Estoński CIT 2.0: Innovative taxation system in Poland

-

Yuri Seleznev

Copywriter Elbuz

A new tax system has appeared in Poland. This is not just another modification or update - it is a real breakthrough. The introduction of Estański CIT 2.0 changed the rules of the game and became an advanced solution for business. And if you want to know why everyone is already talking about her, then keep reading. You will learn what advantages the Estonian tax system provides and why it is considered innovative.

Glossary

Estoński CIT 2.0: This is an advanced taxation system implemented in Poland. It offers innovative methods for calculating and paying taxes and provides a number of benefits to taxpayers.

Estoński CIT: Abbreviation for "Estonian Corporation Tax". This is a tax that is levied on corporations and other organizations in Poland based on their profits. It is used to finance government programs and infrastructure projects.

Estonian CIT tax rate: This is the percentage rate that is applied to the organization's profits to determine the tax amount payable. The amount of taxation may vary depending on various factors, such as the size of the company and the industry in which it operates.

Who can pay Estonian CIT: Estonian CIT is mandatory for all corporations and organizations that are registered in Poland and have a profit. This includes both local companies and foreign branches and representative offices.

Who cannot use Estoński CIT: Some organizations and entrepreneurs cannot use the Estoński CIT system. This includes freelancers, sole traders and some non-profit organizations.

What income is taxable under Estoński CIT: Taxable income includes profit from the activities of the company, as well as income from the sale of assets and investments. They are included in the tax base and are used to calculate the amount of tax.

How payments and reporting of Estonian tax occur: Taxpayers are required to regularly pay tax contributions and submit tax reports their activities and income. Contributions can be calculated and paid monthly or quarterly, depending on the system chosen.

How to switch to Estonian CIT 2.0: Switching to the Estonian CIT 2.0 system can be done by changing your tax registration and tax return updates. Companies may wish to seek assistance from a tax advisor or lawyer to ensure a proper transition to the new system.

Estonian CIT what will change from 2023: Starting from 2023, new changes to the system will come into force Estonski CIT. This could include changing tax rates, introducing new tax deductions, or changing reporting rules. Participants in the CIT 2.0 system should be alert to such changes and take the necessary measures to implement them.

This glossary contains key terms and definitions to help you better understand the Estoński CIT 2.0 System in Poland.

Estonian CIT: advanced taxation system in Poland

What is Estonian CIT in Poland

Estonian CIT (Estoński CIT) is an advanced tax system that is used in Poland. It provides for the payment of lump sums of tax on company income when they are withdrawn from circulation, for example, when paying dividends. At the same time, until the funds are withdrawn, no taxes are paid and no reporting is maintained.

Advantages of the Estoński CIT system

The Estonian CIT was introduced in Poland based on a similar system proposed by American advisers to the Estonian government in the 1990s. Despite the discussions surrounding the positive impact of this system on the economy, it has taken root in Poland and is considered innovative.

The main advantages of the Estoński CIT system in Poland can be highlighted:

- No need to maintain complex tax records.

- No need to determine expenses to be deducted from the taxable base.

- No need to calculate tax depreciation.

Thus, an entrepreneur who chooses the Estoński CIT system does not need to worry about the complexities of taxation, and this allows him to manage his finances more freely and develop his business.

Features of taxation within the Estoński CIT

In the Estoński CIT system, tax is paid only for specific withdrawals of funds from the company, for example, when paying dividends. There are no monthly tax advances, which is also one of the advantages of this system. This feature allows the entrepreneur to freely determine the moment of tax payment and effectively plan financial flows.

Thus, the Estoński CIT system provides the business environment in Poland with greater flexibility in tax management, and this, in turn, stimulates the development of entrepreneurship and the economy as a whole.

Summary

The Estoński CIT system in Poland is an advanced and innovative tax system that provides entrepreneurs with a number of benefits and reduces the burden of tax reporting. It allows you to freely determine the moment of taxation, manage financial flows and develop your business.

Despite controversial expert opinions, the Estoński CIT system has taken root in Poland and is considered effective in certain cases. Choosing a tax system is an important decision for entrepreneurs, and the Estoński CIT system gives them more freedom and flexibility.

Use the capabilities provided by the Estoński CIT system to effectively manage your finances and take your business to new heights.

"Sistema Estoński CIT in Poland is an advanced tax system that provides the business environment with greater flexibility and freedom in tax management." - Maria Rogowska, tax expert

Table: Recommendations for using the Estoński system CIT in Poland

| Actions | Helpful | Not useful |

|---|---|---|

| Select Estoński CIT | ✔️ | |

| Maintain complex tax accounting | ✔️ | |

| Determine expenses subject to tax deduction | ✔️ | |

| Calculate tax depreciation | ✔️ | |

| Plan when to pay tax | ✔️ |

Implementation and use of the Estoński CIT system in Poland can be a significant step for the development of your business . Apply modern approaches to taxation, manage your finances flexibly and reach new heights in business.

The use of the Estoński CIT system allows businesses in Poland to manage taxes more freely, which promotes growth and development. - Jaroslav Mladek, business and tax expert

Amount of taxation according to Estoński CIT

When discussing the taxation system in Poland, one cannot fail to mention the Estoński CIT 2.0 system. This advanced tax system offers a number of advantages that make it innovative and attractive to entrepreneurs. Let's look at how the system works and what benefits it can bring.

What is Estoński CIT 2.0?

Estoński CIT 2.0 is a taxation system introduced in Poland based on the principle of “income tax on distribution only”. The essence of this system is that tax is withheld only when dividends are paid, and not when the company accumulates profits. This means that entrepreneurs can invest in their business first and reinvest the profits before paying tax on dividends.

How does the Estoński CIT 2.0 system work?

Under the traditional tax system in Poland, entrepreneurs are required to pay tax on profits as they accumulate. However, with Estoński CIT 2.0, tax is only withheld when profits are distributed in the form of dividends. This means that if a company decides to reinvest profits into growing the business, it can defer paying tax until a more appropriate time.

Benefits of Estoński CIT 2.0

Estoński CIT 2.0 offers a number of benefits for entrepreneurs and companies. Let's look at some of them:

Reducing the tax burden for new and small businesses: One of the key advantages of Estoński CIT 2.0 is a tax reduction for new and small entrepreneurs. Instead of the standard tax rate of 9% for normal conditions, this system allows them to pay only 10%. This can significantly reduce the tax burden and increase financial opportunities for business development.

Dividend tax reduction for partners: One of the most attractive features of the Estoński CIT 2.0 system is the ability to reduce tax on dividends received. Under this system, dividends are taxed only on the amount the company has already paid in income tax. For newbies and small businesses this reduction is 90%, and for other companies - 70%. Thus, it becomes more profitable for partners and investors to receive dividends from companies while paying less tax.

Effective tax rate: Estoński CIT 2.0 is also attractive because it reduces the overall tax burden of companies, which often called the effective tax rate (ETR). For small taxpayers this rate is only 20%, instead of the standard 26.29%, and for other companies - 25% instead of 34.39%. This means companies can significantly reduce their tax bills and keep more money within the business.

Application examples of Estoński CIT 2.0

Let's look at two examples to better understand how the Estoński CIT 2.0 system works :

For newbies and small taxpayers:

- Taxable income: 1,000,000

- Estoński CIT: 10%

- Tax payment: 100,000

In this example, beginners and small entrepreneurs pay income tax at the rate of 10% of their taxable income, which is 100,000.

For others companies:

- Taxable profit: 1,000,000

- Classic CIT: 9%

- Partner taxation dividends: 90%

In this example, other companies pay a classic income tax of 9% of their taxable income, and partners receiving dividends can reduce this tax by 90 % of the amount already paid by the company.

Summary

Estoński CIT 2.0 is an advanced tax system in Poland that offers a number of benefits for entrepreneurs and companies . Thanks to this system, entrepreneurs can save on taxes and invest more money in their business. In addition, partners can reduce taxes on dividends received, which makes them more attractive to investors.

"Estoński CIT 2.0 is an advanced tax system that allows entrepreneurs to optimize their tax payments and invest more money in their businesses." - Małgorzata Krul, tax law expert.

Useful tips and tricks

As you can see, the Estoński CIT 2.0 system can provide a number of benefits to your business. Here are some best practices and guidelines to help you make the most of this tax system:

Plan your finances : By only paying tax on dividend distributions, you have more time to plan your finances and reinvest profits. Take advantage of this opportunity to develop a strategy for growing your business and take advantage of available financial opportunities.

Consult a tax professional: The Estoński CIT 2.0 system can be difficult to understand and apply correctly. It is recommended that you consult a tax professional to help you understand the benefits and risks of this system. Such a specialist will help you develop the most effective tax strategy and apply the Estoński CIT 2.0 system to its fullest extent.

Consider these recommendations and get all the benefits of the Estoński CIT 2.0 system for your business.

We hope this article helped you understand the system better Estoński CIT 2.0 and its benefits for entrepreneurs in Poland. Remember: good planning and consultation with a tax professional can help you reduce your tax burden, increase your financial strength and grow your business. Make an informed choice and implement the Estoński CIT 2.0 system in your business today!

Question to reader: Which benefits of the Estoński CIT 2.0 system do you find most attractive for your business? Share your thoughts in the comments below!

Overview of the table "Advantages of the Estoński CIT 2.0 system"

| Things to do | Things to avoid |

|---|---|

| Plan your finances and reinvest profits in your business, thereby reducing your tax burden. | Don't delay your decision to implement Estoński CIT 2.0, as you may miss out on savings opportunities. |

| Consult a tax professional to take full advantage and use the system with confidence. | Remember to stay updated with legal changes and adapt your tax strategies. |

| Consider your financial options carefully and discuss this with a tax professional to make an informed decision. | Don't copy other companies' strategies. |

| Develop and implement a tax strategy tailored to your business and your financial needs. | Don't ignore general tax rules and requirements. |

| Take advantage of estimating tax rates and reducing your tax liability with affordable online tax calculators. | Don't rely on just one source of information, conduct your own analysis and assessment. |

Remember, Estoński CIT 2.0 is not just about taxes! It's about being able to grow your business and keep more money in your pocket. Another reason to fall in love with the tax system!

This article looked at the Estoński CIT 2.0 system and its benefits for entrepreneurs in Poland. We hope it has helped you better understand this advanced tax system and its benefits for your business. Good luck in development and taxation!

Which companies can use Estoński CIT

To understand who can use the Estoński CIT 2.0 tax system in Poland, it is worth considering a few basic rules. First of all, this applies to legal entities, namely joint-stock companies, limited liability companies, limited partnerships, limited joint-stock partnerships and simple joint-stock companies.

However, it is not enough just to be one of these types of companies to switch to the Estoński CIT system. There are also some conditions that must be met. Firstly, income must be at least PLN 2 million per year. Secondly, if the number of individuals employed by a company exceeds 50% of the total number of employees, they cannot use this system. In addition, companies registered in special economic zones are also excluded from using the Estonian CIT.

Strictly speaking, not all information sources have updated their materials on this tax system, which may cause confusion among readers. Therefore, it is important to consider only the most current data and consult with tax professionals.

Who cannot use Estoński CIT

However, there are some categories of enterprises that cannot take advantage of the capabilities of Estoński CIT. For example, financial companies such as banks and credit institutions cannot apply this tax system. Also, companies in bankruptcy or liquidation are not eligible to use this system. Companies formed as a result of a merger or division also cannot use the Estoński CIT.

It is important to note that Estonian tax payers may lose this right if they notify that they wish to opt out of this type of taxation. Also, companies cannot use Estoński CIT if they do not maintain tax books or if they are maintained in a way that does not allow the determination of the net financial result within the meaning of the Accounting Law.

Regardless of the type of company, it is important to consult a tax professional and consult professional and up-to-date sources of information to ensure the applicability of that tax system.

"Many companies are still unaware that they can use Estoński CIT and what benefits it can bring. It is important to keep up to date with the latest changes in tax legislation and seek assistance from professionals so as not to miss the opportunity to reduce their tax burden and gain other benefits from using Estoński CIT." - says tax consultant Grzegorz Bernadski.

| Advantages | Disadvantages |

|---|---|

| - Reduced tax burden. | - Not all companies can use the system. |

| - Simplification of tax accounting and reporting. | - Restrictions on company type and conditions. |

| - Attractiveness for investors and business partners. | - Possibility of losing the ability to use Estoński CIT if the conditions are violated. |

Knowing and understanding which companies can use Estoński CIT is key for business owners and tax professionals. This will help them make an informed decision about applying this tax system and take advantage of all its benefits to develop their business in Poland.

What income is subject to taxation? Estoński CIT

The Estoński CIT 2.0 tax system offers advanced solutions for the Polish business environment. It differs from traditional approaches and provides a number of benefits to companies and entrepreneurs. In this article we will look at what income is subject to taxation under this system, and why it is considered innovative.

Benefits of Estoński CIT 2.0

Estoński CIT 2.0 offers a unique tax model that promotes business development in Poland. One of the main advantages of this system is that taxes are only charged on the profits that the company actually pays out as dividends.

This means that companies can invest their profits into growing their business without worrying about tax liabilities. This system also helps attract foreign investment and stimulate economic growth in Poland.

.gif)

What income is subject to taxation

According to the Estonian CIT 2.0 tax system the following types of income are taxed:

- Net profit: This is the profit received by the company during the period of use of this type of taxation and intended for payment to shareholders or partners. It can also be used to cover losses incurred in a previous period.

- Income from distributed profits: The company can use part of the profits to pay dividends to shareholders or partners.

- Income from profits to cover losses: A portion of profits can be set aside to cover losses that were incurred in a previous tax period.

- Hidden profits: These are benefits received for the benefit of shareholders, partners or related persons. Including, but not limited to, the value of the loans provided by the company, interest, commissions, fees and charges on those loans.

- Services provided by the company to private or family foundations: This is a fee paid out of profits when shares of shares are redeemed or the value of shares is reduced.

- Excess of market value of controlled transaction: This is the amount by which the controlled transaction exceeds the agreed upon transaction price.

- Amount of surcharge returned by the company: This is the excess of the surcharge returned to the company over the amount of the surcharge provided for by regulations.

- Interest, commissions, fees and charges on loans: The Company may earn income from the provision of loan services.

- Other types of income: The Estoński CIT 2.0 system provides for the taxation of other types of income in accordance with legal requirements.

Summary

Estoński CIT 2.0 offers an advanced tax system in Poland that takes into account different types of company income. This system provides flexibility for entrepreneurs and stimulates economic growth.

However, before deciding to apply the CIT 2.0 tax system, it is recommended that you consult with professional tax advisors or lawyers to ensure that all aspects are taken into account and that legal requirements are met.

Review table:

| Income | Taxation | ||

|---|---|---|---|

| Net profit | Subject to taxation | ||

| Income from distributed profits | Subject to taxation | ||

| Income from profits to cover losses | Taxable | ||

| Hidden profits | Subject to tax | ||

| Services provided by the company to private or family foundations | Subject to tax | ||

| Excess of the market value of a controlled transaction | Subject to taxation | ||

| Amount of surcharge returned by the company | Subject to taxation | ||

| Interest, commissions, fees and charges on loans | Subject to taxation | ||

| Other types of income | Subject to taxation | ||

We recommend that you read the full list of conditions and CIT 2.0 requirements to make informed tax decisions for your company.

How payments and reporting for Estonian tax occur

In the Estoński CIT 2.0 system, payments and reporting are carried out in accordance with specific deadlines and procedures. In this article, we will look at how Estonian tax payments and reporting occur to help business owners, entrepreneurs and tax professionals understand tax laws and regulations in Poland.

Deadlines for filing a return

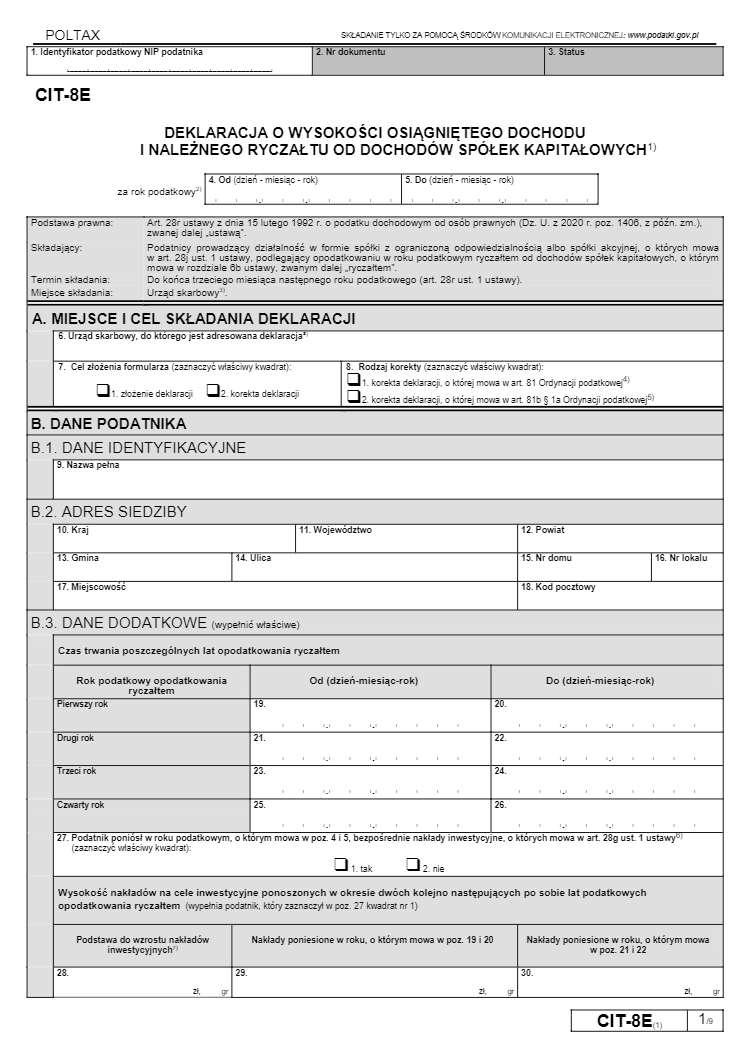

The deadline for filing a return on the amount of income for the previous tax year is the third month of the tax year. Therefore, the taxpayer needs to submit the return electronically on Form CIT-8E by this date. The declaration form can be found at cit-8e.

Tax payment deadlines

In the tax system Estoński CIT 2.0 tax is paid regardless of the declaration, and the payment period depends on the type of profit and income.

Distributed profits and income from profits intended to cover losses must be paid by the 20th day of the seventh month of the tax year. The tax on distributed profits is paid regardless of the declaration, and its payment period does not depend on the date of filing the declaration.

On distributed income from net profit, tax must be paid by the 20th day of the month following the month in which the income was paid or distributed. Tax on net income is paid regardless of the declaration.

Tax on undisclosed business transactions must be paid by the end of the third month of the tax year following the year in which the transactions took place. Tax on undisclosed transactions is payable regardless of the return or filing date.

Importance of timely tax payment

Following tax payment deadlines is a very important aspect in the system Estoński CIT 2.0. Failure to meet deadlines may result in fines and penalties that will affect your company's financial position. Therefore, it is recommended to pay taxes on time and adhere to the deadlines.

What you need to know about payments and reporting for Estonian tax

- The income declaration must be submitted electronically on Form CIT-8E by the end of the third month of the tax year.

- Tax on distributed profits and income from profits intended to cover losses must be paid by the 20th day of the seventh month of the tax year.

- Tax on distributed income from net profits must be paid by the 20th day of the month following the month in which the income was paid or distributed.

- Tax on undisclosed business transactions must be paid by the end of the third month of the tax year following the year in which the transactions took place.

Now you know how payments and reporting of Estonian tax occur in the Estoński CIT 2.0 system in Poland. Meeting deadlines is an important aspect to avoid fines and problems with tax authorities. We hope this information was useful to you.

"Maintaining tax payments on time is a fundamental principle of responsible business." - Marta Tomczak, tax law expert.

| Helpful | ||

|---|---|---|

| Submit a declaration of the amount income in electronic form on time | ☑️ | |

| Pay tax on distributed profit and income from profits before the 20th day of the seventh month of the tax year | ☑️ | |

| Pay tax on distributed income from net profit by the 20th day of the next month | ☑️ | |

| Pay tax on undisclosed business transactions by the end of the third month of the tax year | ☑️ |

Please note that these recommendations are not an exhaustive list and do not replace the advice of a tax professional.

.png)

How to upgrade to Estonian CIT 2.0: complete guide and necessary steps for business

If you own a business in Poland and want to benefit from an advanced tax system, Estoński CIT 2.0 may be the ideal solution for your company. In this section you will learn how to make the transition to this innovative system and what benefits it offers.

Transition to Esteński CIT 2.0

The first thing worth noting is that the transition to the Estonian CIT is voluntary. You can use this tax system if you meet the terms and conditions. To begin the transition, you must submit a notice of choice of this form of taxation to the competent head of the tax office.

In order for the notice to be taken into account, it is important to submit it before the end of the first month of the financial year in which you plan to receive income from the Estonian CIT. Please note that before moving to a new system, all aspects of classic CIT must be settled, the books closed and financial statements prepared. This will allow you to correctly determine the tax base for the period of application of Esteński CIT.

Once you select this tax system, its rules will automatically apply for four subsequent tax years. Thus, unless during this period you have a need to return to classic CIT, the Esteński CIT 2.0 system will act as the main tax system for your company.

Benefits of Esteński CIT 2.0

Upgrading to Esteński CIT 2.0 can provide your company with a number of benefits. Here are some of them:

Simplified administration: The Estonian tax system offers simple, easy-to-understand rules, making it easier tax administration for business.

Double taxation exemption: If you own foreign assets, you are exempt from double taxation when using Esteński CIT 2.0 on profits in Estonian and foreign countries.

Taxation of realized profits only: Unlike classic CIT, you will not have to pay taxes on undiscovered profits or unallocated funds. Taxation occurs only when actual profit is received.

Taxation only on dividend payments: When using Esteński CIT 2.0, you are only required to pay taxes on dividend payments to shareholders . Undiscovered profits remain untaxed until distributed.

Digitalization and e-government: Estonia is known for its advanced technology solutions and digital services, including e-government. Users of Esteński CIT 2.0 can take advantage of digital tools for more convenient and efficient work.

Summary

The transition to Esteński CIT 2.0 is an opportunity to use the advanced tax system in Poland. It provides a number of advantages, such as simplified administration, relief from double taxation and taxation only on profits received. Before the transition, it is important to settle all aspects of classic CIT and prepare for the use of the new system.

| Helpful | Not helpful |

|---|---|

| Submission of notice before the end of the first month of the financial year | Incorrect accounting records and reports |

| Resolving aspects of classical CIT | Lack of understanding of the benefits of the system |

| Application Esteński CIT 2.0 for 4 tax years | Insufficient preparation for transition |

| Double taxation exemption | Opt-out of the system before the end of the 4-year period |

| Taxation only on profits received and on dividend payments | Incorrect interpretation and application of tax rules |

Using the information in this section, you can make an informed decision regarding the transition to the Esteński system CIT 2.0. Please note that it is always recommended to consult with professionals and tax experts to obtain personalized advice based on the specifics of your business.

Note: All materials and information provided in this section are indicative only and do not constitute legal advice or guide for action. The decision to switch to the Esteński CIT 2.0 system should be made after consultation with professionals and taking into account the specifics of your business.

Estonian Income Tax (CIT) 2.0: new changes, benefits and deadlines

In accordance with the adopted regulations, new changes to the Estonian income tax (CIT) will come into force from January 1, 2023, which will radically change the tax system in Poland. Check out this cutting-edge tax tool known as “Estonian CIT 2.0” and find out why it is considered an innovative and beneficial tax system.

What will change in 2023?

The new system introduced as part of the Estonian CIT 2.0 will bring many promising changes for taxpayers in Poland. One of the key dates associated with the new changes will be the date of joining the Estonian CIT. The legislation allows taxpayers to notify the tax authority of their desire to be taxed under the new method before the end of the first tax year. This creates a comfortable environment for businesses, allowing them to plan their tax obligations in advance and avoid unnecessary hassles.

Another important date will be the date of lump sum payment of dividend advances. The new system provides for the opportunity for taxpayers to make one-time payments of advances on dividends based on an application. This simplifies the tax payment process and reduces the bureaucratic burden on businesses.

However, it is important to note that the new changes also introduce a tax liability expiration condition in connection with the initial adjustment. According to the new rules, this obligation ceases completely after the expiration of at least one full period of lump sum taxation, that is, after the expiration of four tax years. This gives businesses greater flexibility and the ability to adapt to new regulations.

Benefits of the Estonian CIT 2.0 system

The implementation of the Estonian CIT 2.0 system will bring a number of significant benefits to taxpayers in Poland. Below are some of the key benefits and features available under the new system:

Simplified tax payment system: New the system provides for the possibility of one-time payment of advances on dividends, which makes the tax payment process simpler and more convenient for business.

Flexible taxation: Estonian CIT 2.0 gives businesses greater flexibility in planning their tax obligations and adapting to changes in economic situation.

Earn-pay principle: The Estonian CIT 2.0 system is based on the “earn-pay” principle which allows a business to immediately pay taxes upon receipt of income.

International competitiveness: The implementation of the CIT 2.0 system will make Poland even more attractive to foreign investors and businesses, which will contribute to development of the country's economy.

Conclusion and practical application

The Estoński CIT 2.0 system represents a new stage in taxation in Poland, which promises to bring many benefits for business and stimulate economic growth. The impact and benefits of the new changes will be felt by all taxpayers, but especially by entrepreneurs and company owners.

To make it easier for you to understand, the application table below summarizes what measures need to be taken and in what order to effectively use the new Estoński CIT 2.0 system:

| Actions | Results |

|---|---|

| Notify the tax authority | Recognition of participation in Estonian CIT 2.0 |

| One-time advance | Payment of advances on dividends |

| Compliance with the deadline | Complete termination of tax obligations after four tax periods years |

The Estoński CIT 2.0 system opens up new opportunities for business in Poland, providing more flexibility and simplicity in taxation. Thanks to this advanced system, entrepreneurs and companies will be able to effectively manage their tax obligations and stimulate the development of their business.

"Estonian CIT 2.0 is not just changes in tax legislation, it is a new era in the transformation of the Polish tax system. Businesses must be ready for changes and take advantage of the new system for their success." - Arkady Timchuk, tax expert.

Learn more about the Estonian CIT 2.0 system and start planning your tax strategies in advance. With the new system, you get more flexibility, simplicity and the opportunity to succeed in business. Get ready for the opportunities that Estonian CIT 2.0 opens up!

Frequently asked questions on Estoński CIT 2.0: advanced tax system in Poland

1. What is Estoński CIT and how does it work in Poland?

Estoński CIT is an advanced tax system in Poland that allows entrepreneurs to pay tax only on the income they actually receive. This approach reduces the tax burden and stimulates business development.

2. What are the advantages of the Estoński CIT 2.0 system?

The Estoński CIT 2.0 system provides a number of advantages, such as a simplified tax payment procedure, no need for VAT accounting and reporting, the ability to transfer losses and others. This helps entrepreneurs reduce the tax burden and improve conditions for business development.

3. Who can pay Estoński CIT in Poland?

Estoński CIT can be paid by legal entities, including Polish companies, that meet certain requirements and conditions of the system.

4. Who cannot use Estoński CIT in Poland?

Certain categories of companies cannot use the Estoński CIT system, such as financial institutions, public companies, non-profit organizations and others. There are special tax regimes for them.

5. What income is subject to taxation under Estoński CIT?

Taxation under Estoński CIT covers all income received by the company, including profit from the sale of goods and services, rental payments and other types of income.

6. How are payments and reporting carried out under Estoński CIT in Poland?

Tax payment occurs quarterly upon submission of reports. Companies must prepare and file a tax return showing their actual profits and pay the appropriate tax payment.

7. How to upgrade to Estoński CIT 2.0 in Poland?

To migrate to the Estoński CIT 2.0 system, companies must meet certain requirements and conditions, including registering with the tax authority and submitting the corresponding application.

8. What will change with the Estoński CIT system in 2023?

From 2023, a number of changes are planned to be made to the Estoński CIT system, which may affect tax conditions and requirements for companies. The details of these changes have not yet been determined.

Thanks for reading and learning about the advanced Estoński CIT 2.0 system in Poland 🎉📚

You are now a tax professional who knows about innovative methods for optimizing tax payments in Poland 🌟

You have learned about the benefits of Estoński CIT 2.0 - a tax system that makes it easier life for businessmen and places Poland among the leading countries in the field of tax legislation. This system offers many opportunities to optimize taxation, reduce the burden of tax obligations and stimulate entrepreneurship.

Now, with your new knowledge and experience, you can successfully plan your tax strategies in Poland, ensuring the efficiency and growth of your business. You can be confident that your organization will ride the crest of tax innovation and continue to thrive.

Don't lose your genius and passion in the world of taxation! Go ahead and let your business reach new heights with the superior Estoński CIT 2.0 system 💪💼

.gif)

- Glossary

- Estonian CIT: advanced taxation system in Poland

- Amount of taxation according to Estoński CIT

- Which companies can use Estoński CIT

- What income is subject to taxation? Estoński CIT

- How payments and reporting for Estonian tax occur

- How to upgrade to Estonian CIT 2.0: complete guide and necessary steps for business

- Estonian Income Tax (CIT) 2.0: new changes, benefits and deadlines

- Frequently asked questions on Estoński CIT 2.0: advanced tax system in Poland

- Thanks for reading and learning about the advanced Estoński CIT 2.0 system in Poland

Article Target

Training and informing readers about the tax system Estoński CIT 2.0 in Poland.

Target audience

Business owners, entrepreneurs and tax professionals interested in Polish tax laws and regulations.

Hashtags

Save a link to this article

Yuri Seleznev

Copywriter ElbuzI unravel the secrets of successful online store automation, plunging into the world of effective solutions and secrets of online business - welcome to my virtual labyrinth, where every line is the key to automated success!

Discussion of the topic – Estoński CIT 2.0: Innovative taxation system in Poland

Find out about Estoński CIT 2.0, which is the leading tax system in Poland. Find out what advantages this system has and why it is considered innovative.

Latest comments

8 comments

Write a comment

Your email address will not be published. Required fields are checked *

.png)

.png)

John

Wow, this Estonian CIT 2.0 system sounds really interesting and innovative! I wonder how it compares to the tax systems in other countries. Has anyone here had any experience with it?

Sophie

Hey John, I'm from England and I've actually read a lot about the Estonian CIT 2.0 system. It adopts a completely different approach compared to traditional tax systems. It's known for its simplicity and encourages entrepreneurship. I think it could be a game-changer for businesses in Poland!

Francois

Salut Sophie! As a French entrepreneur, I totally agree. The Estonian CIT 2.0 system promotes cross-border business opportunities and helps startups thrive. It might be worth considering implementing a similar system here in France to boost our economy.

Luisa

Hola Francois! I'm from Spain, and I find this Estonian CIT 2.0 system intriguing. It could be a potential model for us too. The simplicity and low administrative burden could attract foreign investors. How does it handle complex financial transactions, though?

Giovanni

Ciao Luisa! From Italy here. The Estonian CIT 2.0 system makes financial transactions more transparent and encourages digitalization. By linking to every transaction, it minimizes tax fraud possibilities. It's definitely an interesting experience in modern taxation.

Magda

Cześć Giovanni! I'm from Poland, and I think it's great to see other countries considering the Estonian CIT 2.0 system. It would revolutionize taxation here. However, do you think it could pose any challenges for small businesses or individuals?

Oleksandr

Привіт Magda! I'm from Ukraine, and I've been following the Estonian CIT 2.0 system too. While it has many benefits, it might require some adjustments to accommodate the small business sector. Flexibility could be key to its successful implementation.

Grumpy

Bah, all this talk about trends and innovation. Tax systems are just a way for governments to swindle more money out of hard-working folks. I'd rather stick to the old ways. There's enough noise and change going on already.