Obtaining a European NIP: A Detailed Guide for Successful Entrepreneurs

-

Vladimir Kosygin

Copywriter Elbuz

Do you know who has the secret to successful business in Europe? This is a European NPC that few people know about. What is it and how to get it? Continue reading to find out all the details! Go ahead, open the door to the European land of opportunity!

Glossary

NIP - Taxpayer identification number in the European Union. This is a unique identification number assigned to entrepreneurs and organizations registered in the European Union for tax purposes.

European NIP - Tax identification number in the European Union issued to entrepreneurs and organizations that carry out their activities in the EU or carry out trade operations within the EU. This number allows you to comply with EU tax laws and pay applicable taxes.

Entrepreneurs - Persons engaged in entrepreneurial activities, such as individual entrepreneurs, companies and organizations that carry out commercial activities activities in the European Union.

Individual entrepreneur registration - The procedure for the official registration of an individual entrepreneur in order to obtain the right to carry out business activities in the European Union.

Benefits of NIP in Europe - Obtaining a European NIP provides a number of benefits for entrepreneurs, including the possibility of free movement of goods within EU, access to the single European market, simplified settlement procedures and reduced tax obligations.

Case study

To better understand the process of obtaining a European NIP, consider the case of a young entrepreneur named Alexey, who decided open your business in the European Union.

Alexey is a citizen of Ukraine and has experience in the field of information technology. He wants to create his own company that would develop and sell software throughout the EU. However, before starting his activities, Alexey needs to obtain a European NIP.

Alexey decided to turn to specialists to get advice and help in preparing the NIP. A firm specializing in legal support for entrepreneurs abroad told Alexey about the requirements and process for obtaining NIP.

The first step Alexey needed to register his company in one of the countries of the European Union. He chose the Netherlands as his country of founding as it offers attractive conditions for entrepreneurs and suitable infrastructure for his business.

After this, Alexey received the necessary package of documents to register his company and filled out an application for a European NIP. The statement included information about his company, its activities and his personal details.

He provided all the necessary documents to the Dutch tax authority and paid the appropriate registration fee. After processing the documents and conducting an audit by the tax authority, Alexey received his European NIP.

Now, having his own research and development IP, Alexey can begin to carry out his entrepreneurial activities in the European Union. He can sell his software online, enter into contracts with clients from other EU countries and legally fulfill his obligations to the tax authorities.

As this case study shows, obtaining a European NIP can be an important step for entrepreneurs wishing to expand their business in the European Union. The NIP provides a legal and tax basis for business activities, and also provides access to many advantages in European business.

What is the European NIP?

European NIP (NIP europejski) is a pan-European taxpayer identification number that is required to carry out business transactions with counterparties from other countries of the European Union. It is also known by the acronym NIP-UE.

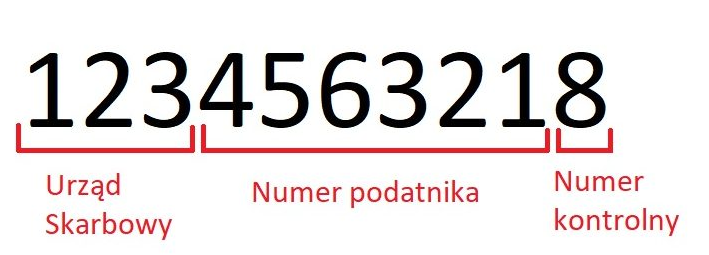

Externally, the European NIP looks the same as the usual NIP, which is obtained when opening a business, but has the prefix PL, indicating the country of origin of the entrepreneur. For example, for Polish IP, the European IP is a sequence of the prefix PL and 10 digits (format PLXXXXXXXXXX).

Why do entrepreneurs need a European NIP?

Obtaining a European NIP has a number of advantages for entrepreneurs doing business in Europe. Here are some of the main reasons why obtaining a European NIP may be recommended:

Global business transactions. European NIP allows you to expand the boundaries of business due to the possibility of interaction with counterparties from other countries of the European Union. This opens up new prospects for establishing business relationships and allows you to explore opportunities for collaboration and partnership.

Simplification of procedures. The European NIP simplifies procedures and makes them more transparent when carrying out business transactions within the Community. This helps reduce bureaucratic burden and increase the efficiency of business processes.

Access to financing. Having a European NIP, entrepreneurs have more opportunities to attract financing and develop their business. Many financial institutions and investors consider the presence of a European NIP as one of the criteria when deciding on the allocation of funds.

Access to markets. The European NIP allows entrepreneurs to gain access to new markets and customers within the European Union. This helps strengthen the company's position in the international market and expand its customer base.

Procedure for obtaining a European NIP

The procedure for obtaining a European NIP is relatively simple and can be carried out in several steps:

Preparation of necessary documents. To obtain a European NIP, entrepreneurs will need to provide a number of documents confirming their identity, business registration and tax reporting. This may include, for example, a passport, business registration certificate and tax returns.

Contacting the tax authority. After preparing the documents, the entrepreneur must contact the relevant tax authority of his country with an application to obtain a European NIP. The authority will register and assign a number.

Registration of a legal address. In some cases, it is necessary to indicate a legal address to obtain a European NIP. Entrepreneurs can either provide their own address or use the services of agencies that provide registration services.

Payment of state duty. In the process of obtaining a European NIP, you may be required to pay a state fee. The fee may vary depending on the country and national regulations.

The process of obtaining a European NIP can take from a few days to a few weeks depending on the country and specific circumstances.

Summary and recommendations

The European NIP is an important tool for entrepreneurs who want to develop their business and conduct international activities in Europe. It allows you to expand business boundaries, simplify procedures and gain access to new markets and financing.

However, it is important to remember that each country in the European Union has its own rules and requirements for obtaining a European NIP. It is recommended to seek advice from specialists or lawyers who can assist in completing the procedure.

Remember that the European NIP is mandatory for transactions with counterparties from other countries of the European Union, and obtaining it can significantly simplify and expand your business.

Note: Below is a general table that will help you understand what is useful and necessary to complete when obtaining the European NIP:

| Action | Helpful | Necessary |

|---|---|---|

| Prepare the necessary documents | ✅ | |

| Contact the tax authority | ✅ | |

| Register a legal address | ✅ | |

| Pay the state fee | ✅ |

Use this table as a guide when obtaining a European NIP and remember to prepare and follow the procedure properly.

Who can get the European NPC

Within the Community there are two categories of entrepreneurs who are entitled to and must obtain a European NIP. The first category is active VAT payers who carry out transactions within the Community. The second category is entrepreneurs enjoying VAT exemption.

Active VAT payers

Active VAT payers are entrepreneurs who supply goods or provide services within the Community. They are responsible for paying VAT and are required to register for VAT EU before entering into transactions. This applies to both the intra-Community acquisition of goods and the intra-Community supply of goods or services, where the responsibility for paying VAT lies with the buyer.

Entrepreneurs exempt from VAT

There are entrepreneurs who enjoy VAT exemption. They may be exempt from VAT for objective or subjective reasons. Despite this, they are also required to register for VAT (EU VAT) before concluding a transaction with an entrepreneur from another EU country, if we are talking about the purchase of goods within the Community.

Register and pay VAT

Regardless of the category to which an entrepreneur who plans to obtain a European NIP belongs, it is necessary to register as a VAT payer (VAT EU) and pay the appropriate amount of VAT (VAT). In Poland, the currency for paying VAT (VAT) is Polish zloty.

Summary

Obtaining a European NIP is an important step for entrepreneurs carrying out intra-Community transactions or benefiting from VAT exemption. Registration as a VAT payer (VAT EU) and payment of the corresponding amount of VAT (VAT) are mandatory procedures. This provides businesses with advantages and the opportunity to enter into transactions with entrepreneurs from other EU countries.

Remember that obtaining a European NIP is a responsible and mandatory procedure. Make sure you understand the requirements and process for obtaining a NIP to avoid violations and potential negative consequences.

| Actions | Results |

|---|---|

| Register as a VAT payer (VAT EU) and pay the appropriate amount of VAT | Legal opportunity to carry out transactions within the Community and enter into transactions with entrepreneurs from other countries |

| Do not register for VAT (EU VAT) and do not pay VAT | Violation of the law, possible fines and negative consequences for business |

How to obtain a European NIP when registering an individual entrepreneur

If you are an entrepreneur living or having a business in the European Union (EU), you will probably need to obtain a European Payer Identification Number (NIP), or NIP europejski as it is also called. This number is issued to VAT payers registered in the EU and is an important tool for participating in international commercial transactions and settlements with tax authorities.

EU VAT Registration

Before obtaining a European NIP, you must register for EU VAT. This process can be completed in several steps:

- Check requirements: Make sure you meet the requirements to register as a VAT EU payer. This usually involves having an existing business or intending to start a business in the EU and achieving a certain turnover level or threshold for mandatory VAT registration.

- Apply for registration: Complete the registration application form for VAT EU. This form will require you to provide your personal details, business details, a brief description of your business and other required information.

- Provide Documents: You may be required to provide certain documents to verify your identity and eligibility to do business in the EU. These can be documents such as passport, company registration certificate, etc.

- Wait for confirmation: After submitting your application, you need to wait for registration confirmation. Depending on the jurisdiction and the burden on the tax authorities, this process may take some time.

- Get a European NIP: Upon completion of registration, you will be issued a European Payer Identification Number (NIP), which will be valid in all EU countries.

It is important to note that obtaining a European NIP (NIP) when registering as a VAT EU payer occurs automatically. After successful registration, you will be assigned a NIP, which will be used in all European EU countries.

Possibility of obtaining NIP in the course of business

If your business is already operating, but it has changed parameters that require obtaining a European NIP, don't worry. You can receive an NPC at any time during your activities.

To obtain a Payer Identification Number, you will need to make changes to the entrepreneur's data. To do this, you need to submit a VAT-R form to the tax authorities. On Form VAT-R, you must indicate all required changes, including your business details, changes in operations, and other related information.

Form VAT-R can be filed in person at the tax office, by mail or electronically using a qualified signature. Make sure the form is filled out correctly and all changes are reflected correctly.

If you are a VAT exempt taxpayer and still wish to obtain a European NIP, this is entirely possible. It is important to note that registering as a VAT EU payer will not result in loss of VAT exemption eligibility as long as the conditions for the exemption are met.

Summary

Obtaining a European NIP is an important step for entrepreneurs wishing to do business in the European Union. Registration as a VAT EU payer allows you to automatically obtain a NIP, open doors to international business and ensure legal participation in commercial transactions.

If your business is already operating, but you need to obtain an NIP, you need to make changes to the entrepreneur's data and submit the VAT-R form to the tax authorities. Make sure all changes are correct and the form is completed correctly.

Check out our table below for an overview of what to do and what not to do when obtaining a European NIP:

| Actions | Best Practices |

|---|---|

| Check VAT EU registration requirements | Make sure you meet the registration requirements. |

| Complete the VAT EU registration form | Submit your registration application with the correct details. |

| Provide required documents | Make sure you have all required documents. |

| Wait for your registration to be confirmed | Wait for your registration to be confirmed. |

| Get your European NIP | You will be automatically assigned a NIP upon registration. |

| Make changes to the entrepreneur's data | Submit the VAT-R form with the correct data. |

This guide should help you carry out the procedure for obtaining a European NIP when registering as a sole proprietor or in the course of business. Make sure you follow all the given guidelines and requirements so that everything goes smoothly and without problems.

Remember that obtaining a European NIP is only one of the important stages of doing international business in the European Union. Constantly improve your knowledge and develop yourself to achieve success in your business.

"European NIP opens up new opportunities for your business in Europe. Register as a VAT EU payer and get your NIP today!"

Summary

When registering a business in the countries of the European Union, entrepreneurs need to obtain a European NIP (NIP) is an additional tax identifier required for VAT payers doing business with entrepreneurs from other EU countries. In this article we will take a closer look at the requirements for obtaining a European NIP, the process of registering it and the benefits it can bring to your business.

Why is a European NIP needed?

European NIP is an additional taxpayer identifier that is assigned to entrepreneurs doing business with partners from the countries of the European Union. This identifier is necessary for cooperation with entrepreneurs from other EU countries and ensures the ability to correctly pay taxes and conduct electronic transactions within the union.

The European NIP provides entrepreneurs with several advantages:

Legality and trust : By having a valid European NIP, you confirm your legitimacy and intention to cooperate in accordance with European tax rules. This helps you gain the trust of partners and clients.

Simplifying business processes: The European NIP provides access to various intra-EU e-commerce systems, giving you the ability to conduct transactions and sell goods or services within the framework of uniform market rules.

Possibility of processing and refunding taxes: Having a European NIP, you can register and return VAT in EU countries, which allows you to optimize your tax burden and improve the financial performance of your business.

Who can and should receive the European NIP?

The European NIP is mandatory for entrepreneurs doing business with partners from other countries of the European Union. In addition, some VAT exempt persons must also have a European NIP.

Here is a short list of groups of entrepreneurs who should receive the European NIP:

VAT payers: If you run a business that is subject to VAT and have transactions with partners from EU countries, the European NIP is mandatory for you. It allows you to enter into transactions within the EU, complete customs procedures and trade with partners on equal terms.

VAT exempt: Certain individuals and categories of entrepreneurs are exempt from VAT. However, they must also obtain a European NIP for business involving partners from EU countries.

How to get European NPC?

The procedure for obtaining a European NIP can be performed both when starting a business and during its process. To do this, you will need to contact the tax authorities of your country and collect the necessary documents.

Here are the main steps of the procedure for obtaining a European NIP:

Registration as a VAT payer: Before obtaining a European NIP, you need to register as a VAT payer with the tax authorities of your country. To do this, you need to fill out the appropriate form and provide the necessary documents confirming your activities.

Applying for a European NIP: After registering as a VAT payer, you need to apply for a European NIP to the tax authority. In the application form, you must provide detailed information about your business and proposed transactions with partners from other EU countries.

Obtaining and using the European NIP: Once your application has been reviewed and approved, you will be issued a European NIP. You must use it on all documents and commercial transactions involving your international partners in the EU.

Conclusion

The European NIP is an important tax identifier for entrepreneurs doing business with partners from European Union countries. It ensures legality, simplification of processes and the possibility of filing and refunding taxes.

The need to obtain a European NIP depends on whether you do business with partners from EU countries and whether you pay VAT. The acquisition procedure includes registering as a VAT payer and applying for a European NIP.

It is important to remember to comply with tax rules and obligations when interacting with partners from other EU countries.

Frequently asked questions on the topic "How to obtain a European NIP: Detailed guide for entrepreneurs"

What is the European NIP?

The European NIP is a business identification number used in Europe. It serves to register a business and identify it to the tax authorities.

Who should receive the European NIP?

The European NIP must be obtained by entrepreneurs planning to do business in Europe or carry out trade operations within the European Union (EU).

How can I obtain a European NIP?

The procedure for obtaining a European NIP varies depending on the country in which you plan to register your business. However, in most cases, you must contact your local tax office and fill out the appropriate forms and paperwork.

What benefits does the European NIP provide?

The European NIP allows entrepreneurs to legally register their business and pay taxes and trade within the European Union (EU). It can also increase your business reputation and the trust of clients and partners.

Is it possible to obtain a European NIP in the course of an activity?

Yes, in some cases entrepreneurs can obtain a European NIP in the course of their activities. However, this may depend on the specific requirements and regulations in each European Union (EU) country.

What are the requirements to obtain a European NIP?

The requirements for obtaining a European NIP may vary in each European Union (EU) country. However, you will usually be required to provide documentation to verify your identity and business, and complete relevant forms and questionnaires.

How to obtain a European NIP when registering an individual entrepreneur?

When registering an individual entrepreneur in Europe, you will usually need to fill out a separate form to obtain a European NIP (NIP), provide the relevant documents and pay a state fee.

What is the cost of obtaining a European NIP?

The cost of obtaining a European NIP may vary depending on the country and type of business. This usually includes government fees and the possible cost of hiring professionals to assist with the process.

How long does it take to obtain a European NIP?

The time it takes to receive a European NIP may vary by country and tax office. In some cases this may take several weeks, and in other cases it may take several months.

What documents do I need to provide to obtain the European NIP?

Documents required to obtain a European NIP may include your passport or other identification document, business registration documents and information about its owner, as well as other documents specified by the tax department.

What sanctions can be applied in the absence of a European NIP?

Failure to have a European NIP may result in tax penalties, fines and other legal consequences, including business restrictions and loss of legal protection.

🌟 Thanks for reading - you are a true expert on European NIP! 🌟

You've just taken the plunge into the European Tax Identification Number (TIN) information flow, and you're now armed with the knowledge to successfully navigate the world of business. You know who can and should receive NIP, what requirements exist and how the procedure for obtaining is carried out.

Now that you have become a true professional in this field, the possibilities that open up for you become almost limitless. A European NIP will give you the opportunity to develop your business internationally, expand your client base and increase your prestige among partners.

Now you know that obtaining a European NIP is not only a legal requirement, but also a huge step in the development of your business. Now is the time to take the initiative, run your business with confidence and open the door to new opportunities.

So don't wait, go forward boldly, put your ideas into practice and make your dreams come true. Remember that your knowledge of the European NAA is your ticket to success. Congratulations, you have taken a huge step forward!

🎉 Good luck on your journey to success! 🎉

- Glossary

- Case study

- What is the European NIP?

- Who can get the European NPC

- How to obtain a European NIP when registering an individual entrepreneur

- Summary

- Frequently asked questions on the topic "How to obtain a European NIP: Detailed guide for entrepreneurs"

- Thanks for reading - you are a true expert on European NIP!

Article Target

Provide useful information and guidance for entrepreneurs who are interested in obtaining a European NIP

Target audience

Entrepreneurs, businessmen, freelancers, managers of small and medium-sized enterprises

Hashtags

Save a link to this article

Vladimir Kosygin

Copywriter ElbuzWords are tools, and my mission is to breathe life into online store automation. Welcome to the world of my texts, where every line fills business with meaning and efficiency.

Discussion of the topic – Obtaining a European NIP: A Detailed Guide for Successful Entrepreneurs

Find out which entrepreneurs can and should receive a European NIP and how to carry out this procedure. In our detailed guide, we'll cover the requirements, process and benefits of an NIP in Europe for business.

Latest comments

1 comments

Write a comment

Your email address will not be published. Required fields are checked *

.png)

.png)

John

Interesting article! I think that becoming a European NIP could be a great step for the growth of my business. Does anyone already have experience with this? It would be interesting to hear your stories and recommendations!