Will they be different from taxes for local entrepreneurs?

Raquel

Hello Pierre! I'm Raquel from Spain. Good question! As a foreign individual entrepreneur in Poland, you will pay the same taxes as local entrepreneurs. However, there are double tax rules that can help reduce your tax liability.

Giuseppe

Hi all! I'm Giuseppe from Italy. Opening an individual entrepreneur abroad looks quite interesting. What do you think about the possibility of using a contract work system in Poland?

Anastasia

Hello Giuseppe! I'm from Poland and I can say that the contract system of work is quite popular here. It is important to draw up the contract and documentation correctly to avoid possible problems. But it can be beneficial for you if you plan to work with different clients.

Oleksandr

Hello, I'm Oleksandr from Ukraine! What are the features of opening an individual entrepreneur in Poland for Ukrainian citizens? Are there any special requirements or differences in the process?

Martin

Hello, Oleksandr! I'm Martin from Poland. For citizens of Ukraine, opening an individual entrepreneur in Poland has some features, but most of the steps and documents are similar. For example, you will need a work permit, as well as documents confirming your financial solvency.

GrumpyOldGuy

Your struggle for new ideas in an individual entrepreneur is like a newly discovered cheese in a mousetrap, but to each his own. I want to see more real results, not advertising. But with all these trends and changes, it is so difficult to find peace. Good luck to you, and I will cut through all this noisy madness.